ATPCO has finalized the first version of the Next Generation Storefront standard for the U.S. domestic market, a year after the initiative to develop the standard was launched at ATPCO's 2018 Elevate Conference.

NGS standardizes how online booking tools, global distribution systems, aggregators and online travel agencies sort and group airline product data in their retailing displays, so travelers can understand everything that's included in a displayed fare and compare airline products consistently across multiple distribution channels.

Over the past decade, airlines have introduced branded fares to differentiate their products. However, airlines contend booking tools, online travel agencies and other indirect distribution channels continue to commoditize these fares.

"In a world of branded fares, no one knows how to interpret and compare. How do we solve for that? That's what this effort is all about. It's making the choice of product between carriers simpler than it is today." Delta managing director of global distribution strategy Jeff Lobl said in October during a Master Class panel at The BTN Group's Innovate conference.

Under the Next Generation Storefront initiative, distribution channels, airlines and distribution system providers have been collaborating in a working group and an advisory group to hash out the standard. Working group members test options and provide feedback and recommendations to the advisory group, which provides guidance and can veto and finalize changes.

The initiative includes 34 airlines, including U.S. carriers Alaska Airlines, American Airlines, Delta Air Lines, JetBlue Airways, Southwest Airlines and United Airlines, as well as global carriers Air Canada, Air France, Air New Zealand, British Airways, China Eastern, China Southern, Finnair, KLM, Scandinavian Airlines and Virgin Atlantic.

System providers in the initiative include GDS providers Amadeus, Sabre and Travelport, airline passenger services system provider DXC Technology, and airline IT specialist OpenJaw, as well as SITA and the International Air Transport Association. Twenty-one distribution channels, including metasearch operators Skyscanner and Kayak and booking app Hopper as well as such online travel sellers as Lola, Psnger1, TravelBank, TripActions, Upside and WhereTo.

Now that the first version of NGS for the domestic U.S. market—also including Puerto Rico and the U.S. Virgin Islands—has been completed, the standard will be hashed out for four other markets. In the coming months, ATPCO will create advisory boards for the Asia/Pacific, Transatlantic, Transpacific and Canada domestic markets. The boards will build and shape the standard for their respective regions. Board participation is invitation-only and will consist of airlines and distribution channels that represent more than 50 percent of flying capacity in its respective region.

Members of the four new advisory boards include CWT, Ctrip.com and Skyscanner, along with Air China, British Airways and Virgin Atlantic, as well as American Airlines and Delta Air Lines.

Show Me the Standard

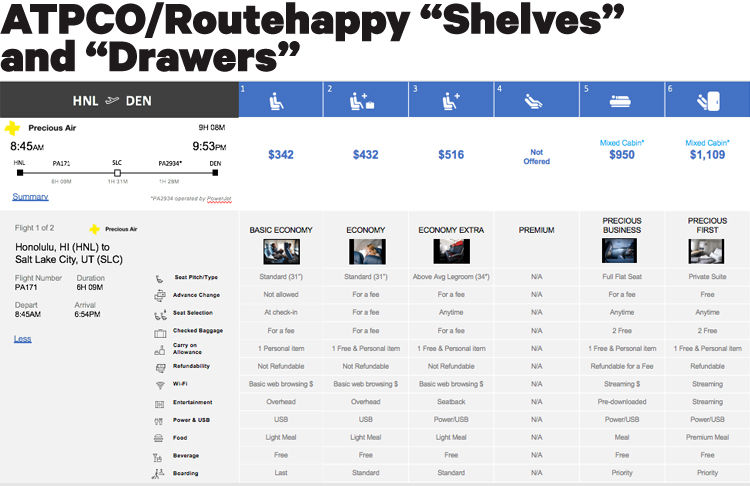

Next Generation Storefront is a sorting and grouping standard for airline product data. Under the standard, indirect distribution channels must group airline product into six columns, called "shelves." Each shelf will have a numeric identifier, from one to six, along with icons and texts. Shelf placement criteria are based on seat pitch, seat type, advance changes, advance seat selection, carry-on baggage allowance and cabin. Channels have flexibility about which shelves they show.

.jpg)

Shelves 1 & 2: Fares in shelves one and two will have seat pitches of less than 34 inches. A fare will be in shelf two instead of shelf one if it meets at least two of the following three criteria (main cabin fares typically will appear in the second shelf, while basic economy fares will fall in the first):

- Advance changes are free or for a fee

- First full-size carry-on is free

- Advance seat selection is available, meaning that seat selection is allowed any time in advance for free for any seat applicable to the fare.

Shelf 3: Shelf three includes fares with extra legroom that are sold a la carte during the purchase process, like American Airlines' Main Cabin Extra and JetBlue's Even More Space. Fares are placed in this shelf if they have one of the following attributes:

- Seat pitch of at least 34 inches

- The seat is a Skycouch, which is an entire row of seats that are made available as one seat, or middle-seat free, which comes with an empty seat in the middle

- A recliner seat in an economy cabin

- A recliner seat with a pitch of less than 36 inches

Shelf 4: In shelf four, fares must have a recliner seat with a seat pitch of at least 36 inches and not be in an economy cabin. First class fares typically will be shelved here.

Shelves 5 & 6: Shelf five contains fares with seats that are convertible to beds. Delta One, which has a lie-flat seat, will appear in this shelf.Fares in shelf six must be in the higher cabin of a two-cabin aircraft with all flat seats and direct aisle access. However, in order to simplify shopping for U.S. domestic flights, fares meeting the criteria for shelf six will be placed in shelf five. For transoceanic flights, these fares will appear in the sixth shelf. For example, American Airlines' Flagship First will appear in shelf six for a transoceanic flight but shelf five for a U.S. domestic flight.

For each fare, there must be a "drawer" that provides the traveler with information about the fare's flight and associated attributes and amenities, such as types of available beverages, entertainment, lounge access, Wi-Fi, checked baggage allowance, refundability, seat pitch, carry-on bag allowance and priority boarding.

Mockup of a fictitious airline's fares displayed under NGS.

Mockup of a fictitious airline's fares displayed under NGS.

Who Has Adopted Next Generation Storefront?

Through out 2019, online travel sellers, including TravelBank, Upside, Psngr1 and WhereTo, and TMCs TripActions and AmTrav implemented NGS on their booking tools and provided feedback to the working group. CWT is testing the standard with Sabre and Delta. Lola and booking tool GetThere are in the process of adopting the standard.

Some enthusiastically adopted the standard, but some OBT executives told BTN on condition of anonymity that Delta threatened to pull its content unless the OBTs adopted the standard.

During the Innovate session, one travel manager audience member asked Delta's Lobl, who was a panelist, about Delta's stance on withdrawing content. He said Delta is pushing distribution channels to be more transparent about the carrier's products, citing basic economy as an example. A lot of business travelers book basic economy through indirect channels, he said, thinking it's the lowest logical fare but unaware or misinformed about its restrictions. This has frustrated customers, who end up blaming Delta, not the distribution channel, according to Lobl.

"On behalf of our customers, we have insisted the distributors we have out there who sell our product do the proper disclosures of what that product represents," Lobl said. "If people are just in the interest of conversion or making a sale and unwilling to share that information with customers, then we are going to have much harder discussions with them," he said.

That said, there is a massive gap in NGS adoption in the corporate travel booking segment. Concur, which has more than 48,000 corporate customers, has "not made a final decision that is the one standard we are going to follow, but we are going to do a better job of displaying stuff like that," said SAP Concur director of distribution and NDC Tom Wilkinson.

New Zealand-based booking provider Serko also has not adopted NGS. "We don't use NGS," said SVP Tony D'Astolfo. "We don't feel we want our user interface to be standardized. We want to have flexibility."

How Will Complex Policies Operate Under NGS?

NGS is a standard built for distribution channels in both business and leisure air travel. That business travelers often are restricted by travel policies while leisure travelers aren't can get complicated.

"We know [policy is] critical to [OBT] adoption and the business needs of the travel managers and their corporations, so there is absolutely nothing about NGS that is inconsistent with travel policy enforcement. All it's doing is putting products out in front of the customers, and there can be policy overlays on that as much as an agency and OBT wants to put them in," Lobl told BTN.

NGS will solve leakage issues that frustrate travel managers while helping travelers find the best experience, according to Lobl. "It provides all products to the traveler in their [corporate's] preferred channel so they don't have to go looking elsewhere to see what else is available," he said. "Once they are within their preferred channel, there may well be products that are within policy and will give customers a better experience, but they have to be able to see [them] in order to make that judgment."

Overlaying policy on NGS is a challenge, according to Flight Centre Travel Group chief experience officer John Morhous, who prefaced his comments at the Innovate Master Class by saying Flight Centre is pro-NGS and has a 25 percent stake in Upside. Booking tools use messaging, grayed-out options and other ways to highlight policy, yet as managed business travelers move up and down the shelves in an NGS environment, they could be tempted to buy more expensive fares. "A lot of people [will see] the actual fare but will buy a different fare class, because they [can also see] the premium economy seat is only $20 more than the economy seat, and they are getting a lot more for that," Morhous said.

In September, ATPCO reported Upside experienced a 62 percent increase in premium bookings after adopting NGS. While that's not a managed channel, it's an indicator of how strong the pull can be to access upgrades, regardless of travel policy.

RELATED: Next Generation Storefront: How it Works, the Potential & the Hazards

Additionally, many of NGS's early partners have been emerging players like TripActions, TravelBank and Upside. These providers service mostly small and midsize travel programs, where travel programs often are lightly enforced or just starting to be developed.

"If early-stage companies are flush with venture capital, travel policies may not be the No. 1 issue because they are just trying to grow and invest, and they don't want any obstacles or barriers to be in the way. They trust their early employees to make good decisions and move quickly," TravelBank CEO and cofounder Duke Chung told BTN. Relying on this type of user for market feedback may not have prioritized the needs of a managed environment.

As providers like WhereTo and TripActions drive into the enterprise market and carriers introduce more premium-class products, the effect of NGS on policy compliance will become clearer, but Morhous gave a preview: "If you have different policy items around specific fare classes or amenities, you better adapt that to all these different permutations of displays, which is a bit of challenge."

Concur's Wilkinson cited the complexity of implementing the standards for its massive customer base, which includes spenders ranging from SMEs to the Corporate Travel 100, as one reason they have not adopted NGS.

"All [our customers] have different policies, and many of them have different policies for different people within their corporation. Now you introduce six new shelves, and inside each new shelf there is a drawer. Trying to show what you want for that group of customers is a magnificently complex issue," Wilkinson said. "It's very much linked to this whole issue of policy enforcement, because you only perhaps want to show the right fares, the right bundles, the rights options to the right traveler based on their level, based their status in the frequent-flyer hierarchy."

At the Innovate session, American Express Global Business Travel global distribution manager Allie Coughlin said the mega TMC is considering an approach that uses more policy tools. "Our NGS adoption is probably going to be an NGS-inspired standard we customize based on policy, to maybe only pull in the shelf that is compliant with your policy, then one shelf that shows actual savings above, because not a lot of our clients want people to book classes above what their policy says they should," she said.

Hammering Out Some Details

Wilkinson and D'Astolfo said not all airlines are on board with the NGS initiative either. "A lot of the airlines have suggested that some of the [shelves] are placing them at a disadvantage," said D'Astolfo.

Some of the participating carriers in NGS still have not submitted their branded fare and amenity data to ATPCO and its Routehappy airline content subsidiary, causing content display problems.

"It's great to have pictures of what lie-flats [and] meal options look like, but if those pieces are not supplied in the Routehappy [application programming interface], then the ability for any booking platform or OTA to display them becomes quite minimized," Morhous said.

NGS provides a shopping experience for air that's different from hotel and ground, which could reduce in-channel bookings, according to Morhous. "If the shopping process is dramatically different for airline versus hotel," he said. "Then you start to see issues where people drop off the tool."