In the upper-midscale and midscale segments, hoteliers face the

difficulty of meeting the expectations of ever-more-discerning guests while working

with lower operating budgets than their upscale and luxury counterparts. The top

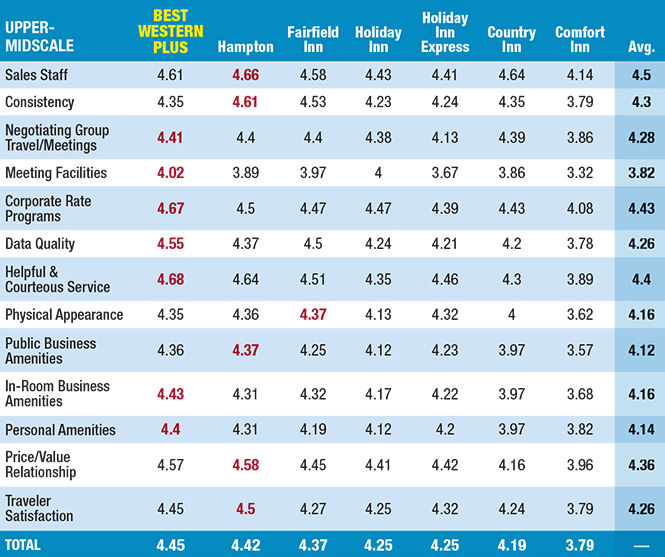

performers in this year's survey for the upper-midscale and midscale segments have

embraced both guest-facing and staff-facing technologies to meet the challenge.

Best Western Hotels & Resorts' Best Western Plus led the

upper-midscale segment, earning the highest scores for such criteria as ease of

negotiating group travel and meetings, facilities for meetings, corporate rate programs,

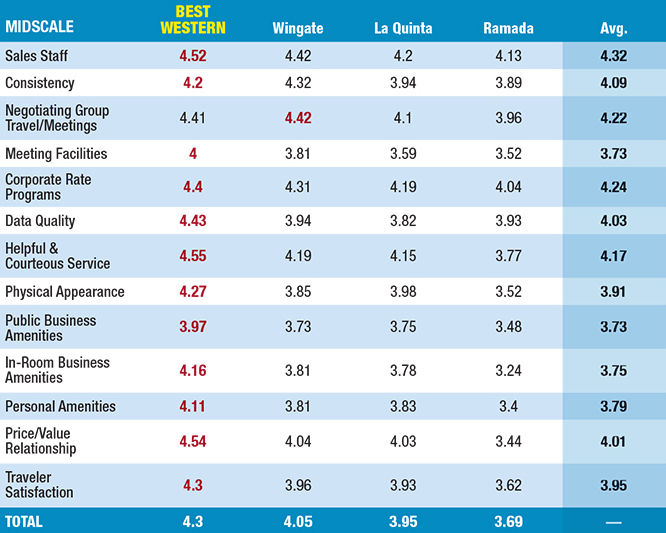

data quality and helpful and courteous service. Its Best Western brand performed

even better in the midscale segment, garnering the highest scores for nearly every

category.

The company is in its second year of a partnership with Mursion

to provide onsite virtual reality training for front desk staff. The simulations

of real-life customer interactions, which are based on real Best Western guest data,

enable personnel to refine their communication skills and practice resolutions for

common problems. The front desk agents "actually are being tested while learning

in a much more fun environment," said Best Western Hotels & Resorts chief

marketing officer and SVP Dorothy Dowling.

VP of worldwide sales Wendy Ferrill said the company takes a

holistic approach with corporate clients, ensuring that the transient travel, loyalty

and meetings aspects of the business all work together. "Really, it's all about

the focus on the buyer first and what outcomes and goals the travel program is trying

to achieve," she said. As such, the company caters its Best Western Rewards

offerings to corporates, communicating with travelers through travel managers and

offering incentives and promotions geared toward business travelers "as opposed

to just blanket offers like a lot of the other brands and chains do," Ferrill

said. She said the product offering focuses on functional rooms with intuitive design

and high-speed Wi-Fi.

More on Upper-Midscale Brands

Ranking at No. 2 in the upper-midscale segment, Hampton by Hilton

earned top marks for traveler satisfaction, price/value relationship, public business

amenities, consistency of offering and sales staff.

Phil Cordell, Hilton global head for focused service and Hampton

brand management, said the brand has worked with its hotels to enhance local sales

efforts. The approach, he said, provides "boots-on-the-ground resources and

support for our sales leaders and value to our hotel owners." Hampton, too,

has shifted to a virtual training program, enabling sales team members to maintain

productivity and learn in a modern environment without leaving their hotels.

A little over a year ago, Hampton updated its rooms' interior

design in response to guest research and design trends. The brand is rolling out

Digital Key mobile entry through the Hilton Honors app, and 30 percent of the portfolio

will have Digital Key capabilities by year-end. In the year ahead, Hampton also

plans to roll out a new hotel design, updated food and beverage programs and enhanced

service strategies. It also will open 160 new hotels globally.

Third-place finisher Fairfield Inn earned the highest score in

the upper-midscale segment for physical appearance of hotels. Portfolio-wide renovations

and a prototype for new-build properties that features flexible, modern workspaces

for travelers have garnered high guest satisfaction scores internally on par with

some of the luxury hotels in its Marriott family, according to VP of Fairfield brand

management Callette Nielsen. The brand also has rolled out digital check-in, as

well as service requests through the Marriott Rewards app across its hotels. The

brand debuted in China this year and expects to open more than 100 properties there

during the next five years.

From January to July, upper-midscale's average daily rate increased

1.4 percent year over year to $113.23, according to STR. Occupancy decreased 0.1

percent 68.4 percent. The segment is beginning to see the impact of 3.1 percent

supply growth outpacing 3 percent demand growth.

More on Midscale Brands

Wingate by Wyndham came in second place in the midscale tier

for BTN's survey but, for the third consecutive year, came in first in the J.D.

Power 2017 North America Hotel Guest Satisfaction Index Study. In BTN's survey,

it earned the highest score of the segment for ease of negotiating group travel

and meetings.

VP of brand operations Aly El-Bassuni said the brand recently

tested a program to support sales in which a third party provides a dedicated team

for RFPs, inbound sales calls and outbound lead generations. The program is in place

at 20 percent of Wingate properties and is "generating really strong results,"

El-Bassuni said.

Wingate's prototype calls for a boardroom meeting facility and

small and midsize meeting facilities at each property. That's a differentiator in

the midscale segment, which tends toward smaller meeting facilities, and El-Bassuni

said Wingate has benefited from savings-conscious corporates that have moved down-segment

for meetings.

El-Bassuni said the brand is in the midst of a strong growth

year "with some really strong, quality conversions." For every two new-construction

properties, the brand also is opening a conversion property, he said, which has

helped the brand grow into some major urban markets.

From a guest-facing perspective, Wingate benefits from its affiliation

with Wyndham Rewards. Last year, the company made it more straightforward to earn

points and redeem free nights at Wyndham Worldwide properties. Wingate also is testing

Google Chromecast-powered StayCast at half a dozen properties. The technology allows

guests to stream TV shows and movies via apps like Netflix, Hulu and YouTube.

"What's really staggering is the amount of streaming that guests are engaging

in," El-Bassuni said. "On an average length of stay just shy of two nights,

we're seeing guests streaming at those six facilities almost five hours. We're seeing

very strong engagement."

From January to July, midscale ADR increased 1.7

percent to $87.08 year over year and occupancy grew 0.7 percent to 60.5 percent,

according to STR.