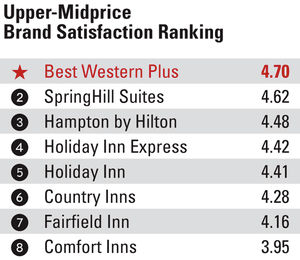

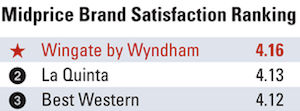

Best Western Hotels & Resorts’ Best Western Plus once more finished atop the upper-midprice tier. Wingate by Wyndham bested La Quinta Inns & Suites and Best Western to head the midprice segment in BTN’s 2015 Hotel Brand Survey.

Best Western Plus earned segment-high marks in multiple categories, including quality of sales staff, corporate rate programs, helpful service, appearance of hotels and facilities and overall price/value relationship.

The segmentation of Best Western into three different brands—Best Western, Best Western Plus and Best Western Premier—is an ongoing boon to the company. “Best Western Plus was designed with the types of room amenities and hotel services business travelers want when they are on the road, including free Wi-Fi, a quality complimentary breakfast, an updated exercise facility and business center services,” said Wendy Ferrill, vice president of worldwide sales for Best Western Hotels & Resorts. “Like any new product, it has taken a few years to build consumer awareness for the type of lodging experience a business traveler can expect when staying at a Best Western Plus.”

Coming in at No. 2, Marriott’s SpringHill Suites received the highest scores for consistency of offering and quality of public-area business amenities. Janis Milham, senior vice president of modern essentials and extended-stay brands for Marriott, said those results are on par with the physical improvements implemented in recent years. “They’re a testament to all the great design work that’s been done, especially with our new lobby footprints,” Milham said. “We’ve been designing the lobbies to be very functional and very purposeful.”

For properties without lobby bars, she said, the brand also has activated the lobbies and worked to appeal to next-generation travelers through craft beer and wine offerings in its 24-hour markets. The brand has yet to roll out service requests through the Marriott International app, but SpringHill guests can manage reservations and check in and out through the mobile offering.

Hampton by Hilton, which came in second place in the tier last year and third this year, recently celebrated its 2,000th property opening; those hotels span 17 countries. One of its biggest growth areas is in urban markets, according to Phil Cordell, global head for focused service and Hampton brand management for Hilton Worldwide. “Hampton is very much a suburban, office park, interstate kind of brand,” Cordell said. “We’re still in all those places, but now it’s also in urban locations.”

The brand is streamlining its breakfast offering through healthier options and local fare. Soon, Hilton rewards program members will be able to use the Hilton app’s Digital Key to enter their rooms. The service is live at select Hilton properties and will roll out through 2017.

Overall, the upper-midprice segment has benefited from corporate travelers’ drift from luxury and upper-upscale down the price scale, a trend Bjorn Hanson, a clinical professor at New York University’s Tisch Center for Hospitality and Tourism, noted in an annual analysis of corporate negotiated hotel rates. Upscale and upper-midscale also have dominated the U.S. hotel construction pipeline, accounting for more than two-thirds of room construction from January through August 2015, according to STR.

A Focus On The Customer Wins The Midprice Segment

In the midprice tier, Wingate by Wyndham received the highest scores for consistency of offering, helpful and courteous service, physical appearance of hotels and facilities, quality of public business amenities, quality of in-room personal amenities and overall price/value relationship.

“Our big focus over the last 12 months has really been customer service,” said, vice president of brand operations Brian Krause. “We continue to be committed to delivering strong customer service and guest satisfaction.”

In addition to topping BTN’s survey, Wingate earned a No. 1 ranking in its segment in J.D. Power’s Hotel Guest Satisfaction Study this year. Krause said consistency and design play a role in the brand’s success, as most Wingate properties are new builds that follow a prototype, with spacious guest rooms and meeting facilities. “Guests know what they’re getting,” he said.

Wingate’s global footprint is expanding quickly, Krause said. It’s focusing on major markets, such as Chicago and New York City, as well as airport markets like Denver and Seattle, to increase brand awareness.

No. 2 La Quinta won in quality of in-room business amenities. Chief marketing officer Julie Cary said the brand recently overhauled its free Internet offering. “Over the last year, our guests have told us they want to be able to stream video and use multiple devices,” Cary said. “La Quinta responded by upgrading our Wi-Fi to be five times faster.” It also changed its minimum Wi-Fi bandwidth.

Though Best Western came in at No. 3, the brand earned the highest scores in multiple categories: quality of sales staff, ease of arranging group travel and meetings, facilities for meetings, corporate rate programs and quality of data.

This is the third consecutive year the brand has received the top score for quality of data and the second consecutive year Best Western Plus has done so in the upper-midprice tier. “Our data is set up in a format that we can really sit down and look at that data with a [corporate] customer and make sure that the hotel program as it relates to Best Western is performing as the travel manager had intended,” Ferrill said. “Then we go through that data to look for gaps and opportunities to see where we can enhance what the travel program is offering,” she added.

The Best Western brand uses a similar, “holistic” approach for its meetings offerings, Ferrill said. “If we don’t have the meeting space in our hotel, we figure out a way to make it work ... It’s evaluating the situation and finding a solution.”

Though midprice hotels haven’t seen particularly strong demand in recent years, the segment has experienced some of 2015’s largest January-through-August year-over-year growth in occupancy, up 2.3 percent to 61.3 percent, according to STR. Average daily rate during that period increased 4.4 percent to $84.13. U.S. rooms under construction dropped 0.3 percent year over year during August.

This report originally appeared in the Oct. 12, 2015 edition of Business Travel News.