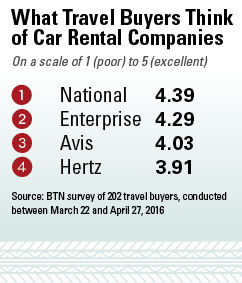

Travel buyers rated National Car Rental as the most

cooperative, responsive and value-providing car rental supplier for the second

year in a row, and overall satisfaction with the industry is on the rise, as

well, according to Business Travel News' second annual Car Rental

Survey.

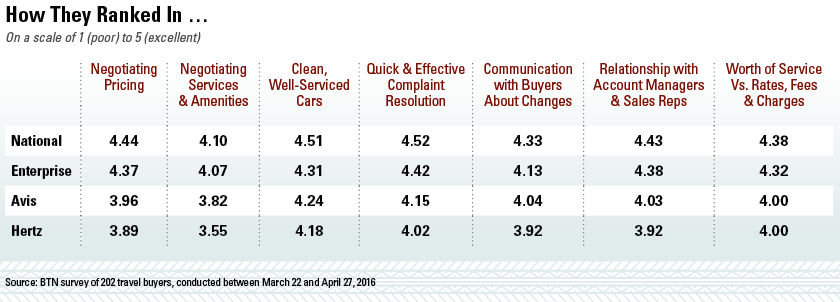

National outscored its competitors in all seven criteria on

which buyers rated their car rental suppliers, repeating its top-ranking

performance from the inaugural survey. The other brands' performances also were

consistent with last year: National's sister brand Enterprise Rent-A-Car came

in second, followed by Avis Car Rental and Hertz.

National, Avis and Hertz all had higher overall scores

compared with the 2015 survey, and while Enterprise's overall score did not

change, it improved in five of seven criteria. Another positive sign for the

industry: Large corporate accounts show little interest in shifting away from

their preferred supplier, regardless of which company it is, said Abrams Consulting

Group president Neil Abrams. "With the top 500 travel-spending companies

across the three major [car rental companies], there's about a 97 or 98 percent

retention rate. There is very little migration, which suggests satisfaction

with the relationship. If you're not happy, why would you stay?"

Takeaways

- All four suppliers ranked in the same order as in 2015.

- National, Avis & Hertz improved on their 2015 scores.

- Overall satisfaction with the car rental industry rose.

- Buyers were happier with each brand's pricing this year.

- Each brand's lowest-scoring category was negotiating

services and amenities.

- Large corporate accounts are unlikely to change preferred

suppliers.

Still, in some ways, car rental has become a "dis-satisfier,"

he said, meaning people pay less attention when things are going well but start

paying attention when service begins to deteriorate.

To that end, communication and problem resolution stood out

as differentiating factors to buyers. When asked what their preferred car

rental suppliers had done to improve their relationships, travel buyers most

frequently cited consistent communication from their account representatives.

One buyer, for example, praised Hertz for its face-to-face quarterly reviews: "These

are important to take the time to deeply review my program, usage, extra

charges and anything that stands out. I value the time we spend together to learn

more about Hertz and to get to know each other, which lends to a great working

relationship."

Hertz senior vice president of North America sales Dave

Myrick said this praise reflected the 2015 reorganization and refinement of the

company's sales structure, which has allowed the sales team to spend more time

with customers. With a large-scale fleet refresh also completed last year, it

was a transitional year for the company, he said. "We realigned

territories to make sure customers had the best talent aligned with them. We

continue to invest in sales force training and are getting deeper and wider

with customers."

Avis customers praised its "great customer support team

that is responsive and empowered to make quick decisions," as well as its

reporting tool. Avis Budget Group senior vice president of sales Beth Kinerk

noted that Avis had focused on data to help buyers with compliance, including

aid for avoiding charges for unnecessary ancillary fees or vehicle types.

National and Enterprise both fill key sales positions

internally, which brings "consistency and continuity," Enterprise

Holdings vice president Brad Carr said. The company "tries to push to the

customer rather than wait for the travel manager to have to pull." It also

keeps corporate customers informed of regulations and other changes on a global

scale as the brands increase their footprints and deal more with global travel

programs, Carr added.

National and Enterprise cover 70 percent of Berry Plastics'

increasingly global car rental program, and corporate purchasing manager

Patrick Fairchild said the brands' quarterly business reviews provide

sufficient information without overcommunication. "I have no bad stories

with National/Enterprise," Fairchild said. "They've come in with a

very robust core trust agreement and provide the lowest rates I can see."

Each of the four brands improved on its 2015 score for

negotiating transient pricing. For National and Enterprise, however, those

scores were among their highest; for Hertz and Avis, they were among the

lowest.

As the car rental industry has struggled to gain pricing

traction over the last year, National and Enterprise are in a better position

to offer corporate discounts than their competitors, DK Consulting CEO Dave

Kilduff said. Thanks in part to better fleet management, their costs per rental

are lower than their competitors. They have "the best margins in the

business," Abrams noted. Enterprise Holdings reported that its U.S.

on-airport car rental revenue for the fiscal year ending July 31 rose more than

10 percent year over year and its

airport market share from less than 29 percent in 2007 to more than 36 percent,

according to the company. "To be competitive against Enterprise Holdings,

it's much more difficult for the others to come in at the same price,"

Kilduff said. "[Enterprise/National] is picking up market share, which is

a good strategy. They're very competitive, plus it puts financial pressure on

their competitors."

What the Suppliers Have Been Working On

Hertz's Dave Myrick: "We realigned territories

to make sure customers had the best talent aligned with them. "We continue

to invest in sales force training and are getting deeper and wider with

customers."

Avis' Beth Kinerk: Avis focused on data to help

buyers with compliance, including aid for avoiding charges for unnecessary

ancillary fees or vehicle types.

DK Consulting's Dave Kilduff: "[Enterprise/National]

is picking up market share, which is a good strategy. They're very competitive,

plus it puts financial pressure on their competitors."

Car rental suppliers have been looking for other ways to

differentiate themselves to corporate buyers, particularly on the technology

side. Hertz, for example, has evolved its mobile alerts to Gold Plus members

not only to show travelers where to pick up their vehicles but also to give

them vehicle options in case their travel needs have changed, said vice

president of customer experience Stuart Benzal. Avis Budget, meanwhile, has

developed mobile apps, alerts and e-receipts while concentrating on "a

high level of customer service, whether travelers are interacting with one of

our employees or bypassing the counter and heading directly to their vehicles,"

Kinerk said.

Negotiating amenities and services, however, still appears

to be a challenge; travel buyers rated this factor lowest for every car rental

brand. While ancillary services—including GPS, program membership benefits,

refueling prices and insurance coverage—all are negotiable, they require clout,

Kilduff said, and can be a challenge for smaller accounts.

"Pricing is easy because a company is

either willing to accept it or not," Abrams said. "Service is a much

more in-depth, nuanced position because whether it's insurance, upgrades or

something else, a buyer has to weigh that against price and ultimately

determine the value proposition."

Methodology

From March 22 to April 27, 2016,

BTN surveyed travel manager and buyer

members of the BTN Research Council and a randomly selected subset of qualified

subscribers of

Business Travel News and

Travel Procurement. Of the 202

respondents, 18.3 percent spent less than $1 million United States-booked air

volume in 2015, 45.5 percent spent $1 million to $12 million and 36.1 percent

spent more. Equation Research hosted the survey and tabulated the results.

Respondents graded only those car rental companies with which they had

negotiated contracts or booked meaningful amounts of business in the past year.

Respondents ranked 11 brands in seven attributes on a scale of one (poor) to

five (excellent).

BTN averaged scores in each category to create an

overall score for each car rental company. Seven brands that did not reach a

minimum usage threshold were disqualified from the survey. Participants who

offered no response for a particular category or brand were not included in

that average rating. A subset of the Car Rental Survey respondents also

answered questions about their chauffeured providers; those results appear

here.