2023 BTN Hotel Survey

Buyers Consider Changes to Mitigate 2024 Hotel Rate Hikes

Consensus says hotel rate increases will hover around 5 percent this year; buyers also see an increase in hotel nights on the horizon.

Hoteliers and analysts in recent months have projected that 2024 corporate hotel rates were on track to be higher than those of 2023. Most buyer respondents to BTN's Annual Hotel Survey are expecting the same, but many indicated they plan to work diligently to keep those increases at manageable levels, even if doing so means significant changes to their hotel programs.

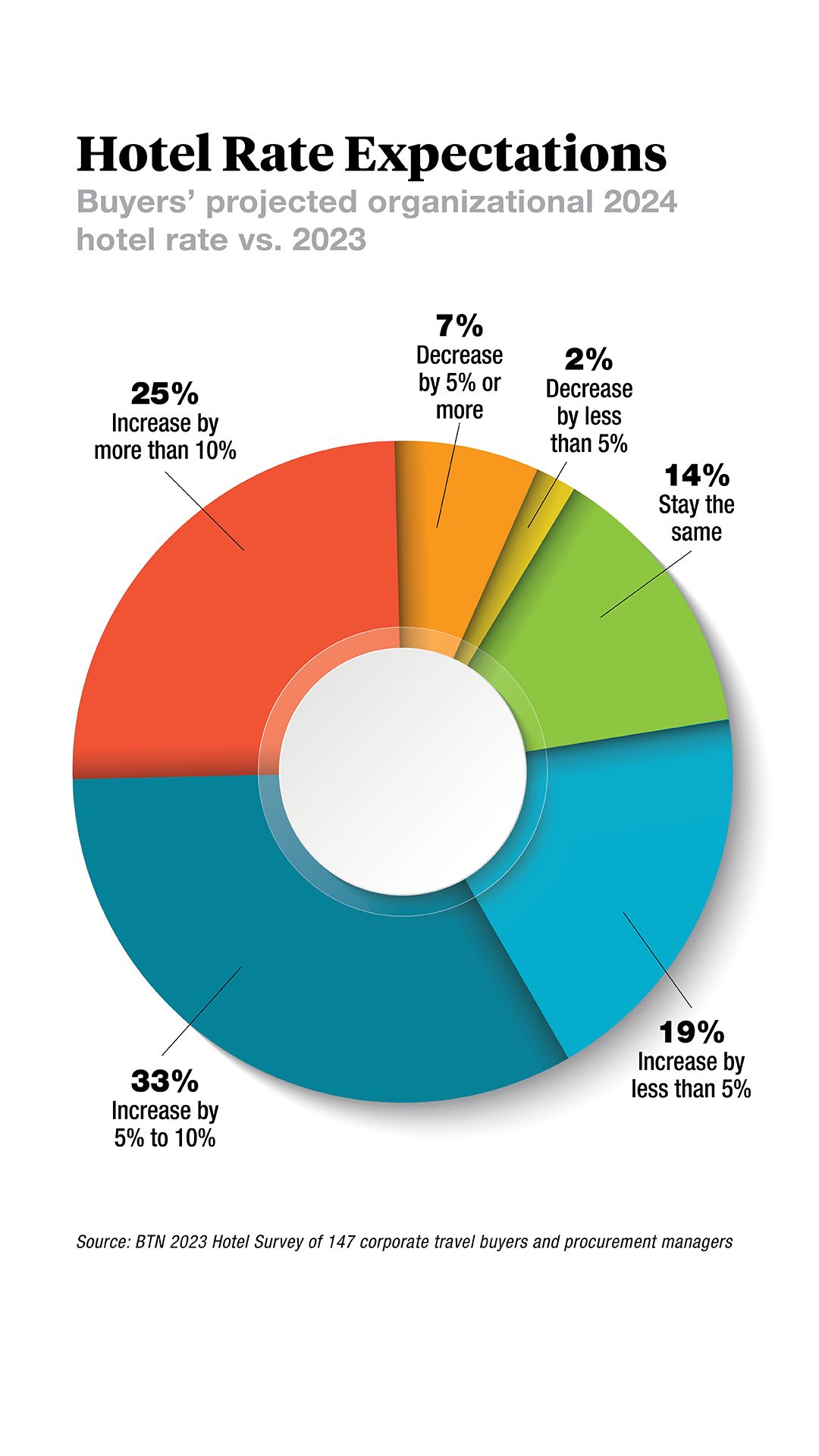

BTN and partner Equation Research in August and September surveyed 147 qualified business travel buyers and procurement managers. About 77 percent of them indicated they expect their organization's negotiated hotel rate in 2024 to increase from 2023, and about three-quarters of that group expect that increase to be more than 5 percent. About a quarter of all respondents expect year-over-year increases of at least 10 percent.

That tracks with some initial projections of 2024 rates. CWT and the Global Business Travel Association in a recent forecast projected global 2024 average daily hotel rates would increase 3.6 percent year over year. Marriott International CFO Leeny Oberg last month during the company's second-quarter earnings call predicted Marriott would achieve a "meaningful increase next year" in negotiated corporate rates.

Hotel executives during the summer have cited the continuing strength of leisure demand, allowing them a base of revenue that perhaps elevates their confidence to increase corporate rates. Additionally, CWT and GBTA in their forecast cited the slow post-pandemic recovery of hotel construction, allowing the supply and demand equation to remain in hoteliers' favor.

Business travel volume continues to increase, as well. "Business transient keeps grinding up and getting better, and the same with group," Hilton Worldwide president and CEO Christopher Nassetta said in late July. Marriott president and CEO Anthony Capuano, meanwhile, said last month that "recovery in business transient remains slow but steady."

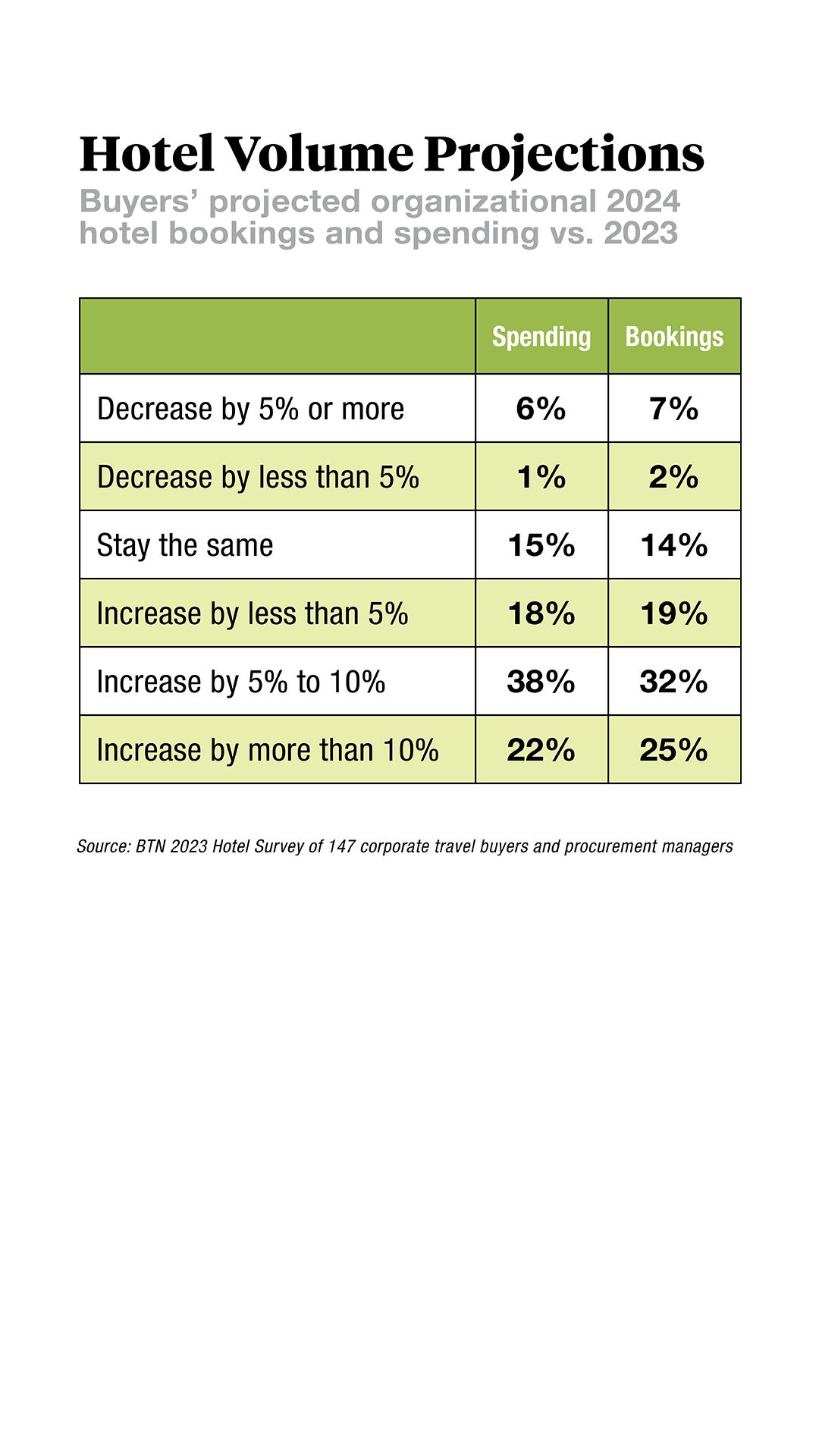

Most BTN survey respondents projected their organizations in 2024 would increase not only their hotel spending but their bookings as well. About 78 percent and 77 percent, respectively, of respondents indicated projected hikes in hotel spending and booking. About a quarter of all respondents indicated they forecast an increase of more than 10 percent.

Limiting the Damage

About 60 percent of respondents project that their organizations will spend more than 5 percent more on hotel costs than they did in 2023. However, several respondents told BTN that a 5 percent year-over-year rate increase was the threshold they were working to remain below.

BTN offered respondents an opportunity to list in an open-ended fashion their goals for their organization's 2024 hotel program. Several volunteered that a primary—sole, even—goal was to keep rate hikes below 5 percent. "Maintain current rates with no more than a 5 percent increase," wrote one, as a complete answer. "Maintain existing cost savings, with less than 5 percent increases," wrote another.

That tracks with some initial projections of 2024 rates. CWT and the Global Business Travel Association in a recent forecast projected global 2024 average daily hotel rates would increase 3.6 percent year over year. Marriott International CFO Leeny Oberg last month during the company's second-quarter earnings call predicted Marriott would achieve a "meaningful increase next year" in negotiated corporate rates.

Hotel executives during the summer have cited the continuing strength of leisure demand, allowing them a base of revenue that perhaps elevates their confidence to increase corporate rates. Additionally, CWT and GBTA in their forecast cited the slow post-pandemic recovery of hotel construction, allowing the supply and demand equation to remain in hoteliers' favor.

Business travel volume continues to increase, as well. "Business transient keeps grinding up and getting better, and the same with group," Hilton Worldwide president and CEO Christopher Nassetta said in late July. Marriott president and CEO Anthony Capuano, meanwhile, said last month that "recovery in business transient remains slow but steady."

Most BTN survey respondents projected their organizations in 2024 would increase not only their hotel spending but their bookings as well. About 78 percent and 77 percent, respectively, of respondents indicated projected hikes in hotel spending and booking. About a quarter of all respondents indicated they forecast an increase of more than 10 percent.

Limiting the Damage

About 60 percent of respondents project that their organizations will spend more than 5 percent more on hotel costs than they did in 2023. However, several respondents told BTN that a 5 percent year-over-year rate increase was the threshold they were working to remain below.

BTN offered respondents an opportunity to list in an open-ended fashion their goals for their organization's 2024 hotel program. Several volunteered that a primary—sole, even—goal was to keep rate hikes below 5 percent. "Maintain current rates with no more than a 5 percent increase," wrote one, as a complete answer. "Maintain existing cost savings, with less than 5 percent increases," wrote another.

“We're going to see a lot of turnover in the program, which is an opportunity for consolidation.”

– Goldspring’s Neil Hammond

Goldspring Consulting partner Neil Hammond agreed that 5 percent represents a general consensus of buyers as to a tolerable 2024 rate increase.

"I think the expectation is that a lot of big negotiated increases were taken last year and, therefore, they need to be tempered a bit this year," he said. "Clearly, we think some suppliers are hoping for stronger increases again, but if I had to characterize it, I think buyers would probably want to keep things somewhere under 5 percent."

(It should be noted this view isn't unanimous among respondents. One volunteered a projection that inflation would damage leisure demand, making hotels more reliant on corporate business, and therefore the respondent planned to negotiate a rate decrease in 2024. Time will tell.)

Limiting rate hikes is a task more easily articulated than accomplished, but several respondents volunteered the methods by which they hoped to do so, and one prominent strategy was a reduction of preferred properties in 2024. Driving business to fewer properties allows for more volume at each, thereby strengthening the buyer's negotiating hand, theoretically.

One survey respondent, in listing 2024 goals, expressed a desire "to streamline our offerings in our major travel cities to three or less properties and push volume to those so we can negotiate a better discount." Another plans to "consolidate to fewer properties per city to maximize our leverage." Still another wants to "reduce the number of properties to increase room nights and [form] stronger partnerships."

Hammond suggested the desire to reduce the number of properties stems not only from a strategy to limit rate hikes but also a delayed post-pandemic natural reckoning and refurbishment of the program.

Goldspring Consulting partner Neil Hammond agreed that 5 percent represents a general consensus of buyers as to a tolerable 2024 rate increase.

"I think the expectation is that a lot of big negotiated increases were taken last year and, therefore, they need to be tempered a bit this year," he said. "Clearly, we think some suppliers are hoping for stronger increases again, but if I had to characterize it, I think buyers would probably want to keep things somewhere under 5 percent."

(It should be noted this view isn't unanimous among respondents. One volunteered a projection that inflation would damage leisure demand, making hotels more reliant on corporate business, and therefore the respondent planned to negotiate a rate decrease in 2024. Time will tell.)

Limiting rate hikes is a task more easily articulated than accomplished, but several respondents volunteered the methods by which they hoped to do so, and one prominent strategy was a reduction of preferred properties in 2024. Driving business to fewer properties allows for more volume at each, thereby strengthening the buyer's negotiating hand, theoretically.

One survey respondent, in listing 2024 goals, expressed a desire "to streamline our offerings in our major travel cities to three or less properties and push volume to those so we can negotiate a better discount." Another plans to "consolidate to fewer properties per city to maximize our leverage." Still another wants to "reduce the number of properties to increase room nights and [form] stronger partnerships."

Hammond suggested the desire to reduce the number of properties stems not only from a strategy to limit rate hikes but also a delayed post-pandemic natural reckoning and refurbishment of the program.

“A mix of static rates and dynamic rates with caps should help us stay close to our goals.”

– Survey Response, open-ended

Buyers may "look at a more mandated policy" to help drive traveler choice of preferred properties and "look at consolidation," Hammond said. But many have kept their programs relatively static since 2019, he said, stymied first by the pandemic, then a desire to ease into normalcy. Now, he said, some buyers are looking for an opportunity for a refresh, "so we're going to see a lot of turnover in the program, which is an opportunity for consolidation."

A Dynamic Process

Post-pandemic hotel rate recovery, and the asynchronous return of leisure over business travel, has complicated the question of whether buyers should seek static annual discounts, dynamic discounts off published rates or a combination of both. Hammond noted midweek rates at some hotels lagged weekend prices—a consequence of leisure demand—and suggested that could offer buyers "a little bit more leverage to play with with hotels than they might have experienced in some of the very tough airline negotiations they've been going through."

One respondent detailed a "multi-tiered" strategy: "Preferred static rates in high-volume markets (some dynamic rates as well), a dynamic discount program in secondary markets, chain agreements covering tertiary markets with a lower discount percentage than the dynamic discount program."

Another respondent targeted "increased dynamic discounts and transitioning those with dynamic rates in 2023 with high pick-up having static rates." Another noted that "a mix of static rates and dynamic rates with caps should help us stay close to our goals."

Meanwhile, about 34 percent of respondents said they preferred to negotiate hotel agreements with regional or global hotel sales reps, while about 22 percent said they preferred negotiations with individual properties. The remaining 44 percent said such an answer depends on the objectives for the deal.

Buyers may "look at a more mandated policy" to help drive traveler choice of preferred properties and "look at consolidation," Hammond said. But many have kept their programs relatively static since 2019, he said, stymied first by the pandemic, then a desire to ease into normalcy. Now, he said, some buyers are looking for an opportunity for a refresh, "so we're going to see a lot of turnover in the program, which is an opportunity for consolidation."

A Dynamic Process

Post-pandemic hotel rate recovery, and the asynchronous return of leisure over business travel, has complicated the question of whether buyers should seek static annual discounts, dynamic discounts off published rates or a combination of both. Hammond noted midweek rates at some hotels lagged weekend prices—a consequence of leisure demand—and suggested that could offer buyers "a little bit more leverage to play with with hotels than they might have experienced in some of the very tough airline negotiations they've been going through."

One respondent detailed a "multi-tiered" strategy: "Preferred static rates in high-volume markets (some dynamic rates as well), a dynamic discount program in secondary markets, chain agreements covering tertiary markets with a lower discount percentage than the dynamic discount program."

Another respondent targeted "increased dynamic discounts and transitioning those with dynamic rates in 2023 with high pick-up having static rates." Another noted that "a mix of static rates and dynamic rates with caps should help us stay close to our goals."

Meanwhile, about 34 percent of respondents said they preferred to negotiate hotel agreements with regional or global hotel sales reps, while about 22 percent said they preferred negotiations with individual properties. The remaining 44 percent said such an answer depends on the objectives for the deal.

“Some suppliers are hoping for stronger increases again [this year], but if I had to characterize it, I think buyers would probably want to keep things somewhere under 5 percent.”

– Goldspring's Neil Hammond

Unsustainable?

One aspect of hotel program management that wasn't highly represented in open-ended responses about 2024 goals was sustainability. Only a handful of respondents cited it, whether on its own or as part of a larger environmental, social, and corporate governance, as part of a 2024 objective. One said that "our primary goal is to incorporate a better mix of mid- and luxury type properties with sustainable initiatives with a traveler wellness focus," for example.

Hammond noted the rigor and urgency that European companies in particular are pursuing sustainability strategies in their air travel programs and suggested that the lower level of carbon-reduction metrics in the hotel sector could explain the low prominence of sustainability in the survey.

"What we really need is some quantifiable metrics, reporting and selection criteria on a par with what we have for the airline industry and what the booking tools have been able to serve up."