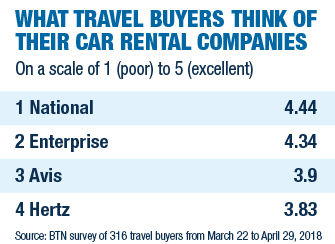

National Car Rental maintained its position as travel buyers’ highest-rated car rental supplier for the fourth year in a row in BTN’s Car Rental Survey. Buyers also indicated that supplier communication is a leading differentiator in satisfaction. While BTN changed up the criteria for this year’s survey from past years, the results were the same as every previous year: National on top, followed by its sister brand Enterprise, then Avis and Hertz. Also similar to last year, about a third of buyers said customer service had improved at their car rental suppliers over the past year. About 62 percent said it had stayed the same, and only 5.4 percent said service had deteriorated.

Abrams Consulting Group president Neil Abrams said all three major car rental companies have kept up with one another in terms of offerings and that pricing remains competitive, especially among large corporate accounts. National and Enterprise’s structure, however, continues to give the company an edge, he said. “Obviously, they are doing it right, and four consecutive years you can’t argue with. There’s little [corporate business] migration among [suppliers] and all of them are doing a pretty good job in pricing and providing services and support, but it’s in that consistency and quality of delivery. [Enterprise Holdings] as a company is very buttoned up and disciplined in how they do business, and they’ve continued to build the brands while maintaining that consistency.”

Pharmaceutical Strategies Group corporate travel and meetings manager Jennifer Brown said National has been particularly helpful in quick resolution of billing issues and providing status matches and upgrades, which helps build compliance. “From my travelers, the No. 1 thing I hear is: They like the ease with National of being able to pick out whatever car you want,” she said. “A lot of my travelers are traveling to specific cities for client meetings, and they can’t have the delay of going to the counters.”

FactSet Research Systems travel manager Alessio Colacino, a National and Enterprise customer, is pleased with the number of upgrades his travelers get and praised the company’s responsiveness. “From any time we have a question or an issue, I have two contacts—one the main account manager and one more on the processing side—and it’s usually handled fairly quickly,” he said. “No complaints there.”

Several buyers told BTN they appreciated regular updates and meetings with their representatives, while several others meet their reps only a few times per year. Hertz EVP of global sales Bob Stuart said responsiveness, particularly in handling problems, has been a focus. “We are known for recovery, and for our corporate customers, we have a dedicated customer service line,” Stuart said. “Probably 99 percent are resolved within 24 hours, and that’s one we take very seriously.”

Several travel buyers called out instances in which account reps used data to show ways to improve their programs. One rep pointed out the percentage of a client’s travelers who were booking at the midsize rate rather than booking at a lower price point and then accepting the loyalty program upgrade to midsize. Another said National and Enterprise provided instances in which travelers had booked with Enterprise but could have booked National and benefited from its Emerald Aisle quick-pickup service.

In general, car rental suppliers over the past several years have been looking beyond the base car rental to help buyers develop and manage their ground transportation programs. Enterprise Holdings VP of business rental sales and global corporate accounts Don Moore cited a calculating tool the company developed to help travelers determine when renting cars is more cost effective for the company than for employees to use their personal vehicles. “We physically sit down with them, talk to them about their needs: where they’re traveling, how many miles they are traveling and what size vehicles they are using,” Moore said. “We will be enhancing that, as well, as we look at being a total transportation solution.”

Avis Budget Group SVP of sales Beth Kinerk said Avis aims to provide a “fully connected journey,” with supplemental offerings like Zipcar, which it acquired in 2013. The company also will launch a customer portal in the near future, which will enable travel managers not only to see the financials of their car rental programs but also to monitor traveler behavior and compliance, she said.

Stuart said Hertz also has worked to provide more detailed data to inform buyer programs. “We give you the usual set—top renting locations, miles driven, etc.—and also give detailed information on that rental transaction: what they spend on fuel, what the destinations are,” he said. “We want to be true consultants.”

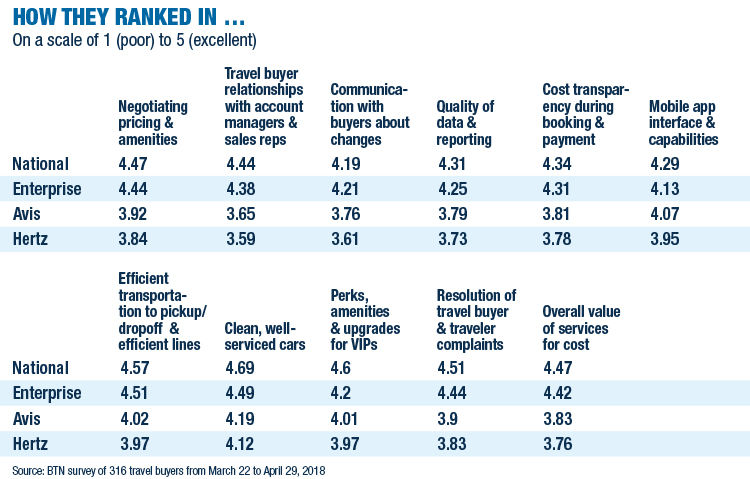

One of the survey’s new criteria this year, mobile app interface and capabilities, turned out to be tight competition, as all four suppliers have invested in that area. Both Enterprise and National recently revamped their apps to decrease the number of clicks and improve travelers’ ability to select vehicles in advance, Moore said. Stuart said Hertz is “constantly refreshing” its app with new features, such as a partnership with another app that lets travelers locate and pay for parking. Kinerk said Avis Budget’s app now lets travelers track airport shuttles to the car rental locations but that one of the most popular features of the app among travel managers remains the simple ability to see the insurance card and rental agreements.

Even with the focus on technology, National, Avis and Hertz all received their highest scores in one of the basics: clean, well-serviced cars, which did not surprise Kinerk. “We require extensive training for all service agents, as well as their production managers, with a checklist of things they have to do,” she said.

Car rental suppliers also stood out as partners in the face of natural disasters in the past year. One buyer said a supplier “went above and beyond in helping us” when the company needed vehicles in Puerto Rico after Hurricane Maria. Moore said Enterprise and National’s disaster plans—which include working with local governments and utility companies, setting up temporary locations and moving in extra vehicles as necessary—had an especially big workout last year. “It was a challenging year, but we were able to work closely with these companies,” he said. Enterprise Holdings executive chairman “Andy Taylor gave us a quote years ago: ‘In times of disaster, it’s time to make friends, not money.’”

Methodology for BTN’s Car Rental Survey

From March 22 through April 29, 2018, BTN surveyed travel manager and buyer members of the BTN Research Council and a randomly selected subset of qualified subscribers of BTN and Travel Procurement. Equation Research hosted the survey and tabulated the results. Respondents graded only those car rental companies with which they had negotiated contracts or booked meaningful amounts of business in the past year. Brands that did not reach a minimum usage threshold were disqualified from the survey. BTN averaged the category scores to create an overall score for each car rental company. Participants who did not respond to questions for a particular category or brand were not included in that category or brand’s average.

This year, BTN adjusted the categories by which car rental companies are rated. Two categories—negotiating pricing and negotiating services and amenities—merged, and BTN added five categories: quality of data and reporting, cost transparency during booking and payment, mobile app interface and capabilities, efficient transportation to pickup/dropoff and efficient lines, and perks, amenities and upgrades for VIPs.