Brands from just three hotel companies qualified for both the upper-upscale and upscale tiers this year: Marriott International, Hilton Worldwide and Hyatt Hotels Corp.

Those brands' loyalty programs likely are the driving factor in that choice, posits industry analyst and adjunct professor at the New York University School of Professional Studies Jonathan M. Tisch Center of Hospitality Bjorn Hanson.

For upper-upscale, buyers "follow in order of the generosity of their loyalty programs," he said, adding that Marriott has "by most independent and objective measurements, one of the best loyalty programs." He then placed Hilton's above Hyatt's. "I wonder if loyalty weighs more than in luxury or in upscale, which can be more about price," he said.

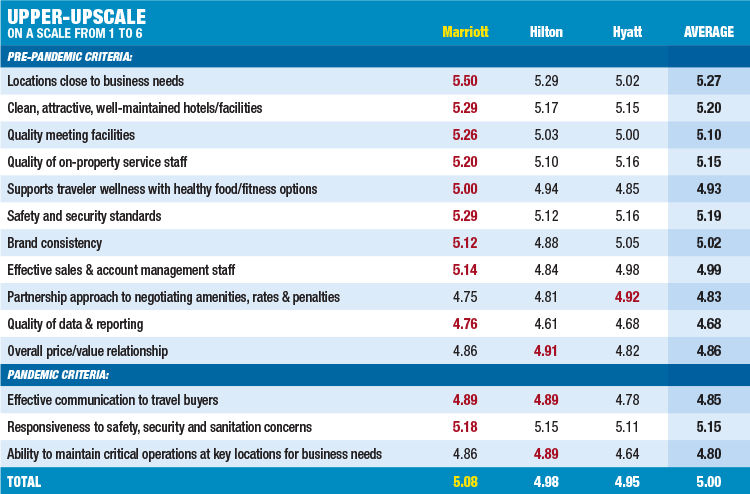

Upper-Upscale

The Marriott brand skipped from fourth place last year to No. 1 this year, and an average score that jumped more than a quarter point to 5.08. Travel buyers also rated it highest for nine of the 11 criteria pre-pandemic, and two of the criteria during the pandemic. In all, it posted average scores of 5 or above in nine of the 14 overall criteria. Last year, the only category it rated highest in was for strategic locations for business needs.

Marriott SVP for premium brands Jason Nuell credited two factors for the improved scores and placement: a product transformation that began a few years ago, and the Bonvoy platform. "We're at about 80 percent of the portfolio in North America that are compliant with those new standards," he said. "The other big piece is the Bonvoy focus on the global traveler, elevating their benefits and getting them onto the platform."

Some of the brand changes include swapping out bathtubs for walk-in showers, adding more functional furniture focused on allowing guests to work in their rooms, and fitness upgrades. "On top of that is the M Club, where we really made sure it was a premium space," Nuell said. "It's gives the business traveler a place to recharge and focus."

Nuell added that Marriott is working with corporate travelers to personalize their approach and get the right hotels in programs. "We're making sure we're being transparent with the right hotels, the right markets, cleaning protocols and ensuring flexibility around them as well," he said, adding that travel managers have requested a personalized approach.

Hilton placed second, taking top ratings for overall price/value relationship, and two of the pandemic criteria: ability to maintain critical operations at key locations for business needs, and tying with Marriott for effective communication to travel buyers.

Hyatt came in third again this year but improved its overall score from 4.75 to 4.95. It also took top honors for its partnership approach to negotiating amenities, rates and penalties.

"We started connecting to customers the first week in March and got together focus groups and by vertical market and by different segments," said Hyatt VP of global sales Gus Vonderheide of the pandemic. "We really wanted to understand how travelers were feeling from a safety perspective and how travel buyers were feeling from a trends and a demand perspective. We had the CEO and others talk to them. We wanted to make sure we were very visible and transparent in our thinking and to make sure we understood their needs."

Hyatt learned that one size does not fit all. "We came up with half a dozen pricing models and laid them out," Vonderheide said. "Pricing will be key as we go into 2021. We know demand will be lower. Supply will be higher. We need to make sure we are priced appropriately to attract the business."

As for overall segment trends, Vonderheide said every offering has to focus on wellness, safety and security, and touchpoints with the customer. "And there's a good amount of pent-up demand for all levels of our properties, and it just is going to be at different levels as business comes back," he added.

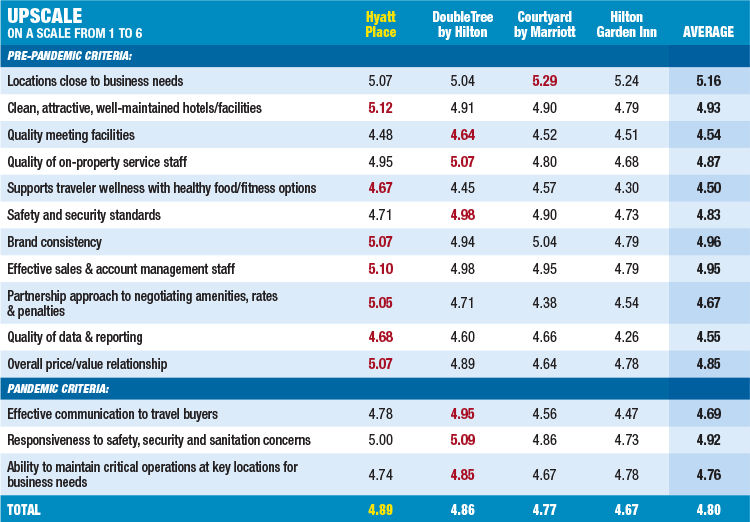

Upscale

Hyatt Place leapfrogged from third place last year to No. 1 this year, rating highest in seven of the 11 pre-pandemic criteria, particularly for cleanliness and having an effective sales and account management staff, as well as brand consistency and overall price/value relationship, and partnership approach to negotiating amenities, rates and penalties, not unlike its Hyatt brand in upper-upscale.

"Fortunately, many of our hotels stayed open the past several months, and we immediately found ways to make the customer feel safe and comfortable," said Hyatt's Vonderheide. "We continued to provide a full-service experience in a select-service environment."

In addition, Hyatt Place in 2019 rolled out the ability for World of Hyatt rewards members to confirm early check-in and late checkout prior to their arrival at all the brand's properties in the Americas. The company also offers mobile entry via the World of Hyatt app, allows guests to see what room they've been assigned and how it aligns to their preferences, and is rolling out new digital capabilities that include the ability for members to select their housekeeping preferences, to view restaurant menus, and to order and pay for their food and beverages.

Close behind Hyatt Place was DoubleTree by Hilton, which fell from the top spot last year to No. 2. It garnered top scores for quality meeting facilities, quality of on-property service staff, and safety and security measures pre-pandemic. It also scored the highest for all three of the pandemic-related criteria, particularly responsiveness to safety, security and sanitation concerns, likely a result of the company's CleanStay cleanliness program, launched in April.

Rounding out the top three was Courtyard by Marriott, moving up from fourth place last year, and it once again scored highest in having locations close to business needs.

"Courtyard is a very well-established brand," said Marriott VP and global brand manager for classic select brands Diane Mayer.

The company has about 1,100 hotels globally. "It's everywhere you want to be," Mayer said. "Our growth strategy the last couple of years has been one where it's increasingly an urban brand. Where you might have more convention center and full-service hotels, increasingly there is a desire for a great hotel product that is more room-focused and a little less group-focused so the business traveler can feel comfortable."

Mayer added that the brand is looking at emerging business districts and technology hubs springing up in markets like Nashville or Texas or other places with call centers or distribution centers.

In addition, as it relates to wellness, "Courtyard has worked hard in both the fitness space and in the food-and-beverage space," Mayer said. "A vast majority of our Courtyards have the bistro concept, which went through a fairly significant refresh about two years ago … with an eye to being healthy and fresh. And as hotels renovate, we're creating larger fitness spaces."