As part of this year’s 2021 Hotel Report, BTN surveyed 138

travel buyers as to the state and future of their hotel programs, and found a

desire to move past the pandemic, back to a world of negotiated contracts and

widely available amenities. But a return to normalcy isn’t that simple, and

persistent labor shortages have left hotels unable to fully return to a

pre-Covid era, and buyers still don’t have anywhere near a complete picture of

future demand. Still, as the recovery continues, both sides are finding ways to

work together to move forward.

2022 RFP Trends, Rate Strategies

Last year, some buyers opted to roll over their negotiated

2020 rates into 2021, given uncertainty about future volume and chain

representatives who were operating with fewer resources and doing more work.

For the current request-for-proposals season, “the situation appears to have

stabilized quite a bit further, and the chains have caught up with some of the

processes needed for dual-rate loading and flexibility,” said Goldspring

Consulting partner Neil Hammond. “There’s a little more beyond, ‘Here’s the rollover,

take it or leave it,’ ” he said, adding that he’s seeing more chainwide

agreements.

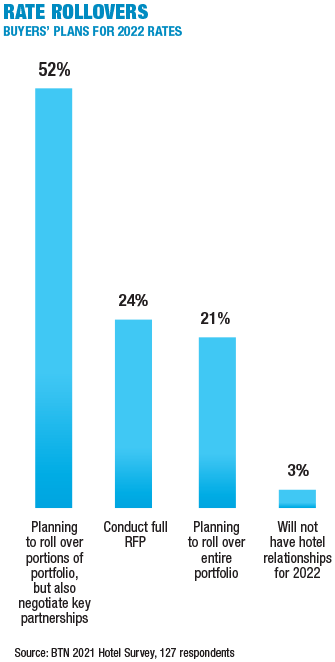

Survey results showed a little more than half of buyers

planned to roll over portions of their hotel program portfolios, but also

negotiate key partnerships. Slightly more than one in five buyers planned to

roll over their entire portfolios, while nearly one in four planned to conduct

a full RFP for the 2022 season.

Those results are consistent with what Areka Consulting

managing partner Louise Miller has seen. “Some customers are at 40 percent to

50 percent of normal levels and know where they are staying and going and can

feel comfortable negotiating,” she said. “Others are traveling 10 percent or

less [of previous volumes]. They are waiting to see where demand materializes

and can practice dynamic program management.”

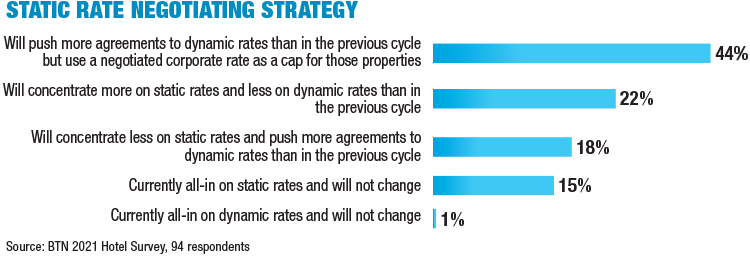

Indeed, nearly 62 percent of buyers reported that they will

push more agreements to dynamic rates than in the previous cycle, with about 44

percent planning to use a negotiated corporate rate as a cap for those

properties. This increase in using dynamic rates surely would please the hotel

companies, many of which have been pushing for them for years.

About 22 percent of buyer respondents planned to concentrate

more on static rates and less on dynamic compared with the previous cycle. Just

15 percent were “all-in” on static rates, and about 1 percent were using

dynamic only.

Geography also may play a part in rate strategy. “2021 saw a

lot of contract rollovers,” said Accor SVP of sales and distribution Markus

Keller. “People were on furloughs on both the supply and demand sides. But

people are coming back to the table and want a discussion on what rates will

be. There is a lot less rollover. That is particularly true for North America.

Other regions, like Asia-Pacific, are more accepting of the rollover. It’s not

all in the same place when it comes to the recovery.”

Some sources noted that, depending on the company and

vertical, hotel programs are generally smaller than pre-pandemic. That could be

the case for S&P Global director of global travel and meetings Ann Dery’s

program. She is holding off on an RFP until after the company completes a

merger with IHS Markit, which should happen before the end of the year.

“My strategy is to have a more strategic program,” she said.

“We’ll expand our footprint globally, as IHS Markit has offices in more

countries than we do. We are switching hotel consultants and solutions to help

with hotel engagements this year. But I don’t think we’ll need 200 hotels, or

multiple hotels in top destinations. We will look at who our top 25 properties

are and most likely try to get the top 10 a hybrid rate, then the next tier

will be dynamic with a discount and cap.”

Dery said it’s about making the program fit to the purpose

and having a smaller footprint and less properties per destination. “I do think

the pandemic has really changed the landscape when it comes to hotel sourcing.

It may or may not come back in a few years,” she said. “With reshopping tools

and better tools to track how often we are getting preferred rates, it’s

changed the whole dynamic of hotel sourcing.”

Supplier and On-Site Challenges

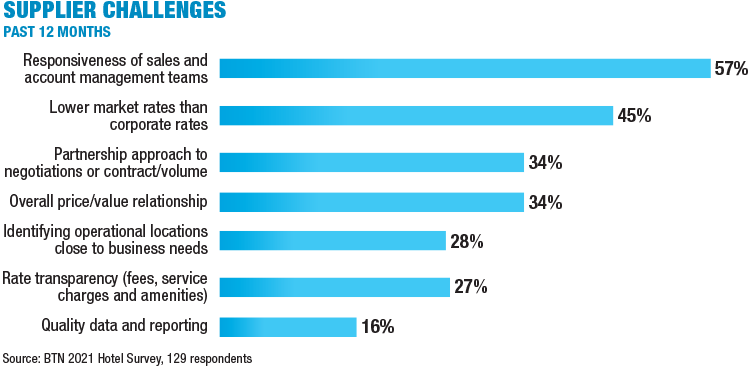

Nearly 57 percent of buyer respondents identified the

responsiveness of sales and account management teams as the biggest supplier

challenge they faced. This no doubt is related to the many furloughs and

layoffs the hotel companies conducted during the height of the pandemic, and

the difficulties they have had in rehiring workers.

“Some of the chains did really well, others did not,” Dery

said. One company “had such a huge amount of people furloughed, and it took so

long to bring some staff back that my account has suffered from a lack of

attention. We now have a new account manager with [them], but we lost all

connection to the former relationships we had.”

Hotel companies told BTN they are working hard to bring

staff back. “It is getting better every day, every week, getting people back to

work,” said Marriott International SVP of global sales Tammy Routh. “We’re

getting to occupancies where we can bring people back and reopen the

restaurants, all the facilities.”

Hyatt Hotels Corp. is looking to “open doors to new types of

people,” said Hyatt VP of global sales for the Americas Gus Vonderheide. “We’re

looking outside of the normal hiring process to recruit talent in ways we have

not done in the past, and it’s working well.” He added that Hyatt also is

getting involved earlier with hospitality schools, and not just interviewing

candidates during their senior year. “We’re getting to know these students

earlier on and getting them into the family sooner,” he said.

Another concern among buyers was finding market rates lower

than their corporate rates, shared by 45 percent of respondents. “If you have

dynamic rates and you’re rolling over, this won’t affect you,” said global

travel manager Mira Rosenzweig, who is co-chair of the Global Business Travel

Association accommodations committee. “Where you have a static rate and don’t

have a dynamic component in addition, that is where you’re running into market

rates much less than what you had solidified in the contract.”

In a somewhat related concern, more than one in three buyers

also noted that supplier challenges included a lack of a partnership approach

to negotiations and the overall price/value relationship.

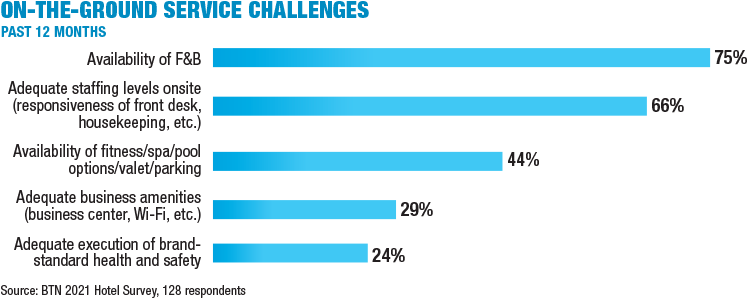

By far the biggest in-hotel challenges were the availability

of food and beverage options (75 percent) and adequate staffing levels on-site,

such as for the front desk and housekeeping (66 percent).

Housekeeping always is a key topic, and most hotel companies

plan at least partially to retain an on-demand option, even post-pandemic,

especially given the increase in the cost of labor.

“Where some of the challenges happened, there was a

disconnect from the information we received and what the experience was on

property,” said Travelsavers SVP of hotel programs Samantha Jones. She added

that some full-service properties couldn’t service guests when the restaurants

weren’t open. “Midscale and economy hotels did better because they always offer

free breakfast as a brand standard,” she said. For one full-service hotel

company that focuses on the corporate traveler, Jones said the experience was

inconsistent from hotel to hotel.

“Service is a hot topic, especially when you don’t know what

you are going to get,” Jones said. “We are working with hotels directly to say

what is open and what isn’t to help us to communicate to our travelers what to

expect before they arrive. It’s difficult when booking for people who have not

traveled for a long time. They are expecting the pre-Covid experience. You have

to set expectations with travelers. But some people don’t care. They expect

what they expect as a paying customer. It’s a tricky thing.”

Service and Amenity Expectations

Nearly 44 percent of buyers found challenges with the

availability of on-site amenities, such as the gym and pool. About 29 percent

were concerned about properties having adequate business amenities, such as a

business center and Wi-Fi.

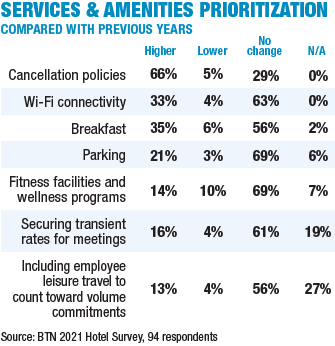

When it comes to service and amenity prioritization, 35

percent of buyers said breakfast would be a higher priority for them in 2022

than in previous years. The good news is hotel companies are beginning to bring

back fuller breakfast options, including BWH Hotel Group, Marriott and IHG

Hotels & Resorts. “Breakfast has one of the biggest impacts on satisfaction

scores, and Covid-19-related restrictions made it difficult for our hotels to

meet traditional expectations,” said IHG SVP of global sales Derek DeCross in

an email. “We’re working closely with owners to create a range of safe,

high-quality solutions for guests that remain cost-effective for our hotels.”

A full one-third of respondents said Wi-Fi would be

prioritized more for them than previously going forward, while 21 percent noted

that parking would be more important. “Standard amenities are still being

negotiated,” Rosenzweig said, adding that Wi-Fi will always be important,

especially as some guests are working from their hotel room. “Parking is an

interesting one because rental car usage has increased for some companies that

don’t want to be using rideshare. Car service has increased as well.”

But the top item that buyers identified as having more

priority in 2022 than before would be cancellation policies, noted by

two-thirds of respondents. “We’re seeing more flexibility with cancellation

policies,” Rosenzweig said. “But I don’t know how long that cancellation

flexibility will last. Those will come out in the RFP. Two to three years ago,

the cancellation policy was more 48 hours. Buyers are pushing for the same day

or 24 hours.”

Goldspring’s Hammond agreed: “Buyers are still holding firm

on no erosion on the cancellation period.”

Alternative Accommodation Usage

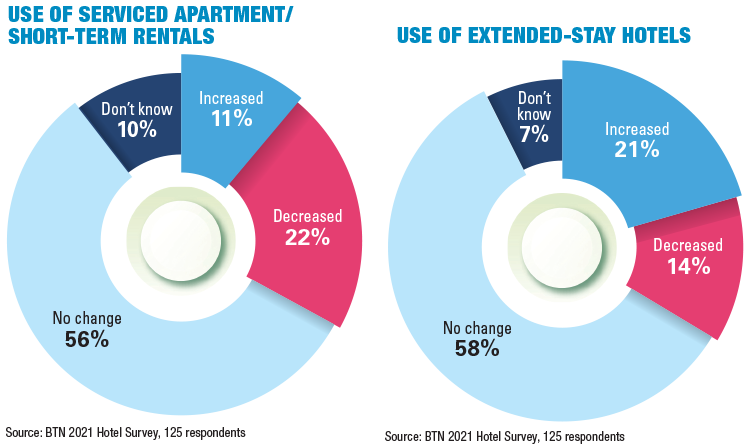

Much ado has been made about how short-term rentals, or

apartment-style accommodations, have been a success story during the pandemic.

Some leisure travelers now prefer these options for similar reasons

extended-stay properties gained in popularity. But what about business travel?

About 56 percent of respondents indicated they would make no

change to the use of serviced apartments or short-term rentals in their

programs. More than 22 percent said they planned to decrease their usage. Just

over 11 percent intended to increase their use in hotel programs. Ten percent

were unsure.

Areka’s Miller, though, is seeing interest in those options

rise. “Especially Airbnb for Work, superhosts and ones that have protections,”

she said. “I’m definitely seeing more interest in those. The travelers usually

drive the choice. Until travelers get back on the road, it’s hard to say. But

buyers control only so much. Three to four years ago at a conference, buyers

were saying, ‘We don’t allow Airbnb, not at all.’ Within a year, there was lots

of usage of those because the travelers did it anyway. That will happen again.

It’s just going to matter what is most convenient for the user.”

Increased Tech Use

Mobile keys and contactless check-in and checkout already

were growing in popularity prior to the pandemic, but Covid-19 accelerated

their acceptance and availability. Accor this year even introduced its first

fully digital hotel room in the United Kingdom.

“That hotel uses a number of technologies, and one is the

Accor key, which is being deployed into different hotels for keyless entry into

guest rooms,” said Accor’s Keller. “They can get the key in their smartphone

and head directly to their room.”

Nearly all of Marriott’s hotels globally offer mobile

check-in through its Bonvoy app, including more than 5,700 hotels in North

America, Routh said. About 3,850 hotels in North America offer mobile key.

“Globally, we are on track to offer mobile key at more than 5,200 hotels by the

end of the year,” she added.

In addition to expanding digital check-in and digital key,

SVP of worldwide sales Frank Passanante said Hilton Worldwide is expanding

in-room technology, enabling guests to use their mobile devices through the

Hilton Honors app for certain aspects of their stay, including streaming media.

“Those technology-enabled hotels are expanding, and the trajectory is that we

will scale that in time,” he said.

Contactless payment is another area of focus. Mobile payment

is currently available at more than 2,500 Hilton hotels, “where guests can pay

with their mobile phones and smart watches by tapping their credit cards,”

Passanante said.

Room service and F&B ordering also have gone digital in

many hotels. “Touchless is absolutely part of the Covid recovery,” Hyatt’s

Vonderheide said. “You can now change the TV with your device, or order room

service by downloading a code. We will continue to look for ways to provide a

sense of security and safety to customers, and a lot will be through

technology.”

Accor in October also announced direct booking for its

meeting spaces in partnership with Groups360. The company’s GroupSync platform

will replace Accor’s current meetings website for RFPs before year-end.

Beginning in 2022, customers will be able to book meeting space in real time

using GroupSync Engage, with instant booking for guest rooms integrated in the

following months, Keller said. IHG, Hilton and Omni Hotels also added the

GroupSync Engage meetings feature earlier this year.

Best Western is in the early stages of some technology

programs, said SVP and CMO Dorothy Dowling. “We are very thoughtful with

hoteliers in terms of investments to make sure they will represent a long-term

solution and be livable in terms of the investment they make,” she said.

Sustainability, DE&I Importance

Sustainability and diversity, equity and inclusion topics

are increasing in importance to many buyers. “Buyers are extremely interested

in understanding those, and there has been more focus from the buyers’ side on

this,” Hammond said. “There certainly has been more information provided on all

those issues from the supplier side. Nobody wants to get left behind on either

of those topics. It remains to be seen how much those factors will ultimately

impact buying decisions.”

S&P Global has a supplier diversity initiative underway,

focusing on its top 100 suppliers. “Unfortunately, hotels do not fall into that

bucket because of the low level of overall spend,” Dery said. “That said, it

doesn’t mean we won’t add questions to the RFP to start collecting the data. If

we can put an icon on the online booking tool to show a property has a level of

DE&I or is using the ESG (Environmental, Social, Governance) acronym, it’s

worth promoting and great for us to do as well. Companies are being asked by

their own supply chains to document ESG, DE&I, and it makes sense in turn

they expect clients to do the same. We will have many new and more socially

engaged travelers, and they are very focused on these types of social

initiatives.”

Cvent Transient partnered with American Express Global

Business Travel to add 47 new questions to its RFP tool this year focused on

sustainability and DE&I. Rosenzweig said GBTA is working to add new

questions to its RFP template around the topics as well. “We expect it to be

available for the 2023 RFP season,” she said. “Everyone is coming out with

net-zero target dates. Travel is one of the biggest contributors to carbon

emissions. How do you control that without shutting down all of your travel?”