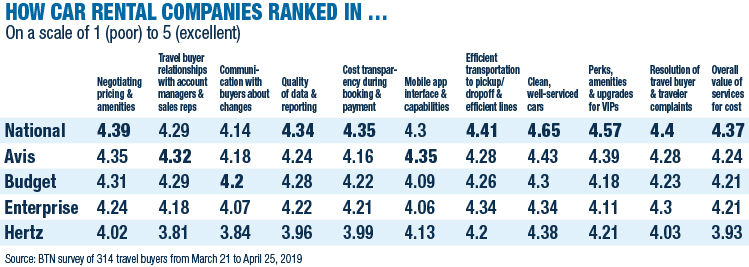

National earned its fifth straight victory atop BTN's annual Car Rental Survey, though it faced stiffer competition than in past years, as travel buyers' overall satisfaction with their car rental suppliers improved.

Despite a slight decline in total score year over year, National's average score across 11 criteria beat its competitors, as it has every year since BTN launched the survey. Both Avis and Hertz, however, significantly improved their scores, and Avis outscored National in two categories: travel buyers' relationships with the sales team and mobile app functionality. Avis' improvement also boosted it to second place, ahead of National sister brand Enterprise, which had held the second-place position every prior year. Avis sister brand Budget also garnered enough use among corporate buyer respondents to be included in the survey for the first time, and it debuted in third place, ahead of Enterprise and Hertz.

This year's survey marked the first time all the car rental suppliers' overall scores topped four, on a five-point scale. A third of buyers saw improvement in their car rental suppliers compared with the previous year. More than 60 percent said their suppliers' service levels had remained the same, and only 5.2 percent said it got worse. Abrams Consulting Group president Neil Abrams said the suppliers are all in investment mode as competition heats up. "You can see that it's so close between top and bottom," he said of the survey. "Their feet are to the fire right now and not just by the customers but by the marketplace."

National has the advantage of being a private company, which means it can invest without the scrutiny of analysts on quarterly earnings calls. "It's a long-term, growing business, and we do not necessarily have to do things in a quick way," Enterprise Holdings SVP of business rental sales and international tour Don Moore said. "We can take time, investing and growing in certain areas." Moore said that on internal surveys, service rankings for National have "never been higher." In BTN's survey, National outscored competitors in most criteria. Its strongest areas were clean, well-serviced cars; perks, amenities and upgrades for VIP travelers; and efficient transportation to pickup/dropoff and efficient lines. For the latter, Moore credited National's speedy Emerald Aisle rental offering. He said changes in the coming year will make things "easier and better for the customers."

Avis, meanwhile, improved its score in every criterion in BTN's survey. Avis Budget Group SVP of sales Beth Kinerk said that stems from "making sure customer experience is paramount." In particular, Avis has aggressively invested in technology, Abrams said, as evidenced by its score on BTN's survey for its mobile app. "Certainly, more than all the companies, Avis has spent time looking at this next generation of connected vehicles, recognizing that this business and industry is changing at an accelerating rate," he said. "Any company that is not spending on technology and evolving from legacy rental will be left in the dust." Kinerk said Avis is on track to have a fully connected fleet by 2020, meaning the vehicles will be able to communicate with the mobile app, and the company has been tweaking its app, based on feedback from customers and travel buyers, to provide insurance information, track shuttle bus arrivals at airports and other capabilities.

Budget not only broke through the usage threshold on the survey this year but also outscored its competitors in the category of communicating with travel buyers about changes. That brand, too, has seen growing use from the corporate space, Kinerk said. "It was always considered more of the leisure brand, but as we get into bleisure, extending work trips into leisure trips, we're seeing the Budget brand growing. [Business travelers] like to have the choice of the two brands on the booking tool."

Scores for Hertz, which declined to be interviewed for this story, also rose across all criteria. The company has achieved something of a turnaround after several years of financial challenges and has been investing in technology and fleet as a part of that rebound. "They're an excellent company with good brands and a good operating team; they've just been playing catchup for so many years," Abrams said. "They're back in the hunt—not back as the leader yet, but they have made strides."

As in previous years, communication with travel buyers emerged as the dominant theme among travel buyers commenting further on BTN's survey. That applies both to what their car rental partners are doing well and to what they can do better. Several buyers credited their suppliers with improving in-person quarterly business reviews.

National and Enterprise have maintained a focus on constant communication with travel buyers, Moore said. "We have more than 700 salespeople out in the field, strategic sales managers and account managers, having continuous conversations with those folks. We understand what their needs are and are constantly looking to get better."

Many buyers complained about transparency, especially in terms of surprise upsells to travelers at the counter. Avis tackled the transparency issue with the launch of its Business Intelligence portal his year, providing rental summary dashboards and other insights for corporate travel buyers. "We've had reporting, but we've built on that, based on feedback from customers, and are giving them direct access to more data than ever before," Kinerk said. "Open rentals, environmental sustainability, mobile app utilization—they can see it on the dashboard and can customize reporting and" key performance indicators.

Even as buyer satisfaction improves, the car rental industry is undergoing a larger-scale transformation. Competitive pressures from outside the industry are increasing, not only from ridehailing apps, whose use cases can replace car rental for some business travel needs, but also from auto manufacturers like Ford and Audi entering the car-sharing space, Abrams said. In the meantime, car rental companies are evolving; for example, some provide vehicles for ridehailing drivers, and they increasingly are investing outside their core rental products. Enterprise, for example, completed its acquisition of corporate travel technology platform Deem this year, and it has partnered to launch a car-and-driver service in China. That service could expand to other geographies. "We like to joke that we no longer call ourselves a car rental company; we're a travel solution," Moore said. Avis, meanwhile, has partnered with Google's autonomous vehicle spin-off Waymo so that when the technology becomes more prevalent, "we'll be ready for it," Kinerk said.

Such an evolution will be crucial to all the players' long-term survival, Abrams said. "I hate to use this metaphor, but it's a Game of Thrones, and who is really going to be sitting in the [iron] throne a year from now or five years from now?" Abrams said. "It's not just car rental companies but mobility companies, so those companies should all be really challenging themselves."

Methodology

From March 21 through April 25, 2019, BTN surveyed travel manager and travel buyer members of the BTN Research Council and a randomly selected subset of qualified subscribers of BTN and Travel Procurement. Equation Research hosted the survey and tabulated the results, and totals were based on 314 respondents. Those respondents graded only those car rental companies with which they had negotiated contracts or booked meaningful amounts of business in the past year. Brands that did not reach a minimum usage threshold were disqualified from the survey. BTN averaged the category scores to create an overall score for each car rental company. Responses from participants who did not respond to questions for a particular category or brand were not included in that category or brand's average. Categories were consistent with those measured in the 2018 survey.