Buyers are most satisfied with their chauffeured transportation suppliers in terms of cleanliness, as that metric moves front and center for suppliers seeking to rebuild demand decimated by the Covid-19 pandemic.

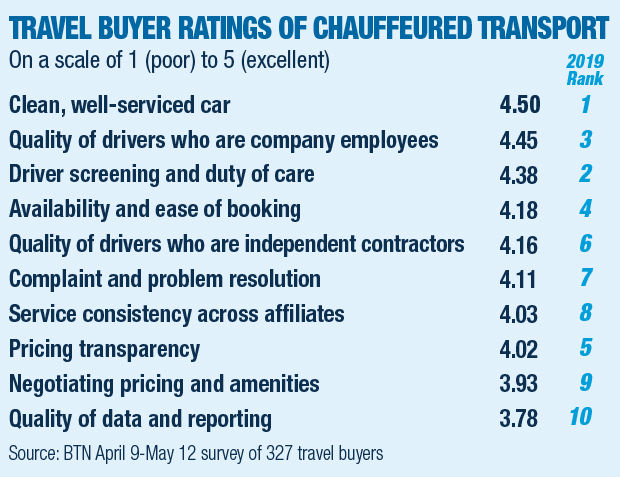

Of the 10 metrics tracked for chauffeured transportation suppliers in BTN's annual Ground Transportation Survey, buyers gave the highest score for their suppliers providing clean, well-serviced cars, earning a score of 4.5 on a five-point scale, up 0.01 points year over year.

In all, buyers indicated that their suppliers are staying the course, with nearly 78 percent saying chauffeured transportation customer service had stayed the same over the past year. More than 17 percent said their service had improved, and only about 5 percent said service had gotten worse, a slightly smaller percentage than in last year's survey.

The metric where suppliers are performing best also is the one getting the lion's share of attention, with suppliers establishing protocols to minimize spread of the virus. EmpireCLS, for example, is requiring both passengers and chauffeurs to wear masks—with chauffeurs required to wear N95 masks or the equivalent—and new sanitization measures and air filtration systems for vehicles. RMA Worldwide Chauffeured Transportation CEO Robert Alexander said he's viewing it as creating "a bubble between people's homes and the destination they're going to."

Providing that "bubble" has let ground transportation firms become a resource for some travelers seeking to avoid short flights or train rides, said Blacklane cofounder and CEO Jens Wohltorf. In the past month and a half, Blacklane's average distance per ride nearly doubled, he said.

"We have the opportunity to provide the business travelers out there the only real alternative they have to travel clean, safe and healthy, at least for short to midsize distances," Wohltorf said. "Rather than having to queue up in airports or train stations, they want to have a private car, with a guarantee of hygiene and cleanliness in place."

Where ride-hailing apps fall along that spectrum remains to be seen. In a recent series of discussion groups with buyers conducted by BTN, some said they had temporarily banned travelers from using the services, and some entities, such as Major League Baseball, have considered bans on their use as they resume operations. The apps themselves are putting their own protocols in place—Uber and Lyft are requiring passengers and drivers to wear masks, for example—but Alexander said the traditional suppliers will tout the greater control they have over their network and drivers as an enticement to buyers.

Even so, the apps are fairly entrenched in ground transportation programs. Only 6 percent of buyers in the survey, which was fielded after the onset of the Covid-19 crisis, said they had a policy prohibiting travelers from using ride-hailing apps. About 41 percent said they are allowed but not addressed in policy. Nearly a quarter said they were enrolled in one of the companies' business programs, and another quarter said they encourage travelers to use them in certain instances.

Traditional chauffeured companies, meanwhile, likely will see consolidation accelerate coming out of the Covid-19 crisis, but Wohltorf said it could strengthen the industry in the longer term.

"There will be a lot of losers in the game, but the crisis has a huge opportunity for players doing the right things and focusing on the right product," he said. "They'll be ready when travel starts kicking back in, and the industry has a chance to be healthier than it has been in a couple of decades."

BTN's Chauffeured Ground Transportation Survey

From April 9 through May 12, 2020, BTN surveyed travel manager and travel buyer members of the BTN Research Council and a randomly selected subset of qualified subscribers of BTN and Travel Procurement. Equation Research hosted the survey and tabulated the results, and totals were based on 327 respondents. Buyers scored their preferred chauffeured providers on a five-point scale. Categories were consistent with those measured in the 2019 survey.