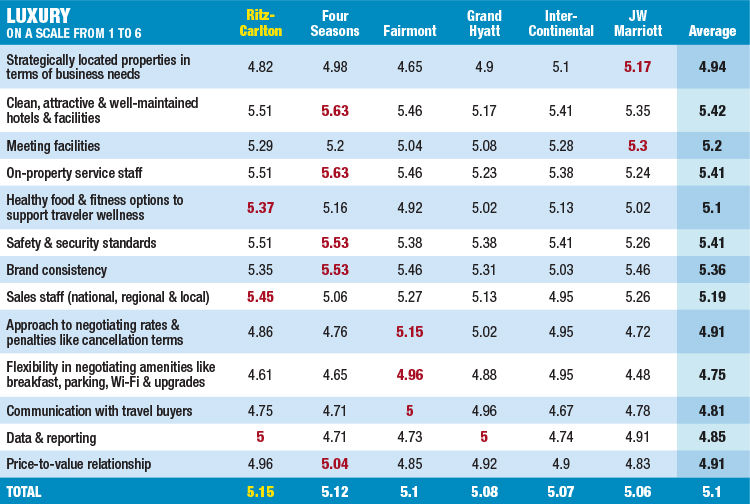

In last year’s BTN Hotel Brand Survey, the gap between first place and last place was 0.31 points on a six-point scale. This year, the distance has narrowed to a mere 0.09 points between Ritz-Carlton at the top of the list with 5.15 and its Marriott International stablemate JW Marriott at the bottom with 5.06 points.

Also notable is that Ritz-Carlton last year earned the highest marks for almost every brand criterion. Following a revision of the survey, travel buyers spread the plaudits far more evenly in 2018. Ritz-Carlton topped two criteria and shared the top spot for another, and it came in first overall while Four Seasons topped five criteria and placed second overall. Despite coming in last, JW Marriott ranked No. 1 for locations and meeting facilities.

Ritz-Carlton also topped the luxury segment in the J.D. Power 2018 North America Hotel Guest Satisfaction Index Study. The brand scored highest among its cohorts in BTN’s survey for sales staff, an achievement Marriott International global luxury sales VP John Harper attributed in part to a revamp it conducted of its sales training program earlier this year. “One thing we really spend a lot of time on is that this isn’t a transactional approach,” Harper explained. “It’s very service oriented. The travelers who stay at our hotels are very important to their travel managers. We want to make sure they are satisfied.”

Ritz-Carlton shared the top spot for data and reporting in BTN’s survey with Grand Hyatt. Harper said Ritz-Carlton is working on analytics to better understand which services corporate guests actually use during their stay. “If we offer a complimentary service to an account, they want to know how often their travelers use it because if it’s not really used, they don’t want to fight for it in the negotiation,” he said. One example, said Harper, would be enhanced Wi-Fi.

Ritz-Carlton also emerged as a clear winner for its support of traveler wellness via healthy food and fitness options, an area where, Harper said, the brand has worked hard to show more flexibility. “Wellness used to be about whether we had a gym, and then it was about food. Today, you have to give a lot of options and it’s not just physical but mental and emotional health. In New York, it could be about offering yoga classes in Central Park at 6:30 in the morning.”

Second place Four Seasons was admired for its well-maintained facilities, on-property service staff, safety and security standards, brand consistency and price-to-value relationship.

Bjorn Hanson, industry consultant and adjunct professor at the New York University School of Professional Studies Jonathan M. Tisch Center for Hospitality and Tourism, said the brand’s strategy sets it apart from others in the segment. “It’s just taking a position of being a single-focus brand,” he said, “maximizing its performance to demand generators and demand segments that are looking for a luxury brand.”

Third place Fairmont emerged as a firm friend of the travel buyer. It garnered the highest marks for a partnership approach to negotiations; for flexibility in negotiating amenities; and for communication with buyers. Accor-Hotels bought the Fairmont brand in 2016, and then the corporate sales teams merged. “What we have focused on in the last year has been customization, trust and data,” said Accor VP of global sales for business travel Christine Kerr.

According to Kerr, AccorHotels salespeople play the role of brokers, mediating the interests of two other parties, the corporate travel buyers and the hotels. “Our team spends a lot of time on the phone between travel managers and our hotels,” she said. “We have built that bond of trust with our travel managers. When we speak to hotels as a global brand, they are listening to us a lot closer. They understand who our largest buyers are in the corporate space.” Pre-acquisition, Fairmont offered chainwide discounts to 50 corporate customers. Now, chainwide discounts also reach 800 Accor customers, minus some Accor/Fairmont overlap.

Kerr said dynamic pricing is “definitely where the trend is going in the market.” She cited it as the perfect example of customization, trust and data in action. Clients are increasingly demanding it, she said, so her salespeople are “working with our hotels to understand if they have the technology to go there,” as it’s not so simple a task when hotels deploy different property management systems.

Still, Kerr is optimistic that a solution can be found through goodwill and dialogue. “Communication and collaboration with corporate customers and our key hotels are the reasons we have been successful,” she said.