For the travel that does return in 2021, programs are evolving, with a focus on communication, duty of care and a closer relationship with risk management partners.

"Risk management is the most important topic right now because it’s the lever we can pull to make progress on all the other elements of managed travel," Miller said.

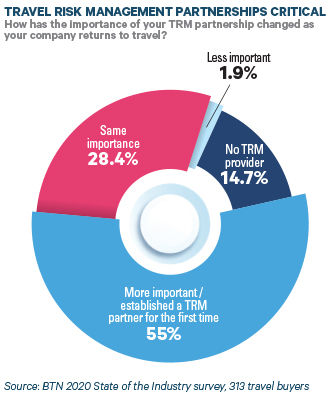

Specialized travel risk management companies report an uptick in client activity, particularly among midsize companies that have not had formal TRM supplier partners in the past. BTN’s survey returned 55 percent of respondents indicating a TRM partner has become more important to their program as they return to business travel during the Covid-19 pandemic.

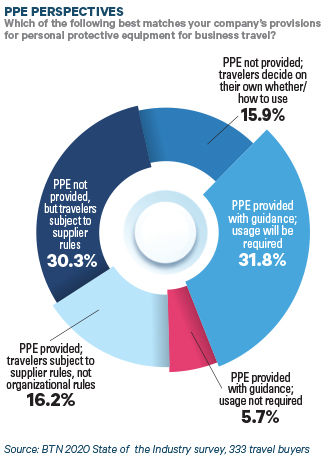

A key reason for this is the complexity the pandemic has foisted upon the business travel process. "There’s so much more you need to do in the planning phase than what you needed to do pre-Covid," one university travel buyer told BTN. The buyer cited internal travel permissions but also the current volatility of government restrictions and quarantine requirements for travel, not to mention current global infection trajectories, potential new guidelines on personal protective equipment for the traveler and other duty-of-care concerns.

TRM companies should be able to provide that advice as well as the associated education and duty of care protocols. Because of the way such providers often are positioned in the process, however, that information may not be automated at the time of booking. That’s a drawback programs are looking to overcome and a point of innovation TRM providers, TMCs and travel technology providers are pursuing (see next page, Bringing It All Together). Nevertheless, TRM providers offer many additional advisory, traveler safety and boots-on-the-ground health and medical services that companies will rely on as their travelers get back on the road.

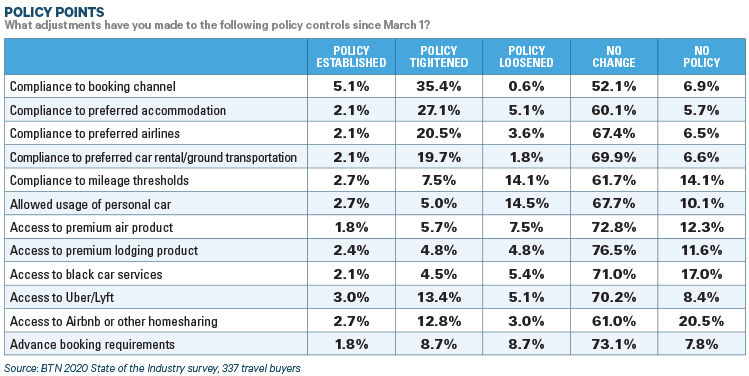

BTN’s survey also revealed emphasis on certain policy points as companies return to travel. First among them is a renewed focus on booking channel compliance. Since March 1, more than 40 percent of survey respondents either tightened their requirement for travelers to comply to approved booking channels or established such a requirement for the first time. This is a critical first step in achieving full visibility into corporate travel, but certainly not the only one.

Policies around the use of preferred suppliers also have been tightened for some companies. Given the heightened concern around hygiene standards, more buyers have said they want to direct travelers to trusted partners who will uphold those standards.

Nearly 30 percent of buyers surveyed indicated they were tightening or establishing policies around preferred hotel usage, and slightly more than one-fifth of survey respondents said the same about their airline and car rental compliance policies. In the wake of renewed compliance initiatives, contract utilization rates may emerge as a key program benchmark moving into 2021.

That doesn’t mean suppliers will be coasting on mandated usage in 2021. Otsuka America Pharmaceuticals senior corporate travel and expense manager Danielle Amoroso told BTN she’s tasked her travelers with reporting back to the organization on hotel cleanliness and suppliers’ ability to live up to their new promises. She’s removing hotel partners that don’t deliver. More buyers report using data services like TrustYou to understand sentiment around hotel product and services and will bring those scores to supplier meetings.

At the same time, a few companies are going the other way, according to BTN’s survey. They are loosening policies on preferred supplier usage and even on access to upgraded product tiers.

Discovery VP of travel management Yukari Tortorich has taken this approach. Speaking at a recent BTN conference, she said Discovery had relaxed policies around preferred suppliers as business travel gradually returns. "Right now, we recognize we have preferred airlines and properties, but we are looking at individual comfort level of using that carrier or hotel," she said. As travel management, she said, "we are there as a consultant, but ultimately we want it to be [the traveler’s] decision."

Tortorich may represent the minority on this, but there’s a common thread linking the views of many travel buyers who spoke to BTN, and that’s traveler empowerment. Whether that’s reflected in the way travelers are empowered to contribute to the program by reporting back on supplier service delivery or the way they are empowered with more flexible options from the outset, travelers are getting a voice within their travel programs. And companies are actively engaging with that feedback to improve what they deliver.

Bringing It All Together

With renewed attention from the C-suite and a laser focus on traveler

care, has Covid-19 underhandedly delivered the support travel programs

need to realize their best form in 2021? READ MORE