In the midst of a pandemic that brought travel of all kinds to a grinding halt, with little clarity on when and how it will resume at scale, the work of managing corporate travel was not business as usual in 2020. A prolonged decline in business travel appears likely, but that does not necessarily mean a decline in demand for skilled travel managers. In fact, the most skilled and savvy report increased demand for their abilities and respect for their strategic value.

At companies big and small, whether thriving or struggling during the COVID-19 pandemic, travel managers faced remarkable challenges in 2020, and their roles continue to change as they navigate unpredictable years ahead.

From Crisis Management to the Messy Middle

.jpg)

In the early months of the crisis, travel managers played a big and very visible role. The more tightly managed a travel program was the easier it was to locate employees, asses their risk, and steer them home through fast-changing health recommendations and border restrictions.

Once everyone was home, and it became clear that trips for the year would be greatly reduced, travel managers entered into the messy middle—with travel-as-usual in the rear view mirror, no trips on the horizon, and no consensus on when road warriors would need to pull their carry-ons out of the closet. They spent the first months of this period handling excess inventory, adjusting and renegotiating volume-based contracts to control costs.

"The second phase of the crisis was asset management," says Maria Chevalier, executive vice president for customer at PredictX, a London-based business travel analytics firm. "All of a sudden you had all of this distressed inventory, these unused tickets and meetings that had to be cancelled. And you were managing through the complexity of clauses. And how many of these tickets do I have and are they going to be extended?"

Travel managers are now in the next phase of that messy middle, planning for the future. For a few, the slow return has begun, but many are still anticipating when their teams will have even a small fraction of the usual number of travelers in the field.

Opportunities Are Out There

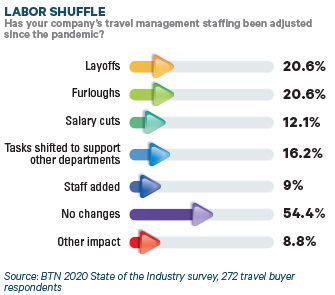

Personnel drawdowns are a nearly ubiquitous reality in 2020, and travel managers have not escaped unscathed. About a fifth of travel buyers responding to BTN's 2020 State of the Industry survey said their teams had experienced layoffs, and the same number had furloughs. Slightly fewer—about one in seven—said that travel management teams were taking on new responsibilities to support other departments.

Some travel managers support expense management more widely, and the pandemic seems to be pushing more companies to use travel managers this way. Some are also taking on new roles that encompass expenses, mobility or new work-from-home policies.

Some travel managers actively seek to expand their scope to support other departments—handling expenses for new home office equipment, for example, or taking over relocation work from human resources departments. The greater reach can do more than keep travel managers busy with administrative tasks; it also gives them greater visibility into broader issues of business continuity.

While in some cases, travel managers' tasks are being moved to support other departments, more companies also are beginning to appreciate their broader strategic value. For many, this shift began as Covid-19 first began spreading beyond Asia. Not only did Infomatica global travel manager Rick Wakida participate in the pandemic core resiliency team that met six times a week early in the crisis, but he opened the call with updates on the travel situation and progress in bringing team members home.

In some companies where travel management was seen as an administrative role, the pandemic has imbued it with more strategic importance. Executives, Chevalier said, now see more clearly the complexity of travel management, as well as its importance to the running of the company.

"There are more job postings than ever before. And they're paying better than they historically have," said Chevalier, who leads an informal networking group for business travel professionals. The opportunities are not limited to companies experiencing pandemic-related growth. Chevalier sees a broader phenomenon of executives taking travel management more seriously, which she observes in dealing with PredictX clients. "Our clients are getting more requests than ever before to participate with the C-suite."

Chevalier, who held travel management roles at HP and Johnson & Johnson, said that the scale of travel spend has long made the strategic importance of travel management clear at Fortune 500 companies. But she has observed, in the midst of the Covid-19 crisis, leaders at small- and midsized companies seeing effective travel management as a strategic imperative, critical to employees' safety and security and to the running of the company.

The crisis has spurred some SMEs to add internal departments to manage travel where before they had outsourced the work to travel management companies or treated travel as a simple administrative task. No data are available on how widespread that shift is, but for Jennie Robertson, when the pandemic closed a door, it quickly opened two others. After being laid off from her travel management role at a design tech firm, she received two offers.

The company that Robertson joined as manager of travel and expense, DocuSign, is one whose products have seen demand spike due to the sudden shift to remote work. The other offer she received came from a company having a good year unrelated to the pandemic. Neither had anyone dedicated solely to travel. Both saw Covid-19 making travel more complex, creating a need to establish formal policies and processes and make sure travelers have the information they need. "Even though the volume is way down, the complexity is way up," said Robertson.

For veteran travel manager Jack Reynaert, the pandemic took him from ramping down 2020 travel at an auto parts manufacturer in Michigan, to laid off, to helping companies plan for the eventual ramping back up of travel. Reynaert joined Illinois-based Options Travel in a newly created role, senior director corporate travel economics and optimization, in which he will work with companies that are creating new travel departments or refining practices at existing ones.

"We are getting a lot of contacts from people wanting insight into how travel can best be run for their company, how they can have more visibility into the details, Reynaert said.

2021 Priorities: Flex Contracts, Compliance & Safe Return

The travel management veterans interviewed for this piece all spoke of a return to travel in 2021, but with little clarity around when and how much. "There's this desire to get back to normal, but so much is changing and will continue to [change] over next year," says DocuSign's Robertson. "I don't think any of us knows what it's going to look like."

Safety will be paramount, and companies are watching infection rates market by market as well as scrutinizing costs and necessity. Robertson points out that, with so many companies not bringing employees back into the office before the second quarter, client visits remain rare: "When you're worried about how many of your people you can get up and down elevators, the last thing you want is to start having vendors come in."

Add to the equation a less robust conference scene, general apprehension about traveling, and, for many companies, many months of little or no revenue, and it becomes clear a quick rebound is not in the cards.

Eric Bailey, Microsoft's global director for travel, venue source and payment, said it took the company 10 years after the Great Recession to get back to pre-recession levels of business travel. "It wasn't because we couldn't afford it—it was because we didn't need it."

The recession of 2008 led to a shift at Microsoft in favor of conducting more meetings virtually. And Bailey says that this year's travel stoppage is ushering in yet another shift toward virtual. His projection is for Microsoft to return to 40 percent of 2019 levels by the beginning of 2022.

All that uncertainty calls for new approaches to budgeting and contracting for the coming year. "Procurement 101 is that it is based on historical data," said Chevalier. "But no past data can serve to forecast 2021, and the pace of recovery depends on a web of complex variables." Contracts will need to be flexible, and Options Travel's Reynaert urged travel buyers to consider a consortia model, pooling resources with other companies. He also urged buyers to identify their best suppliers and shore up long-term relationships: "Identify those partners that are strong enough to be willing to grow with you. Pricing might have to be adjusted because they need to stay in business. Everybody needs to stay in business."

As travel slowly returns, compliance will also get greater attention. "The duty of care factor is always been important, but never really as enforced as it should be," Reynaert said. "If they book their air, car, and hotel through your TMC, you know what hotel, you know what city they're going through, what flights they are on, what hotel they are staying at. And if you start getting high compliance with corporate credit card usage, you actually can go into the tool and know in more detail where people are."

Wakida said that Informatica currently only allows employees to book travel with explicit management permission, a practice many companies are likely using. As those policies loosen, travel managers will have a renewed focus on keeping bookings within the program.

Get Involved in the Future of Meetings

Live conferences and events will continue to face challenges well into 2021. Bailey, who says that 20 percent of Microsoft's pre-Covid travel was to conferences, expects the company to cut back the number who attend events in-person, leaving the rest to experience events virtually. Like other travel managers interviewed for this story, he also anticipated some disconnect between workers' desire to resume business travel and companies' willingness to continue at past levels. Trips will be scrutinized for necessity and value—initially for the sake of safety, but eventually because virtual substitutes have been embraced. The days of flying cross-country to present to the executive team could be over.

But Bailey is not just planning for less conference travel—he is focused on and very involved in designing Microsoft's future approach to events. "For me, the best example of a hybrid meeting is the Super Bowl. Nobody would say that if you put the Super Bowl on TV, nobody will go to the game anymore," he said, pointing out that people attend it live, while others have a great experience watching it with friends at home or a bigger venue. Still others record it so they can skip around.

"We're looking at putting an event together and it's more than just a hybrid meeting; it's a distributed meeting," Bailey said. "The central location is still key to the best experience, and you need to make sure that the right people go there and [then] have smaller meetings in multiple cities." Bailey and other travel managers will be among those creating new models for face-to-face events, and optimizing them for experience as well as the most prudent travel plan.

Bailey is not the only travel manager finding himself involved in envisioning and executing a post-Covid future. Wakida is working on return-to-office plans, including strategic planning around how liberal Informatica should be with work-from-home policies. Both Wakida and Bailey say that travel managers should think creatively about how they can help companies navigate to the future in areas adjacent or related to travel.

That future may be uncertain, but it will certainly include travel, and a need for strategic-minded travel managers, Bailey says: "I think there are going to be tons of opportunities, but the opportunities are for the people who realize how much we have shifted and how much we're going to shift."