As traditional chauffeured suppliers and ride-hailing apps battle

to coexist, travel buyers prioritize service and safety over price in dealings with

their chauffeured car suppliers.

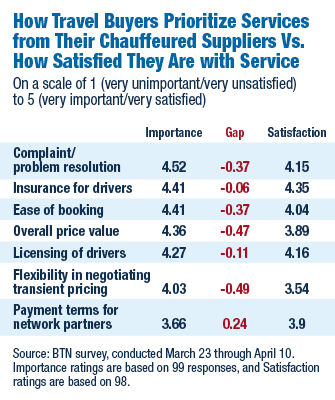

Buyers in a recent BTN survey ranked complaint/problem resolution

as the most important aspect of their chauffeured programs. Not far behind that

were ease of making bookings and insurance for drivers. Buyers also were most satisfied

with suppliers' performances in these categories.

Buyers' satisfaction with their chauffeured suppliers decreased

from 2016 in all categories except price/value ratio. They cited more detailed reporting,

more transparent billing and more consistent service among ways suppliers could

improve satisfaction. "I have to have more than five companies because every

exec has had a bad experience with one of the companies so I can't get anyone to

decide to just use one—or even two or three," one buyer said. "It's an

incredibly high-touch business with a complete lack of attention to those details."

Even so, buyers' priorities validate chauffeured suppliers' focus

on driver training, background checks and other duty of care elements as ways to

provide value in the ground transportation space. Oddly, they might have ride-hailing

suppliers to thank for that. Travel buyers' priorities differed before the advent

of ride-hailing apps, Dav El/BostonCoach CEO Scott Solombrino said. "Ground

wasn't the focal point, but now it's becoming the really hot duty of care topic,"

Solombrino said. "We see major corporates every week, and that's what they're

hyperfocused on. They want to see the differentiation."

Several chauffeured suppliers, meanwhile, are concentrating on

ease of booking. This year, Dav El/BostonCoach parent company Marcou Transportation

Group acquired car service platform GroundLink to help develop an on-demand platform

for chauffeured transportation suppliers. Solombrino said the company is making

progress on that. Meanwhile, ground transportation booking platform Blacklane, which

offers near on-demand booking and fixed pricing for chauffeured service, has broadened

to 255 cities in 54 countries, including more than 70 cities in the Asia/Pacific

region, said chief revenue officer Sascha Meskendahl. Blacklane also has integrated

into Amadeus, he said. "We are investing heavily in being integrated into the

different booking channels out there to make a seamless booking experience. And

we want to be where travelers actually travel so they can have one consistent solution

out there in the world."

Travel buyers reported low satisfaction with their suppliers

on negotiating pricing. Even though they also ranked this category low in importance,

it still represented the largest gap between buyers' satisfaction and importance.

Solombrino said corporate clients are concentrating less on pricing and more on

duty of care. "Pricing has leveled off," he said. "When we were coming

out of the recession, most of them renegotiated their deals and got what they needed.

We have nowhere else to go."

Meanwhile, there are signs that Uber and Lyft's charge into corporate

ground transportation is leveling off. First-quarter year-over-year growth in the

number of Uber expense transactions Certify processed was the slowest growth since

Certify started tracking it, though negative publicity bore some of blame. Both

Uber and Lyft also have focused on improving their offering to the corporate travel

space, however, including reporting and working with buyers to keep rides in policy.

In the end, there's room for both, considering the BTN survey's

price/value category outranked price alone in terms of importance, Blacklane's Meskendahl

said. Less than 30 percent of buyers said migration from chauffeured cars to ride-hailing

apps had been considerable or significant in their programs, and nearly 20 percent

saw no shift. "We're not so much into inner city mobility, trying to undercut

prices on short trips where you might not care so much about the quality of the

car," he said. "If you want a reliable service to get you to the airport

at 6 a.m., that's where something like Blacklane comes into the game."

Methodology

From March 23 through April 10, 2017, BTN surveyed 99 travel manager and buyer members of the BTN Research Council and a randomly selected subset of qualified subscribers of BTN and Travel Procurement. Equation Research hosted the survey and tabulated the results.

Of course, autonomous cars once again could shuffle

buyers' priorities for their ground transportation suppliers. At the recent Association

of Corporate Travel Executives conference in New York, Lyft chief business officer

David Baga projected that half Lyft's rides would be in autonomous vehicles in five

years, and perhaps all rides would in 10 years. "While autonomous vehicles

are closer than you think, they're also further away. Technology capabilities are

accelerating and the costs are going down, but to see an autonomous vehicle able

to serve all of the rides, we're really not ready."