Buoyed by some of the strongest demand and highest occupancy

seen in continental Europe in years, as well as a strengthening euro and

British pound against the U.S. dollar, the daily cost of travel increased year

over year in most of Europe’s Corporate Travel Index markets. Spending levels

and forecasts are far less consistent in Africa and the Middle East. In the

latter, a supply boom continues to outpace demand.

For the 59 cities that comprise EMEA in this edition of the

CTI, the average 2017 daily cost of an upscale hotel room, three meals and a

taxi from the airport to the city center is $326.72 in. Last year’s CTI doesn’t

represent an apples-to-apples comparison, as BTN replaced a melange of

miscellaneous trip costs with the simpler taxi ride. Daily combined hotel and

food costs, however, show a year-over-year increase of slightly less than 5

percent.

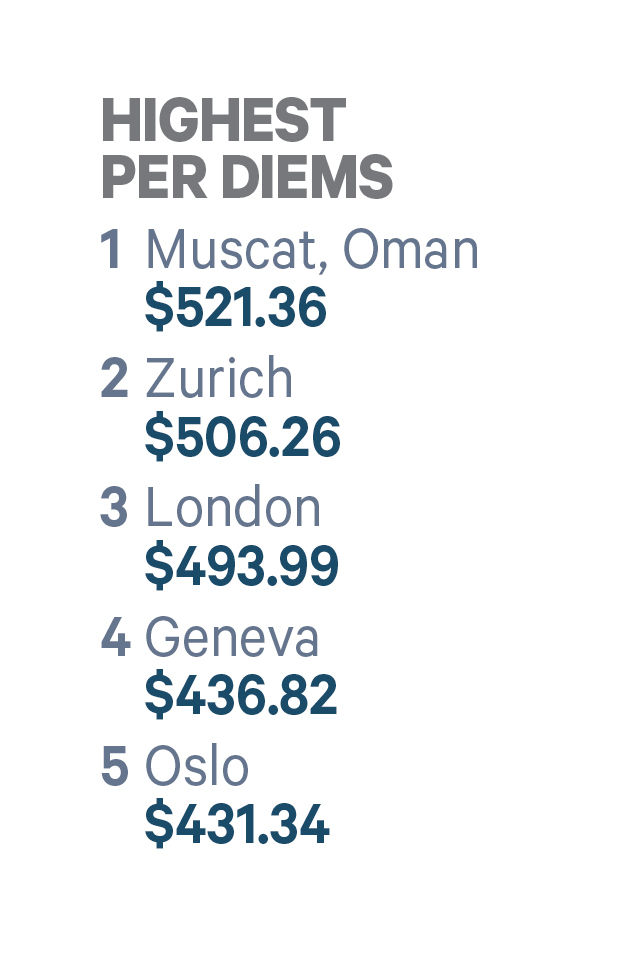

In fact, despite seeing nearly a 7 percent increase in its

daily hotel and food total, Zurich, which was last year’s highest-ranking EMEA

city for travel costs, has been dethroned this year by the Omani capital of

Muscat, where the 2017 daily business travel cost was $521.36. Don’t be fooled,

though: Muscat’s lofty perch atop the CTI EMEA ranking is a function of its

taxi costs. Only in Tokyo does it require more to travel from the airport to

the city center than Muscat’s $191.

In fact, Muscat’s 2017 daily hotel and food costs declined

more than 6 percent from 2016, a common theme among cities in the Middle East.

Excluding the taxi, travel per diems dropped year over year by 1.5 percent in

Kuwait City, nearly 4 percent in Riyadh, more than 2 percent in Abu Dhabi, more

than 3 percent in Dubai and almost

18 percent in Doha. In many of these cases, the culprit remains a significant

influx of hotel supply paired with a depressed global market for oil prices.

Due largely to these trends, BCD travel management consultancy Advito projects

continued general softness in travel costs in the Middle East in 2018.

Europe

A far different story occurred in Europe. Combined hotel and

meal prices increased by at least 10 percent from 2016 to 2017 in 15 European

cities. In Prague, Warsaw, Stuttgart, Lisbon, Madrid and Rome, the increases

were at least 15 percent.

One key cause is strong hotel demand throughout the

continent. Occupancy rates in Europe in 2017 reached levels not seen since the

early 2000s, according to lodging consultancy MKG Consulting. A second factor

was the increasing strength of the euro versus the U.S. dollar and the British

pound in 2017. CTI hotel rates are converted from local currency to U.S.

dollars using the conversion rate on the date each hotel invoice was paid; food

costs, meanwhile, are based on a Dec. 2, conversion rate, so there is no single

date to assess for conversion rates. Deutsche Bank analysts expect the euro to

strengthen further against the dollar in each 2018, 2019 and 2020.

The weakness of the pound against the euro and the dollar is

one reason British cities showed a year-over-year decline in business travel

costs in the Corporate Travel Index. Combined hotel and food costs dropped 2.7

percent in London; almost 5 percent in Manchester, also the site of a 2017

terror attack; and under 1 percent in each Birmingham and Glasgow. Edinburgh

increased about 2 percent.

Africa

Africa continues to be a mixed bag in terms of daily

business travel spend. Combined hotel and food costs dropped by more than 20

percent in Lagos, the second straight major drop for the Nigerian city, and another

indicator of a slow global price market. According to lodging research firm

STR, “Nigeria’s hotel industry continues to be affected by a poor reputation

around security concerns in the country.”

Still, Advito projects sharply higher hotel rates

in 2018, not only in Nigeria but also in areas like South Africa and Egypt, due

to “massive pent-up demand for quality accommodations” and an influx of new

branded supply.