Compared with traditional hotel segments, the extended-stay

segment performed well throughout the depths of the Covid-19 pandemic, even

though the comparisons are not exact. The type of essential travelers who

remained on the road and some leisure guests who began traveling again a year

ago often desired longer stays, wanted kitchens as many restaurants in and near

hotels had closed or had limited services, and sought extra space for working

or simply spreading out.

Extended Stay America capitalized on its pandemic success

and agreed in March 2021 to be sold for about $6 billion, taking the company

private. Choice Hotels, which now counts four extended-stay brands in its

portfolio, has leaned into the segment, which as of June 30 accounted for 10

percent of the company’s domestic rooms. Its WoodSpring Suites brand reported

occupancy levels at nearly 86 percent and 16 percent revenue-per-available-room

growth during the second quarter of 2021 compared with the same period in 2019.

In development activity for the period, Choice’s franchise contracts for the

segment grew nearly 60 percent.

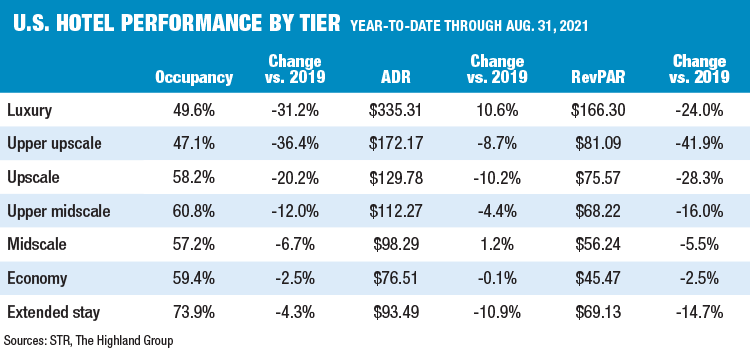

Economy extended-stay in particular year-to-date through

Aug. 31, 2021, had surpassed its 2019 levels for all three key performance

indicators, according to The Highland Group. The 2021 midscale tier was down

mid-single-digit percentages for each metric—RevPAR, occupancy and average

daily rate—while the upscale extended-stay segment continued to lag, with

occupancy down 9 percent from 2019 levels, ADR off 14.8 percent and RevPAR down

22.5 percent.

As the recovery continues and travelers have become more

comfortable with hotel stays in general, the segment’s growth has tapered, and

its overall performance shows occupancy down 4.3 percent, ADR off 10.9 percent

and a RevPAR decline of 14.7 percent compared with 2019 year-to-date metrics.

Traditional Tier Performance

Looking at the same period for the traditional tiers, the

story is simiI’llar, with lower-priced segments doing better than higher-priced

ones. The economy segment performed the best, with occupancy and RevPAR off

just 2.5 percent each compared with 2019 and ADR essentially fully recovered,

according to STR.

The midscale segment also has shown a strong recovery.

Year-to-date as of Aug. 31, occupancy was at 93.3 percent of 2019 levels, ADR

had increased 1.2 percent, and RevPAR was down just 5.5 percent. BWH Hotel

Group, whose portfolio is about 60 percent midscale and includes the Best

Western brand, has seen RevPAR recover to about 90 percent of 2019 levels

year-to-date, and expects a full recovery in 2022. The company’s ADR has fully

covered, and occupancy is only about six points behind 2019 levels, according

to the company.

The upper-midscale tier has shown a slower but steady

recovery, with year-to-date occupancy levels as of Aug. 31 at nearly 61

percent, off 12 percent from the same period in 2019. ADR recovered to nearly

96 percent of its previous level, while RevPAR was still down about 16 percent

from 2019 levels.

Throughout the pandemic, upscale, upper-upscale and luxury

segments were hit the hardest, not least because those typically cater to

business and corporate group travel, which have been slower to recover than

leisure. Those segments also saw more hotel closures and partial closures.

The exception is for ADR. Rates in the luxury segment have

fully recovered, and as of Aug. 31, had increased 10.6 percent over 2019.

Average upper-upscale and upscale rates still were lower than 2019, but just

8.7 percent and 10.2 percent, respectively. Among the three segments,

upper-upscale lagged the most, with occupancy down 36.4 percent for the period,

and RevPAR off by 41.9 percent.

These three segments are poised for a stronger bounce-back

as business travel begins to pick up steam, and group business on the

books—especially for 2022—has rebounded, with multiple hotel companies

reporting average group rates that meet or exceed those for 2019.

The unknown variable is the return to offices. The hotel

industry had been counting on an autumn return to spur increased demand,

particularly for the upper tiers. But many companies that planned a September

return delayed that by a few months as the delta variant spread and Covid-19

cases rose. Further, in recent weeks, some major companies, such as PwC,

announced they would offer employees full-time remote work. It remains to be

seen how this will affect business travel hotel demand going forward.

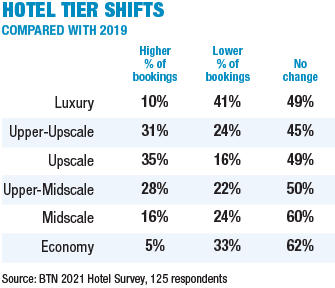

Tier Shift in Hotel Bookings

The 2021 BTN hotel survey found that travel buyers reported

shifts in their booking patterns by tiers. Just under 50 percent of buyers

reported no change in the share of bookings since 2019 for the luxury,

upper-upscale, upscale and upper-midscale segments. The remaining half for each

tier, however, showed interesting shifts.

Coinciding with performance metrics, about 41 percent of

buyers reported a lower share of bookings for luxury properties since 2019,

while just more than 10 percent had a higher percentage for this segment, not

surprising considering group business and high-end business travel were nearly

at a standstill during much of the pandemic.

Still, buyers also reported that they have seen a higher

share of bookings for upper-upscale and upscale properties since 2019, at 31

percent and 35 percent, respectively. About 24 percent reported a lower share

of bookings for upper-upscale hotels, and 16 percent reported less for upscale

properties.

Upper-midscale slightly favored a higher booking share, at

28 percent, while about 22 percent of buyers reported a lower share than in

2019. Three in five respondents said there had been no change in midscale

booking shares, while a quarter saw fewer midscale booking shares, and only 16

percent reported an increase. After the luxury segment, economy showed the

highest decrease of share of bookings since 2019, at 33 percent.

In the beginning of the pandemic, much of the essential

travel was at properties in the three- to 3.5-star range rather than the four-

to 4.5-star range, said Goldspring Consulting partner Neil Hammond. But those shifts

have almost recovered, he added. At the same time, pricing pressure drove some

four- to 4.5-star properties down to almost three-star level rates, Hammond

said, making full-service hotels more appealing than select service for the

same price, which would explain the increase in percentage of bookings for the

upper tiers, aside from luxury.

Global travel manager and co-chair of the Global Business

Travel Association accommodations committee Mira Rosenzweig agreed that there

is less tier shift happening now “because service levels are returning,” she

said.

“What I do see is more focus on the experience of the

traveler at the hotel,” she added. “If you are going to a name-brand hotel

where it’s the same and consistent everywhere you go versus do you want a hotel

where you have more of an experience where you can feel like you are in that

city, I think those are the conversations the travel managers are having with

their travelers. It allows the travel manager to focus not so much on how many

stars a hotel has, and more on what does it actually bring in service level,

product and experience.”