Amid a year of mixed business demand and financial performance indicators for the extended-stay segment, travel buyers generally rated extended-stay suppliers higher than last year. They also spread the love. Every brand included in the extended-stay segments led or tied for the lead in at least one category.

Buyers appear to be gaining comfort with the sales staffs and the negotiating strategies at extended-stay hotels. 2019 aggregate marks for flexibility in negotiating amenities, a partnership approach to negotiating rates and penalties, and sales staff were notably higher than in 2018. That doesn't mean buyers simply are extracting more concessions: Extended-stay average daily rate increased 1.2 percent year over year for the first half of 2019, according to The Highland Group. The extended-stay pipeline, meanwhile, is contracting. Upscale extended-stay rooms under construction as of June 30 declined 21.3 percent from a year earlier, and midprice rooms declined 3.3 percent. Still, respondents seem satisfied with recent expansions, as scores for brands' strategic locations increased sharply from 2018.

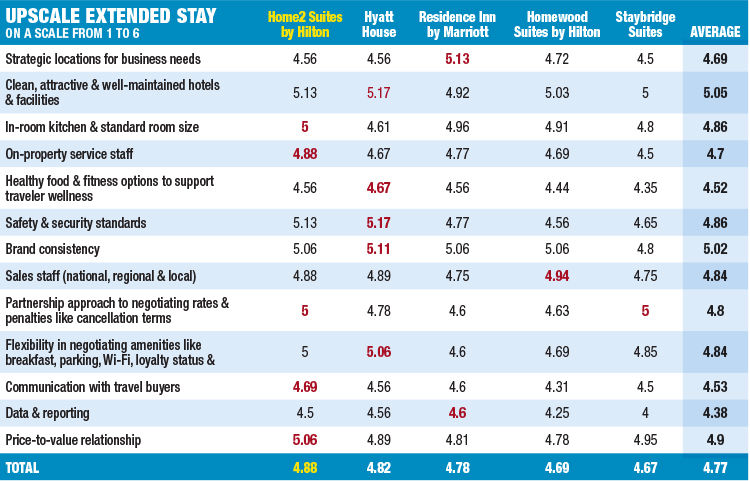

Upscale Extended Stay

Home2 Suites by Hilton, in its second year in the survey, tops the tightly packed upscale extended-stay category. Only 21-hundredths of a point separated the overall scores of the five brands included. Still, Home2 Suites took over first place on the strength of top scores in five categories, including price-value relationship and communication with buyers. Home2 Suites' overall score increased from 4.77 last year to 4.88.

"We had a tremendous expansion focus. [The brand] is really growing exponentially," said sales, customer engagement and industry relations SVP Kelly Phillips, adding that Home2 Suites has opened more than 332 hotels and has another 435 in its pipeline, representing one of Hilton's fastest-growing brands. "As a sales organization, we are leaning into the extended-stay business and how we approach housing accounts and project business. It has been making a difference."

The brand led the upscale extended-stay segment in on-property service staff, as well as standard room size/in-room kitchen; each kitchen includes place settings for six with a refrigerator and freezer, dishwasher, microwave oven and coffee maker, according to Hilton.

Last year's top upscale extended-stay brand, Hyatt House, placed second this year, six-hundredths of a point behind Home2 Suites. Hyatt House also led in five categories, including brand consistency; clean facilities; flexibility in negotiating amenities; and safety and security standards. "Hyatt House is a major player in the business transient market, and the market is essential to the brand's success," said Hyatt Place and Hyatt House VP of sales Kevin Kelly. "[These] hotels serve the extended-stay guest ... and these hotels have also been designed to cater to those staying for shorter periods. Hyatt House hotels offer den guest rooms without kitchens, as well as studios and one-bedroom suites, both of which offer full kitchens. With varying room types, our hotels can provide the flexibility to serve guests with different needs."

During the past 12 months Hyatt House has added properties in Kuala Lumpur, Malaysia, and Jeddah, Saudi Arabia, its first hotels in Southeast Asia and the Middle East. More than 90 Hyatt Houses are open globally.

Marriott International's Residence Inn rounded out the top three, finishing first among respondents for strategic locations and for data and reporting. Residence Inn's rating of 4.78 represents a year-over-year gain of a quarter point. Marriott global brand officer and luxury portfolio leader Tina Edmundson cited changes to the brand's service and amenities. "Residence Inn debuted Marriott Classic Select brands' innovative proprietary service training platform around two years ago, and it has allowed us to maintain and even grow our service strength," Edmundson said. "We released a new decor prototype in 2017 that started coming online in 2018. And between renovations and around 50 openings a year, that means a lot of great new product in the system."

Edmundson also noted Residence Inn's "highly differentiated amenities." Every room is a suite and is on average 35 percent larger than same-tier hotel rooms. The brand also offers a free grocery shopping service and outdoor fire pit and barbecue grills, among other amenities.

Homewood Suites by Hilton led the upscale extended-stay segment in sales staff, and InterContinental Hotels Group's Staybridge Suites tied Home2 Suites as the top brands for flexibility in negotiating amenities.

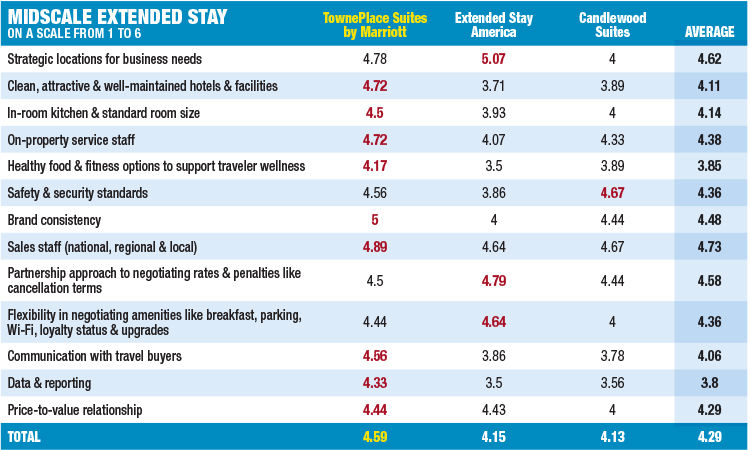

Midscale Extended Stay

Marriott International's TownePlace Suites notched the highest rating in the midscale extended-stay tier by a healthy margin, leading nine of the 13 categories—including clean facilities, data and reporting, and price-value relationship. The brand improved its overall rating by nearly six-tenths of a point over last year, TownePlace's first time as the segment's leader since 2013. "We have a separate extended-stay sales effort … we have a renewed focus on our training programs … and we see that occupancies are pretty good in this segment," Edmundson said. "We also doubled down on our partnership with The Container Store. We have this innovative organization system that helps [guests] settle in and feel at home while on the road. [It's] this feeling of familiarity and the personal connection they make with our associates that sets [TownePlace] apart from the rest."

The rapidly growing brand has more than 400 properties in the U.S. and Canada and offers studios, one-bedroom suites and two-bedroom suites. The brand allows travelers to borrow games, grilling tools from its partnership with Weber and other items and offers guests a cookbook co-branded with Tastemade.

Extended Stay America's rating increased about 15-hundredths of a point versus 2018, enough to land the brand in second place. Last year, it launched its Extended Stay America Works program of volume-based services for corporate travel buyers, including preferred partner pricing, dedicated account managers and central direct billing, among others.

EVP of revenue Tom Buoy told BTN that ESA Works set the stage for the brand's top finishes in the segment's partnership approach to negotiating and flexibility in negotiating amenities categories. "Our buyers place great emphasis on having a highly competent sales staff on partnering and on having flexibility, so they can buy the way they choose to buy [to] help them achieve their goals," Buoy said. "We've changed our overall sales strategy and spent a lot of time listening to the travel buying community. We designed ESA Works around meeting their needs. We have a greater focus on our team's engagement and creating a more professional salesperson."

InterContinental Hotels Group's Candlewood Suites rounded out the segment, leading in safety and security standards. "For all of our brands, but specifically for Candlewood Suites, this is a holistic approach to safety and security," IHG SVP of mainstream category global marketing Heather Balsley told BTN. "Rigorous brand safety standards, ongoing monitoring and management from our global risk specialists, risk guidance, training [and] tool kits. We are also very conscious of where we place our hotels."

Candlewood, which has 401 hotels open and 94 in the pipeline, is set to launch new-build prototype Beacon 4.0 later this year. "The choices we've made in that design program were very much informed by both our guests as well as our corporate travel managers and B2B customers," Balsley said. "Through that process, we enhanced kitchens [and will add] larger TVs and enhanced public space [for guests] to use as an extension of their suite."

—Additional reporting by Donna M. Airoldi

_______________________________

Correction— Oct. 14, 2019, 1:30pm ET —A previous version of this article referred to 400 properties in the Hyatt House pipeline. That number was inaccurate. BTN regrets the error and will update the article if an accurate pipeline count becomes available.