Despite the tremendous difficulties the lodging industry has faced because of the pandemic, the extended-stay segment has proven resilient, especially the lower-priced tiers. After a trough in April, occupancy for the midscale extended-stay segment was higher in June than in March. For the month of August, the average occupancy level for upscale extended stay properties in the U.S. was 50.8 percent; for midscale extended stay, it was 63.1 percent, according to The Highland Group. These levels compare with the overall U.S. hotel industry average of 48.6 percent, according to STR.

Though overall room night demand remained down year over year for the upscale and midscale tiers, room night supply was up in August for both, by 3.2 percent and 7.4 percent, respectively, according to The Highland Group. Extended stay's inherent design favors current guest trends of wanting fewer touchpoints, booking longer stays and preferring a kitchen in order to better control food options.

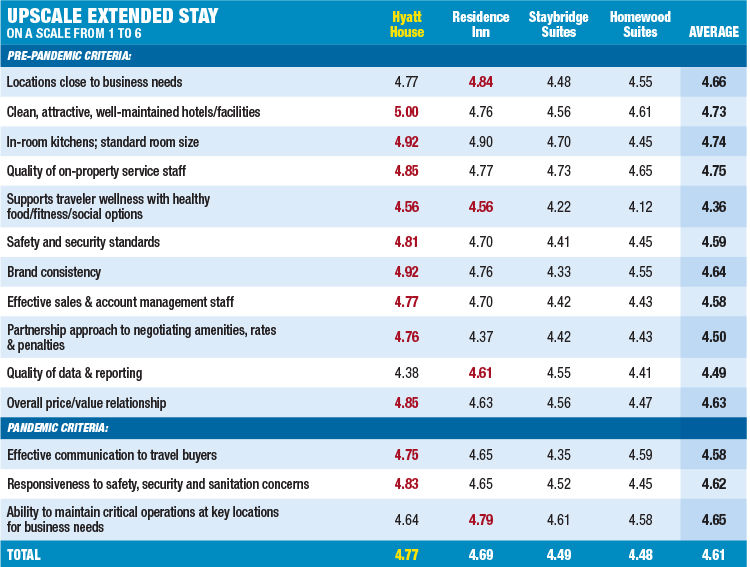

Travel buyers, however, generally gave lower overall ratings to the upscale extended-stay segment this year compared with last year. The only criteria that scored higher were for the quality of on-property service staff and the quality of data and reporting. As a result, its overall average dropped from 4.77 to 4.61.

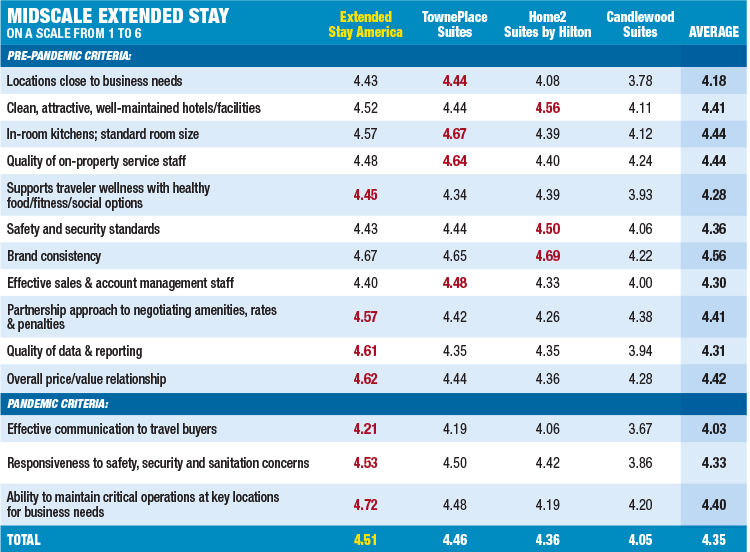

The midscale extended-stay tier, however, did somewhat better than in 2019, with its average score climbing from 4.29 to 4.35, and eight out of the 11 criteria rating the same or higher than last year. The tier most improved with buyers was in offering healthy food and fitness options to support traveler wellness, jumping from 3.85 to 4.28, and in data and reporting, going from 3.80 to 4.31.

Upscale Extended Stay

In a strong showing, Hyatt House moved up from second last year to take the top spot this year, garnering the highest scores for nine of the 11 pre-pandemic criteria and two of the three pandemic-related criteria. It scored particularly high for its cleanliness and responsiveness to safety and security concerns both pre-pandemic and during the crisis.

"We decided early on we wanted to make sure any product with Hyatt over the door would ease the concern or uneasiness of travelers," such as adding hygiene managers and partnering with GBAC for cleanliness accreditation, said Hyatt VP of global sales Gus Vonderheide, referring to the company's Global Care & Cleanliness Commitment.

The Hyatt House brand is becoming well-established and moving into international markets and urban downtown locations, he added. "It has really taken off," Vonderheide said. "The extended-stay product is really doing well, it's up across the board, and the length of stay has increased by a day or so."

Residence Inn by Marriott took the No. 2 spot this year, moving up from No. 3 last year. Its top pre-pandemic ratings were for locations close to business needs, quality of data and reporting, and tying for supporting traveler wellness. It also had the highest rating for the pandemic-related criterium for the ability to maintain critical operations at key locations for business needs.

"I think Residence Inn is in a sweet spot for what business travelers want and need right now," said Marriott VP and global brand manager of classic select brands Diane Mayer. "The brand is growing rapidly in urban markets and in emerging technology markets. … One thing I think we've been doing is messaging and communicating a little better about the facilities and programs that we've had for a while. During the pandemic, folks might have realized for the first time that we do grocery delivery. We've always done that, with no service charge."

The brand also has a partnership with Under Armour for an offering called Residence Inn Runs. "Every hotel has customer running routes designed and vetted by folks who use the Under Armour running app," Mayer said. "It's a nice resource, especially if you don't want to go into a gym and want to be outside where it's a little safer. We've offered it for a bit of time, but now it's super-relevant."

Staybridge Suites, an InterContinental Hotels Group brand, rounded out the top three, moving up from fifth place last year. "Travel managers look to this brand for guests that want to work longer and have work/life balance on the road," said IHG SVP of global marketing for mainstream brands Jen Gribble, adding that the brand recently refreshed its food options. "There's more variety and customization of those items," she said. "We introduced freshly baked muffins and changed the bacon and egg products."

The brand, which has 311 open properties, also launched a new service training program called Creating Community. "That's one of the brand differentiators," Gribble said. "It's a toolbox of how [staff] can create that environment and meet the needs of guests who are staying longer."

Midscale Extended Stay

Extended Stay America scored significantly better this year than last and moved up from No. 2 to No. 1, taking top scores for all three of the pandemic-related criteria, as well as four of the 11 pre-pandemic criteria, including supporting wellness, partnership, quality of data and reporting, and price/value relationship.

"One of the things that really struck me with joining Extended Stay America is how it recognizes that travel planners are a critical part of our business, and the company does not make any decisions without thinking about them," said ESA chief commercial officer Kelly Poling, who joined the company in January. "As a result, we treat our travel partners like a true partnership. We are flexible to meet the needs of clients, whether it's preferred rates, flexible cancellations, types of amenities for a particular hotel. We are committed to meeting the unique needs of each one of those relationships."

Poling added that 100 percent of ESA's properties remained open through the pandemic, and said travel managers said that "even though nothing in the world is business as usual, dealing with us feels like business as usual. We've been just as available and communicative as we always have been. We haven't had to make reductions in workforce."

TownePlace Suites by Marriott dropped to second from last year, but was not far behind ESA in scoring, and rated first for locations near business needs, its in-room kitchens and size, quality of on-property staff and effective sales and account staff.

After Fairfield, the brand has the largest pipeline in North America, said Marriott's Mayer. "We've been opening 50 TownePlace Suites a year for the last several years," she said. "We are now at 450 hotels, so it's not surprising to me that people are noticing it." She also credits its drive-to locations, and two new prototypes for the brand. One is with a smaller footprint and key count to enable it to get into more markets. There's also a dual branding with the upper midscale brand Fairfield by Marriott. "A lot of customers use both brands, and you get the special amenities and programs of both in the envelope of the same building."

Hilton's Home2 Suites rounded out the top three, but scored highest for its cleanliness and well-maintained hotels and facilities, safety and security standards, and brand consistency.