Extended-stay hotels have until recently been somewhat of a black sheep within the corporate travel lodging landscape, used more for relocations and project work, which traditionally fell outside the “travel” purview. However, factors like the rise of Airbnb, improved internal data around traveler stays, record industry occupancy and improved communication from extended-stay brands have prompted corporates to look to extended-stay like never before. And the brands are responding in kind. Representatives for the first-place brands in both the upscale and midscale extended-stay segments cited education and communication as key to their efforts in working with today’s corporate travel managers and buyers.

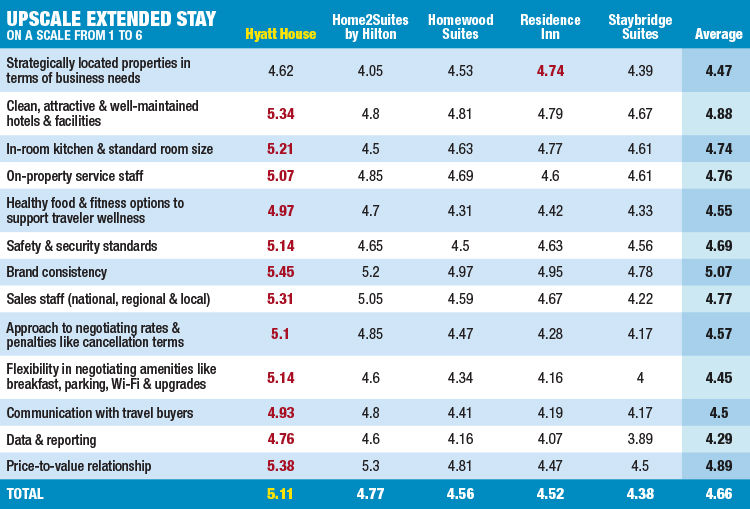

Upscale Extended Stay

This year marks the first time in the history of this survey that Hyatt Hotels Corp.’s Hyatt House brand has led its segment. That milestone speaks less to an uptick in quality at Hyatt House—the brand placed first or above average during the past three annual J.D. Power North America Hotel Guest Satisfaction Index studies—and speaks more to the growth of the brand, both in actual footprint and in its penetration of the corporate travel market.

Hyatt Place & Hyatt House VP of sales Kevin Kelly put the brand’s global portfolio at about 85 hotels, with another 35 in development, and said that together the select-service brands of Hyatt Place and Hyatt House comprise 40 percent of Hyatt’s current pipeline. In BTN’s 2018 Hotel Brand Survey, Hyatt House earned top marks in nearly every criteria in its segment. Hyatt Place & Hyatt House VP of global brands Steven Dominguez said Hyatt House stands out among its competitors for spacious units that offer an urban residential feel, such as one might expect from a condo or furnished apartment.

The brand is alleviating the pain points procurement professionals have faced with extended-stay hotels. In April, the brand rolled out the HyStay Portal, an automated sourcing platform for third-party, temporary housing providers and relocation management companies. The platform streamlines clients’ sourcing experience and shortens properties’ response time to leads. Kelly said the brand also is rolling out to its client partners a “best-in-class” centralized billing system, which has already received positive feedback from users.

Second-place Home2 Suites by Hilton makes its inaugural appearance on BTN’s survey this year. The brand, which was first in its category in J.D. Power’s 2018 North America Hotel Guest Satisfaction Index Study, is one of the fastest growing in Hilton’s portfolio, according to Home2 global head Adrian Kurre. Key to its growth is its flexible, easy-to-build prototype that allows developers to bring the brand to suburban and urban markets. “Home2 Suites by Hilton was created due to surging demand from value-conscious extended-stay travelers in markets where extended stay hadn’t previously flourished,” Kurre said. “Developers have leveraged the flexibility of Home2 Suites by Hilton to enter these new predominantly urban or suburban markets and found strong success by meeting that demand.”

The properties are comprised of both new builds and conversions. Some guest-facing standouts for the brand include its Inspired Table customizable breakfast offering; its Spin2 Cycle dual-purpose laundry and gym area; modular room furniture; and its in-suite flexible working/media space.

Rounding out BTN’s top three upscale extended-stay tier is Homewood Suites by Hilton. The brand is nearing the end of its Take Flight renovation program and expects to have finished more than 230 of its properties by year’s end. As of June 30, Homewood Suites’ portfolio totaled 468 properties in the Americas. In recent years, the brand has been revitalizing and activating its public spaces to meet changing consumer preferences. “Feedback revealed that extended-stay guests had a desire to spend more time out of the suites,” said Homewood Suites global head Rick Colling. “Our focus has been to create flexible shared spaces that enable those who want to socialize to do so but also provide intimate nooks for those guests who prefer solo time to work or read while others interact nearby.”

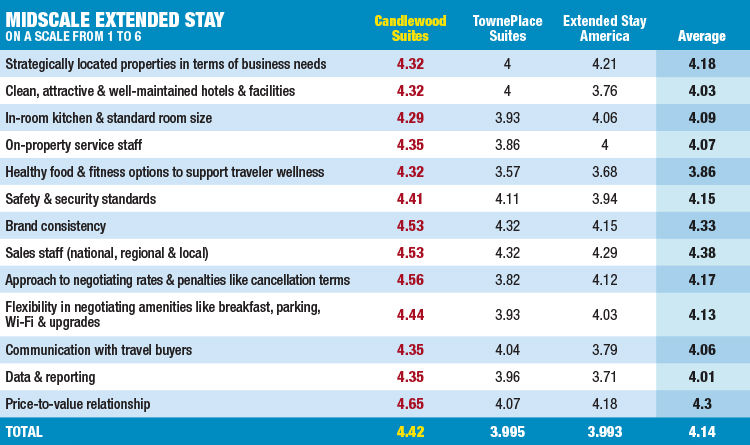

Midscale Extended Stay

InterContinental Hotels Group’s Candlewood Suites topped the midscale extended-stay segment for the second consecutive year, earning the highest scores in every category. Key to Candlewood’s brand promise, according to IHG SVP of global marketing for mainstream brands Heather Balsley, is spaces that allow guests, particularly business travelers, to feel comfortable and settled via features like easy-to-rearrange guest room furniture, lots of storage space and quality bedding.

In BTN’s survey, Candlewood earned particularly high marks compared with its competitors in categories that directly touch the travel buyer, such as data, a partnership approach to negotiation, and communication with travel buyers. Balsley said much of the brand’s success stems from its marketing and communications efforts to engage with the corporate travel community. Additionally, the brand provides its local teams “the collateral and the strategies to educate travel managers and buyers around the unique benefit of this offering for their guests.”

As of June 30, Candlewood’s portfolio totaled 383 properties in the Americas, with 104 properties in the pipeline. The brand also earned the highest marks for safety and security standards. Balsley said that begins with the locations of Candlewood’s properties. “For the midmarket extended-stay business traveler, safety and security is a big part of what they’re looking for in the experience,” she said. “It’s been front of mind for us with this brand for many years.”

Marriott International’s TownePlace Suite inched past Extended Stay America to claim second place. TownePlace properties feature a robust borrowing program for everything from grilling equipment to board games; in-room work stations; full kitchens; and closets from The Container Store. It’s a rapidly growing brand for Marriott, with 354 properties in North America as of June 30.

Extended Stay America is a brand in transition as the company, fresh off years of portfoliowide renovations, works to become more asset light and grow its portfolio through franchise deals for the first time ever. As of June 30, ESA’s pipeline stood at 34 hotels, or 4,200 rooms, more than half of which are franchised properties. The company in August launched a suite of business travel products and services for corporate travel managers called Works, which includes customized client landing pages for booking, reporting on bookings/stays; tools to manage spend and reservations; preferred partner pricing; a 24/7 customer assistance line; dedicated account managers for assistance with bookings, billing and reporting; and central direct billing.