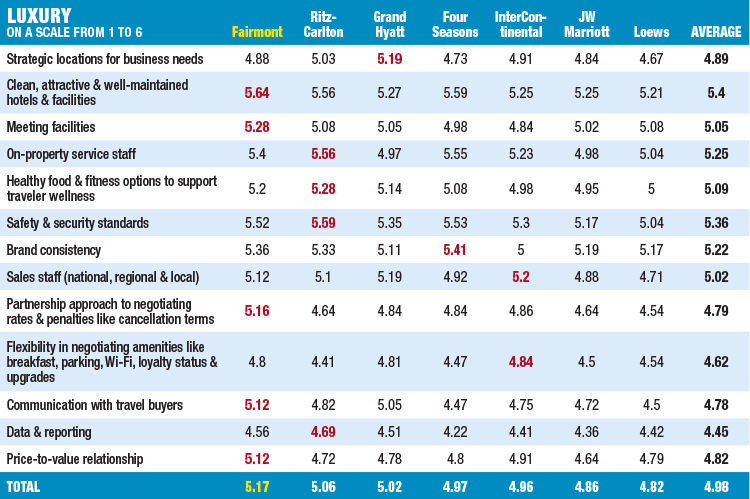

Competition was tight for the luxury category once again. After several years at No. 1, Marriott International's Ritz-Carlton brand fell to the second position. Accor's Fairmont stepped up to the top spot for 2019. Still, the difference between the two was just 0.11 points, as graded by travel buyers on a scale of 1 to 6. Grand Hyatt trailed by a mere 0.04 points more. In addition, this year Loews made the cut, based on usage, coming in seventh but still just one-third of a point behind the leader.

Since becoming part of Accor in 2016, Fairmont has been able to reach a wider audience, said Meenaz Diamond, Accor SVP of global sales for North and Central America. "Some buyers limit their program to two or three major [hotel] companies, and Fairmont on its own would not have been considered a major company. But now, as part of Accor, we were able to get into a couple of programs that may not have been open to us before. It's been a big benefit for some of our properties."

Accor also has been able to expand its sales team focused on business travel and meetings and events to more than 30 people, working for all its brands. Prior to being bought by Accor, Fairmont had about eight people on business travel, Meenaz added. Accor also has invested in the Fairmont brand by opening new properties and renovating existing ones. "Accor is a company on the move," said hospitality industry consultant Bjorn Hanson. "Its regional sale activities, promotions and customer relationship management initiatives over time are having an effect. I don't think Ritz-Carlson or Grand Hyatt is doing a bad job. Just all these things are new and adding a level of energy and positive messaging for Fairmont."

Fairmont scored top marks for clean and attractive facilities, meeting facilities, a partnership approach to negotiating rates and penalties, communication with travel buyers and price-to-value relationship. "The thing really concerning buyers is not just rate anymore, said GoldSpring Consulting partner Neil Hammond. "It's being flexible on the cancellation terms, which we know have been an issue. It's being strategic, and the amenities are very important. And if you look at the key things that moved [Fairmont], their focus on being flexible, which they were leading on last year, put them in top place."

Meenaz said that even though Accor is larger, it still takes a personal approach to talking and listening to customers' needs to tailor programs to their requirements. "We're holding more roundtables and think tanks that bring buyers together where it helps them communicate," she said. "It's an opportunity for us to hear from them and help us to understand more deeply and then push internally for what we need to meet buyers' requirements."

No. 2 Ritz-Carlton, which still topped the luxury category in the J.D. Power 2019 North America Hotel Guest Satisfaction Index Study, scored high for on-property service staff, traveler wellness, safety and security standards, and data and reporting. "Safety and security continue to be a top priority for our corporate travel buyers that book our hotels globally," said Marriott global brand officer and luxury portfolio leader Tina Edmundson, calling it a trend for the overall luxury category. "Ritz-Carlton hotels in particular are in high demand due to the level of security that corporate travel buyers know is in place at these hotels." Edmundson also has seen an increased interest in sustainability from guests. The brand also is "laser-focused" on "unique and exceptional experiences, wellness offerings and using technology to enhance the guest experience."

Edmundson noted that Ritz-Carlton Rewards transitioned to Marriott Bonvoy, Marriott's unified loyalty program, this year. "This transition has been very positive overall for both our corporate travel partners and their travelers, but it did represent a change," she said. "However, our guests now get more benefits and have greater options."

Third-place Grand Hyattt scor-ed in the top spot for strategic locations for business needs, and it placed second for sales staff, flexibility in negotiating amenities and communication with travel buyers. "Grand Hyatt is a special brand in our portfolio," said Hyatt VP of global sales Gus Vonderheide. "It has been known as a group hotel, but based on these hotels being located in many big cities, they are also very highly popular destinations for business travelers. And the brand has done a great job of welcoming the business traveler and not making them feel as if they could get lost in the midst of a convention if there was one on property." One way is a special check-in for loyalty members.

Grand Hyatt also has invested in the user experience, including mobile room keys and mobile app access to past folios for expense purposes, Vonderheide said. "We are working with virtual pay solutions in order to make that easier for our customers, as well."