Strong service isn't reserved solely for the luxury and

upscale tiers. This year's top upper-midprice and midprice brands also placed a

high priority on educating hotel staff on improving the guest experience. In

the upper-midprice tier, Hampton by Hilton moved up the ranks from third place

to first and Marriott International's Fairfield Inn & Suites climbed from

seventh place to second. In spite of improvements from those brands, however,

the overall scores for the segment fell from 2015, as No. 1 Hampton received

4.53 points against last year's top score of 4.70 from Best Western Plus.

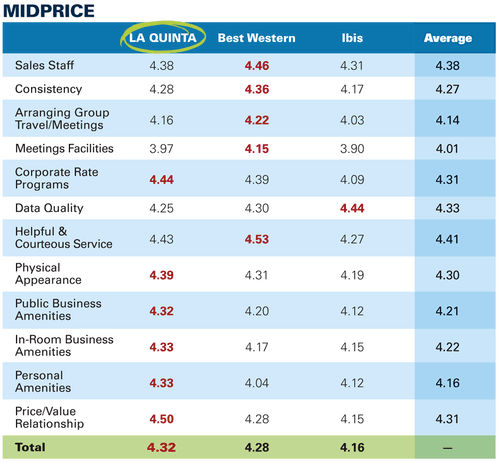

Scores did improve in the midprice segment, where La Quinta

Inns & Suites moved from second place in 2015 to first place this year and

Best Western rose from third place to second place.

Hampton altered its brand identity during the past year by

adding "by Hilton" to its moniker. It's a change that has led to a

rise in new guests in the United States, said Phil Cordell, Hilton Worldwide

global head for focused service and Hampton brand management. "Hampton has

a very strong reputation and following among Hampton loyalists, but there are significant

opportunities for continuing to move customers from brand to brand based on

their business needs," Cordell said. Nonmembers of Hilton HHonors may not

have known the brand before, but since the company added 'by Hilton' to the

name, the brand has received more U.S. business.

The brand earned the highest scores for sales staff,

consistency, corporate rate programs and price/value relationship. Cordell said

that reflects efforts to improve sales team operations. "We noticed

sometimes our management and sales staff is a bit more lean and they're focused

on doing a lot of things, so over the past year or so, we've implemented a

number of enhancements to try to encourage them to be more responsive to leads

and [requests for proposals]." Hampton also has embraced more group

business, particularly in urban-core markets like Manhattan, where Hampton has

10 hotels.

Hampton continually invests in Internet bandwidth at its

properties and is on track to implement Hilton's direct-to-room Digital Key

through the HHonors app in 2017.

Fairfield Inn earned the tier's highest score for helpful

and courteous service. It was the second in the Marriott International family

to launch the Shaping Service program. Senior vice president of select-service

and extended-stay brands Janis Milham said that within the Marriott family, the

brand's service scores are behind only Residence Inn, which won the upscale

extended-stay segment in BTN's survey. Milham added that the brand has

experienced success with its 100 percent-guarantee program, launched a little

over three years ago.

Fairfield Inn also garnered top marks for physical

appearance, public business amenities and in-room amenities, both business and

personal. Milham said the brand is 90 percent current on its renovations and is

reaching critical mass with its Generation 4 prototype, which promotes

flexibility for property developers and offers modern, smart-spaces for

travelers. "Between the renovations and the new prototype, that's what's

contributing to a lot of the great product scores," Milham said.

The brand launched mobile check-in through the Marriott

Rewards app last year and is slated to implement mobile service requests,

already available at full-service Marriott hotels, during the fourth quarter of

2016.

Last year's upper-midprice victor, Best Western Plus, in

third place this year, still earned the highest scores for ease of arranging

group travel and meetings and for meetings facilities. "Previously, buyers

didn't see Best Western as a possibility for group business," said Wendy

Ferrill, vice president of worldwide sales. "Now we're really out in front

of that buyer to talk to them about the solutions we can provide, and it's

truly changing their point of view in terms of placing groups in the midmarket.

A lot of times, you don't need a big ballroom. In many of our hotels we can

certainly provide that, but many times it's rooms only and we can direct them

to those hotels that have more meeting space."

The brand also got the highest score for data quality, an

ongoing focus for all Best Western brands, Ferrill said. "We know that

data drives the decision and they need that information to be successful,"

she said. "We have invested a lot in our data, and everyone from our CEO

to our technology team to worldwide sales has been involved in how we look at

that differently."

Upper-midprice makes up 32.4 percent of rooms under

construction in the United States, according to July figures from STR. While

the segment attracts investors for its low development costs, supply growth was

higher than demand growth from January to July and occupancy declined 0.3

percent year over year.

Midprice

La Quinta received the highest scores in midprice for

corporate rate programs, physical appearance, public business amenities,

in-room business amenities, personal amenities and price/value relationship.

The brand is in the early stages of several initiatives,

including driving consistency in its product and in the delivery of an outstanding

guest experience, as well as investing in points of differentiation from its

competitors, CEO Keith Cline said during the company's most recent earnings

call. Beginning this year, La Quinta will invest $60 to $70 million to renovate

50 of its properties. The brand has 238 hotels in its pipeline and is focused

on new properties in high-barrier-to-entry urban markets.

Second place Best Western scored highest for sales staff,

consistency, ease of arranging group travel and meetings, meetings facilities

and helpful and courteous service. This spring, Best Western Hotels &

Resorts launched virtual reality for all its brands, allowing travel buyers to

view individual properties. "A lot of times, [buyers] are not able to come

and site the hotels anymore," Ferrill said, "so that virtual reality

application has been very beneficial because they see the experience they're

going to have at the property. Frankly, they see how lovely it is."

Ferrill said the Best Western team has and will continue to

focus on customization rather than programmatic RFPs "because every buyer

has a different need."

From January to July, the average daily rate for

midprice increased 2.6 percent year over year to $85.74, according to STR.

Occupancy decreased 0.8 percent year over year to 60.2 percent, the

second-highest drop-off of any tier tracked by STR.