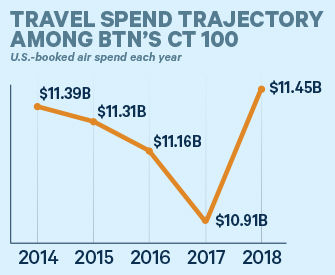

Corporate travel came on strong in 2018. Total U.S.-booked air spend by the top 100 corporate travel spenders in the U.S. surged to $11.45 million—more than half a billion dollars above 2017. Spend among this year's top 12 companies alone increased by more than $300 million, even accounting for No. 2 IBM's reduction. Deloitte, which took over the top spot from IBM in the 2017 list, based on 2016 volume, bolted farther ahead of the pack with an additional $64 million.

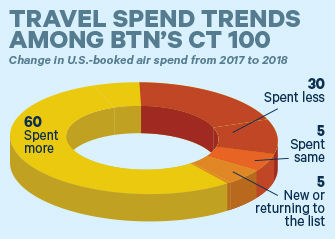

The rise in corporate travel spending went beyond the biggest of the big. Sixty companies on this year's list increased their U.S.-booked air volume in 2018. Thirty companies decreased that spend, and just five remained flat compared to last year. Five that are either new or returning to the list this year are unknown.

Notable Moves & Spend Trends

While global accounting and consulting firms have established firm digs at the top of BTN's Corporate Travel 100, technology companies like Microsoft and Amazon are right on on their heels, and IBM has been a perennial fixture at the top of the Corporate Travel 100.

Rising significantly in the ranks this year is Facebook, which moved from No. 32 to No. 18, based on an estimate of its 2018 U.S.-booked air volume. Surges like these aren't typical, especially in the top quarter of the list, where significant movement reflects large dollar values. With Facebook's acquisitions of companies like Instagram and What's App, its corporate travel spend isn't likely to ease.

Even as younger tech companies bolt up the list, more mature names like Cisco and Siemens are moving the other direction. Cisco dropped from No. 11 to No. 35 this year. The company sells TelePresence tools among its vast portfolio and has made a concerted push for employees to use them to defray travel costs. Siemens, which dropped from No. 21 to No. 27, has also cited a push toward virtual collaboration and videoconferencing to reduce travel costs.

Pharmaceutical companies on BTN's CT 100 are reining in their travel costs. Abbvie fell from No. 43 to No. 66 even as revenue increased 16 percent and employment numbers rose in 2018. The company announced its intent to acquire Allergan, another CT 100 pharma company, which tumbled from No. 63 to No. 74 this year. The merger, however, will make the company a big account on future lists. German pharma company Bayer's U.S. operations dropped from No. 66 to No. 87 this year; Pfizer dropped from No. 36 to No. 45 and Swiss pharma giant Roche fell four spots to No. 24. That said, Indianapolis-based Lilly surged from No. 89 to No. 68. Shire held steady at No. 73.

Travel investment at oil and energy companies generally rose in 2018. Royal Dutch Shell jumped 9 spots to No. 28, with a BTN-estimated $20 million rise in U.S.-booked air volume. BP and Chevron moved modestly up the lower half of the list: Chevron popped four spots to No. 53 and BP rose 11 places to No. 68. Paris-based Schlumberger dropped three spots to tie BP at No. 68. BP made big news in 2019, however, by inking a travel management company deal with Egencia and planning a complete departure from CWT by January 2020.

Emerging Practices

A handful of trends stood out this year among companies in the CT 100. The first was attention to carbon emissions. The travel industry has come under scrutiny for its contribution to climate change, and CT 100 companies are paying attention to how much their business travel activities contribute to their carbon footprints. Tracking carbon emissions took hold in the financial and tech industries a decade ago. GE, however, reported its travel-related carbon emissions for the first time in 2018. Some companies, such as Apple, are refining their emissions calculations to better account for differences like business class air travel compared with economy class. Good news: Several companies like United Technologies and FedEx are beginning to meet their carbon-reduction goals, and others are reducing emissions and purchasing carbon offsets to mitigate their environmental impact. However, several companies that track emissions have reported larger carbon footprints related to increased travel in 2018.

Traveler-oriented business travel processes and policies continue to penetrate CT 100 companies. At least 20 percent cited some type of focus on easing processes via automation, mobile technologies, personalization and simplifying travel policy. At the same time, companies like Boeing and Nike have very specific efforts underway. Nike cited policy changes to address the effect of travel on employee health and wellness. Boeing is making specific policy changes to cover expenses related to freezing, storing and shipping breastmilk home, addressing concerns for families.

Contractor travel policies and processes emerged as another, smaller, trend among the CT 100 companies. It's likely driven by increased scrutiny by tax authorities of contractor arrangements, particularly in the U.K. but in other countries, as well. Travel policies play into that. If a contractor travels on the company dime or with certain corporate payment mechanisms, it could trigger how tax authorities view an individual's employment status. Precise, enforceable policies and processes mitigate that liability. Moreover, contractor travel has been a morass for many companies, and the tools are emerging to address it.

Another tax-related trend rippling through corporate travel is global immigration tracking. Companies like Accenture, EY, Siemens and 21st Century Fox have or are implementing immigration solutions that will alert managers and travelers not only about required travel documentation but also about whether they have traveled to or stayed in a particular destination for a period of time that obligates them to pay local taxes. Traditionally, tax authorities have focused on expatriates, but these days they are scrutinizing business travelers, as well.