The 2021 edition of BTN’s annual Hotel Report differs

significantly from its traditional coverage. This edition’s focus is not on

brand performance, as there was too little business travel that took place the past

12 months, and some buyers did not feel comfortable rating brands when booking

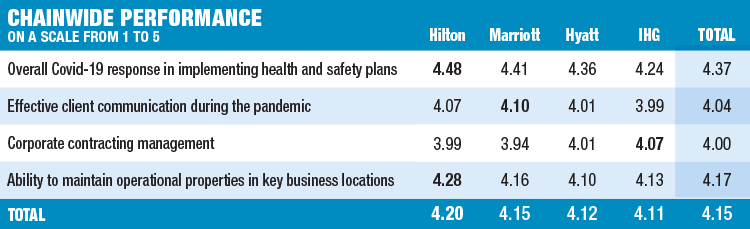

volumes were so low. Instead, the survey includes ratings on a chainwide level

only, and on just four Covid-19-related attributes.

Hilton Worldwide earned the top spot among corporate travel

buyers, followed by Marriott International, Hyatt Hotels Corp. and IHG Hotels

& Resorts, all within a couple hundredths of a point from each other. BWH

Hotel Group and Accor, while not making the final cut due to lower usage rates among

survey participants, were close behind, and performed well in certain

categories.

The survey asked travel buyers to rate chains on their

overall Covid-19 response in implementing health and safety plans—the attribute

in which all the hotel companies scored their highest marks—effective client

communications during the pandemic, corporate contracting management, and their

ability to maintain operational properties in key business locations. Hilton

garnered the highest marks for two of the four: its Covid-19 response and

ability to maintain operations.

“We are really proud of the work we did,” said Hilton SVP of

worldwide sales Frank Passanante. With Hilton CleanStay, its cleanliness and

safety program, “we took what was foundationally very high standards and elevated

them throughout the entire stay,” he said. “Flexibility, cleanliness, these are

the things customers told us they needed us to focus on.”

For maintaining operations, Passanante said Hilton looked to

its properties in China to get an early perspective on the effect Covid-19 had

on the business and to gain insights to manage through the crisis. “It required

us to evolve how we managed our hotels,” he said, adding that engagement and

communication with key accounts was important. “One thing we were able to do

was shift resources internally to where the needs were.”

An example of how Hilton did that was the deployment of its

catastrophic task force. “As crises unfolded, new needs emerged,” Passanante

said. “We moved resources, doubling down on how we supported catastrophic

events. We always had a desk, but we more than doubled that and followed the

globe to make sure there was continuity in how we serviced that. It became a

24/7 response team to help with anything that came up, whether weather-related

[such as a hurricane] or other crisis.”

Marriott took top marks for effective client communications

during the pandemic and second for its overall pandemic response. The company’s

SVP of global sales, Tammy Routh, said that staying in contact with every customer

made the difference, even though the company had significantly reduced its

workforce. “People that formerly handled five accounts now handled 20,” she

said. “The direction I gave them was, ‘Every day you come into the office, the

No. 1 priority is to stay in contact with your customers.’ ”

Routh said Marriott did that in two ways. First, the company

checked in on customers personally. “We were all dealing with this, and I

didn’t want them to think we called only when asking for business,” she said.

The second was to stay apprised of clients’ stances on travel policies, return

to office, and group and meeting philosophies. “We took that information and

then made decisions based on the customer voice. We kept the dialogue going

weekly, in some cases more, so the customer felt that their voice mattered.”

Best Western also scored well on its pandemic response, and

SVP and CMO Dorothy Dowling credited the company’s longtime commitment through

its “I Care Clean” program, launched in 2012. “We created a foundational

program and started deconstructing the guest room and public spaces and really

looked at where the high-touch levels were from a customer point of view. … We

created a cultural shift in the commitment to cleanliness,” she said. Once the

pandemic hit, the company evolved the program further into “We Care Clean,”

with an even more elevated level of cleaning protocols, and the sales team

focused on communicating that to the buyer community.

For Accor, which according to SVP of sales and distribution

Markus Keller is the largest hotel operator in every geography except North

America and China, communications during the pandemic “came with challenges and

opportunities,” he said, adding that the company was able to implement its All

Safe hygiene and safety standards in more than 4,900 hotels worldwide, despite

geographical dispersion. In communicating those protocols, “in the early part

of the crisis, we had direct one-to-one communications with key customers, and

wrote letters explaining what we were doing,” Keller said. “We conducted tens

of thousands of phone calls, from headquarters as well as in each region to

their respective client bases. We switched a lot of our sales activities to

virtual. … We shared what we were doing and how we were reopening hotels. We

also shared not only information about ourselves but also what we observed

globally in the markets where we were present, and that was something that

[clients] appreciated as well.”

IHG outscored its competitors for corporate contracting

management. “We’ve focused on being nimble and responding to the needs of our

customers throughout the pandemic,” said IHG SVP of global sales Derek DeCross

in an email. “We extended rates and discounts from 2021 into 2022 to maintain

flexibility for our customers who are still uncertain about travel programs and

budgets. We also implemented dynamically priced products to provide customers

with confidence that they had access to a market-appropriate rate. This has

been a bright spot for both buyers and suppliers given resource and demand

constraints. As a result, we’ve seen an increase in adoption of dynamic rates

across corporate verticals, particularly in finance, retail and

construction/engineering.”

Contracting was the one category where both Hilton and

Marriott scored below Hyatt and IHG. “One thing we have heard loud and clear

from customers is we need rate assurance,” Hilton’s Passanante said. “There are

many unanswered questions on markets and the volatility of some markets. 2020

proved that dynamic pricing models did provide a benefit to customers. We are

focused on providing rate assurance, and dynamic is a key part of that answer.

And delivering greater efficiency in what we know is a tedious and challenging

[request-for-proposals] process, and resources across the board are more

constrained than ever. We are trying to listen and respond and get it right.”

Marriott once again offered to roll over rates into 2022,

and many buyers took that offer, according to the company. But some buyers

noted that Marriott wasn’t willing to negotiate RFPs this season. Routh

countered that the company “will always sell the way the customer wants to

buy,” she said. “We weren’t sure what the right thing to do was for the pricing

season, and we spent time with the revenue management teams trying to figure

out how to put forward something where everybody wins. And travel buyers really

do not know how much travel they will have. Our analysis and numbers prove that

rolling over rates with rate protection is a winning value proposition for all

parties. And we would never want buyers to be in the position where the retail

rate is better. … If a customer wanted a full RFP, of course we would honor

that.”

Hyatt was the only company to score above a four in all four

of the attributes rated, with its top score for its Covid-19 response. “It was

everything we implemented, including hygiene managers on staff at every

property,” said Hyatt VP of global sales for the Americas Gus Vonderheide. “We

will continue to work with outside organizations to audit the properties on a

regular basis, because we feel strongly that we could not do that ourselves.

That’s not going away in 2022. As business travel returns, it will be even more

important than a year ago to show we are still living and breathing the

standards we set.”

Vonderheide added that “it’s easy to say, ‘let’s get back to

normal,’ but travelers will still be at different levels of comfort. Some were

ready a year ago. Some might not be for another year. We need to talk to all of

them. … We immediately believed that flexibility and creativity would be key to

getting through this.” The company offered different pricing models and

contract opportunities that “we felt would be a good variety or a large enough

variety to appeal to the masses,” he said. “Over the past year and a half, I’m

very proud of the comments we’ve heard from customers. It’s not a seller’s or

buyer’s market; it’s a partner’s market. If ever there was a time to benefit

from strongly being together, this is it.”

2021 BTN Hotel Survey Methodology

BTN emailed audience members responsible for corporate hotel

buying decisions, and 138 participated Aug. 10-Sept. 17 in an online survey to

rate hotel chain pandemic performance during the previous 12 months. Buyers

rated only the chains with which they have conducted business or hold a

corporate contract on four pandemic-related attributes on an ascending scale from

one to five. Only chains with multiple brands were considered for this survey,

and BTN reported results only for chains with significant respondent usage. BTN

also surveyed respondents about the evolution of their hotel program practices

over the past 12 months as well as their go-forward strategies.