Travel Suppliers = Easy Pickings For Hackers

Doug Clare, vice

president of product management for Fico, an analytics software company, said

the travel industry gets hit “pretty hard” with fraudulent transactions. The top

reasons:

Anonymity

Booking a ticket or

hotel room online is anonymous.

Acceptance Of Arrangers

Common practices

allow cardholders to book trips for others.

Card Matching Not Required

Airport counters and

kiosks don’t ask for the card with which the flight was purchased; the same

goes for hotel reservations.

The avalanche began

with Starwood.

On Nov. 20, 2015,

Starwood Hotels & Resorts Worldwide announced that malware had infected

point-of-sale systems at 54 of its North American hotels, including 26 Westins,

18 Sheratons and seven W-branded hotels. The malware targeted cardholder names,

card numbers, security codes and expiration dates.

Then, five days

later, Hilton released a statement that it, too, had been the victim of malware

attacks on POS systems at an undisclosed number of its properties and that

payment card information had been accessed.

Two days before

Christmas, it was Hyatt's turn to disclose that cybercriminals going after

payment card information had targeted its hotels. In that breach, POS systems

at restaurants, spas, golf shops, parking facilities and a "limited number"

of front desks were affected.

Within the span of

34 days, three of the most recognized companies in the hotel industry announced

major breaches of customer payment data. But they weren't the first to make

such an announcement in 2015. In July, the Trump Hotel Collection announced it

appeared to have been the victim of malware attacks on POS systems, later

confirming seven properties were affected. In April, previous hacking victim

White Lodging Hotel Services Corp. announced POS systems at 10 of its

franchised hotels had again been compromised. The month prior, Mandarin

Oriental Hotel Group disclosed hacks at "an isolated number" of

hotels in the United States and Europe.

Why Hotels?

Cybercrime threats

to the lodging industry are nothing new, but the volume of attacks going after

guest card payment information raises the question, why does this keep

happening to hotels? But that question is, perhaps, a flawed one. Chris Zoladz,

founder of Navigate LLC, an information protection and privacy consultancy,

suggests POS systems are the larger target, and those exist well beyond the

hospitality industry.

According to Privacy

Rights Clearinghouse, a nonprofit group that keeps a chronology of all manner

of data breaches disclosed to the public through company releases and media

reports, there were 111 breaches related to hacking or malware on POS systems

during 2015. Of that total, only seven of the breached entities were hotel

companies. Others on that 2015 list included Sabre, United Airlines, American

Airlines, Uber, Starbucks and Chick-fil-A.

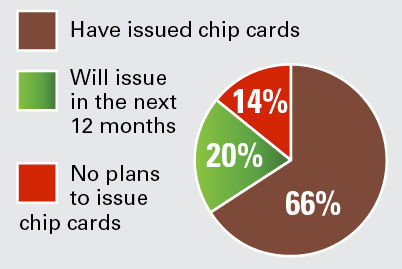

Chip Cards Help, Right?

Business Travel News survey of 198 travel buyers

Business Travel News survey of 198 travel buyers

They add security within the point-of-sale environment, but card-not-present transactions and holding card numbers on file remain risky.

"POS systems

are often the weak link in the chain and the choice of malware," said Mark

Bower, HPE Security global director of product management for enterprise data security.

"They should be isolated from other networks but often are connected. A

check-out terminal in constant use is usually less frequently patched and

updated and is thus vulnerable to all manner of malware compromising the system

to gain access to cardholder data."

Instead of why

hotels, a better question is what is it about hotels. What makes their

POS systems particularly vulnerable and valuable to hackers?

Bower suggests the

type of POS systems used at hotels are part of the problem. "These are

often integrated POS environments running applications in an environment that

is not as secure as modern hardened payment terminals designed to capture

payment data and implement encryption independent from the POS itself."

With integrated POS

systems, multiple POS feeds converge in the back-office system or electronic

cash register, whereas a semi-integrated or "hardened" system sends

encrypted data directly to the payment processor. The extra stop in integrated

systems creates a weakness that cybercriminals are quick to tap.

In addition, hotels

deal with a high volume of payment card transactions—between restaurants,

on-site shops, spas, parking facilities and front-desk billing—and card

information is stored with the hotel in the run-up to, and duration of, a

single stay.

"If you call a

hotel to make a reservation, they manually type in your card information and

leave your credit card on file," said Shaun Murphy, founder and CEO of

SNDR, a message- and file-sharing app, who specializes in cybersecurity. "Your

personal details are stored in so many different systems, there are so many

more ways for malware to have access to them."

What Travel Managers Care About

68%

Mitigating

unauthorized charges incurred on corporate cards

81%

Protecting

travelers’ personally identifiable information/identity theft

61%

Protecting

corporate travel information/location of travelers

Source: Business Travel News survey of 198 travel buyers

The hospitality

industry, too, suffers from a high turnover of employees and staff members. The

overall turnover rate in the restaurant-and-accommodations sector was 66.3

percent in 2014, according to the U.S. Bureau of Labor Statistics' most recent

figures. If a hotel is regularly losing staff members and hiring new ones, it

can be difficult to ensure each is well trained in handling guest data.

Individuals who work

in a hotel restaurant or behind the front desk are rarely IT people, meaning

staff members are often completely dependent on a POS system installer to make

sure everything is programmed correctly. Think of a POS system like a garden hose.

It doesn't matter how good the hose is, Zoladz said, if it's improperly

installed, there are going to be some leaks. Murphy said after such software is

installed, "a lot of times [hotels] don't have mobile IT systems to make sure

the systems are monitored."

Basically, if the

hose becomes defective, it may take a while for anyone to notice.

In the Hilton

breaches, hotels were hit between Nov. 18 and Dec. 5, 2014, then once more from

April 21 to July 27, 2015. According to security blog Krebs on Security, that

breach wasn't discovered until August, when Visa confidentially alerted

multiple financial institutions that cards used at a brick-and-mortar entity

were compromised.

"You have my

personal assurance that we take this matter very seriously, and we immediately

launched an investigation and further strengthened our systems," executive

vice president of global brands Jim Holthouser said in a statement during

Hilton's November disclosure.

A Hilton

spokesperson told Travel Procurement the company had no further

information to share about the number of hotels affected by the incident or the

type of malware found by forensic experts. Timelines for other breaches, from

when the attacks occurred to when an investigation was launched, are less clear

in the other hotel incidents disclosed in 2015.

"The malware

frameworks that the point-of-sale operators are ... infected with is very, very

sophisticated," Murphy said. "These hackers go out and they find a

top point-of-sale operation system and they figure out how to breach it."

Last year, global

cyber-threat intelligence company, iSight Partners made a concerted effort to

educate companies within the retail, healthcare, food services and hospitality

sectors about the newest and most sophisticated POS system malware, ModPOS.

Stephen Ward, senior director and spokesperson for iSight, said the company

doesn't believe ModPOS is the malware behind the recent hotel malware attacks.

But the module, which is customized to its targeted environment and is

extremely difficult to detect, demonstrates how such attack systems are

evolving.

What Is The Legal Responsibility Of Hotels?

The structure of the

hotel industry is complicated and fragmented. With big hoteliers making their

money mostly through franchise agreements with owners and separate companies

managing hotels on behalf of franchisees, it's not always clear which party is

responsible for what at any single branded property. The legal landscape around

customer payment and privacy can be similarly difficult to navigate.

"There are a

lot of places where regulation of data-security conduct can come from in the

hotel industry," said Sandy Garfinkel, chair of law firm Eckert Seamans'

data security and privacy practice group.

The first place,

Garfinkel said, is through the Payment Card Industry Data Security Standard, a

set of requirements "designed to ensure that all companies that process,

store or transmit credit card information maintain a secure environment,"

according to the PCI compliance guide. It's not law, Garfinkel said, but it

helps the credit card industry avoid liability.

Contracts also tell

hotel companies and franchisees how to handle cybersecurity. "More and

more you have hotels, especially franchised hotels, having their data-security

practices controlled or regulated through contracts with franchisors—or on a

lower level it may be a contract between a manager and an owner—that imposes

data-security standards of conduct and policies on whoever operates the hotel,"

Garfinkel said. "Those wouldn't be case law, statutes or regulations, but

they would be contractual, legally binding provisions that say you must handle

data in a certain way."

Garfinkel said the

growing practice of regulating data security through contracts is a direct

result of the best-known hotel data breach, at Wyndham Worldwide, in which

hackers infiltrated the corporate computer system and the systems of individual

properties between 2008 and early 2010, stealing payment card information from

hundreds of thousands of guests. The U.S. Federal Trade Commission sued Wyndham

in 2012, alleging Wyndham failed to take proper cybersecurity measures to

protect customer information. The FTC settled the suit with Wyndham in early

December 2015, and the hotel company must comply with several orders, including

establishing a data-security program to protect cardholder data processed in

the United States.

"Wyndham has

woken up the hotel industry to be more aware and proactive about data breaches

and data security," Garfinkel said. "Not that it's where it should

be, but there's been much more attention." Though the contracts can seem

like nothing more than legal finger-pointing, he said the heightened fears of

liability and damage to a company's reputation have brought the industry along.

After a breach

occurs, things can get even more complicated. The United States doesn't have a

comprehensive federal data-security law. Instead, that power is handed over to

the states. "Right now, there are 47 different states with 47 different

data-breach response laws, which have a lot of consistencies but some of which

are wildly inconsistent," Garfinkel said.

These state laws

vary in how customers should be notified of a breach, how soon they need to be

notified and whether a hotel should have a written information security plan prior

to any breach. Complicating matters further, when a breach does occur, a hotel

is not beholden to the laws of the state in which it's headquartered or even to

the laws of the state in which breaches occurred. Instead, hotels must follow

the notification laws of the state in which each individual guest resides. "If

a hotel has a data breach and people from 25 different states have stayed at

the hotel during the time of the breach and are affected by the breach,"

Garfinkel said, "the hotel, by statute, must comply with all 25 of those

state's laws when it comes to responding to the breach."

What Can Travel Managers Do?

The onslaught of

threats from cybercriminals can cause fatigue in travel managers.

"I always have

concerns about me personally and any of our travelers; they all have individual

cards," said Christel Peterson, corporate services and travel manager

associate at Exp. "But I don't think in this tech world there's any way

around it."

To protect their

travelers and to ensure hotels take the proper steps in protecting their

security, travel managers can start by putting special provisions in their

hotel contracts.

Garfinkel, who

reviews sales contracts for his hotel clients for both meetings and transient

business, said in the past two years he's seen an uptick in the number of

companies putting special data-security riders into their contracts.

"They say, 'As

part of all this and the money we're going to pay you for having our [business]

at the hotel, you also agree that your hotel is compliant with PCI, that your

hotel's data-security measures obey or comply with applicable law and that you

will use the utmost care in handling our individual employees' personal

identifying information," he explained. "You could even have indemnification

provisions if the information is stolen while in the hotel's possession."

Ensuring Data Security: A Sourcing Guide

PCI Compliance

See if the supplier complies with these 12 requirements, defined by the

payments card industry to ensure a merchant systems security baseline.

Local Compliance

Confirm that data-security measures comply with local laws.

Semi- Versus

Fully-

Integrated POS

Fully-integrated systems have more connection points for malware and

less encryption. Ask your supplier.

Plan Of Action

Vet the supplier’s plan of action for data breaches.

Indemnification

If possible, include an indemnification clause in the hotel contract

and define penalties for failure to protect data.

In 2014, Interpublic

Group vice president of global travel and corporate card services Fran

McClarnon told Business Travel News she had begun requiring a $10

million indemnification from suppliers that handle her company's data

consolidation and reporting.

This year, the

company specifically assigned a resource to ensure all airline contracts worth

over $5 million of spend include clauses that address data security and

privacy, regardless of whether the contracts are up for renewal or not.

Airlines with renewal contracts have so far adhered to her requests. "We

give them enough business. If they're worried about losing it, they usually try

to compromise and come to the table with a solution and typically we get what

we need," she said.

Interpublic has

stopped short of requiring the same from hotels, in large part due to the fact

that transient travel contracts are negotiated through a tool, not a legal,

signed document. This makes it nearly impossible to insert an addendum,

according to McClarnon. But she believes suppliers are taking data security

more seriously as a result of corporations like hers taking it more seriously.

Garfinkel would

encourage travel buyers to keep pressing for change both on transient and group

contracts. "It really depends on your negotiating power,"

individually, yes, but also as an industry.

—Additional

reporting by JoAnn Deluna