Where are the opportunities and how will travel managers

need to work with their airline partners moving into 2021? One thing is sure,

historical data isn’t the answer. In addition, airlines have changed key

policies and will be flexible with buyers who can offer volume. Here’s what the

industry is saying about recovery and how corporate agreements are shaping up

for 2021.

LOOK WHO’S TALKING...

Louise Miller, Areka Consulting Americas Managing Partner

On Pragmatic Negotiations: We had relied on such robust

growth and schedules for so many years. Services were expanding and becoming

better every day. Now, a lot of the conversations have shifted from “What’s my

percent discount?” to “What are the services going to be like for my travelers when

they return?” and we’re really working hard to preserve important partnerships and

make sure travelers don’t have false expectations. There’s a good chance you can

set yourself up for failure if you negotiate too much on the wrong things and make

assumptions about services that will take a while to come back.

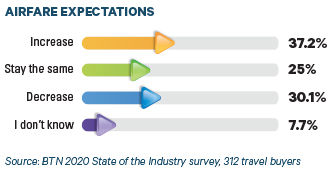

On Pricing: Volatility is extreme. If you book pretty far

in advance, you can still get pretty good deals. As it gets closer, the prices

are a lot higher. I fly on certain routes across country very frequently, and I

can pay $99 one way on any of the top carriers. If I wanted to go this weekend,

it might $800 round trip. That span always existed, but it’s more extreme now,

because you don’t have as much lift to balance it.

On the Impact on Booking Patterns & Corporate Deals: There

were a lot of companies that planned even long-haul international with three-

to five-day notice. Now, the companies that used to get really good deals

because they could plan three or four weeks in advance? Oh, no. Everyone’s

going to plan three or four weeks in advance, so they’re going to have to plan

six or eight weeks in advance to get the good deals, and the front of the

aircraft is going to be booked solid really far in advance.

On Eliminated Change Fees: That premium has been built

into changes at the last minute anyway. For changes without much lead time, I

don’t see an actual net benefit or cost savings. When you can make changes with

advance notice, of course it’s a great benefit.

LOOK WHO’S TALKING...

Mauro Ruggiero, Finastra Director of Global Travel Management

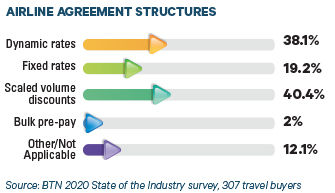

On More Agile Airline Agreements: Even pre-Covid, your business changes. The

traditional approach [to contracting] prohibits the ability to pivot.

Continuous sourcing is a win-win, because you are able to proactively take

advantage of new routes and new offerings and see how they match up with your

business. Internally, you can work with your stakeholders and pick up new

volume based on projects that are coming and going. What the pandemic shows us

is that we need to be more agile as an industry. Dynamic is a better way to

approach this.

On How He Did It: We started with a solid foundation using our

anchor city pairs where we knew the business wasn’t going to change because

it’s between our headquarters and key locations. From there, everything else is

a living document. A lot of the conversations with the carriers were driven by

input with functional business leads, as they talked about new projects and

consultancy work.

On Covid Accelerating His Strategy: There’s one difference post-Covid: We’re

trying to expect what the baseline will be in the future. If I’m using the last

12 months of regular business as the baseline, I’m going to go out based on

where I think we’ll see decrease in travel. There will be a permanent reduction

in travel spend. We already were trending down prior to Covid, as we were

trying to move more people to virtual collaboration... Covid has accelerated the

end game of our program, which was to look at about a 25 [percent] to 30

percent travel reduction.

LOOK WHO’S TALKING...

Bob Somers, Delta SVP of Global Sales

Kristen Shovlin, Delta VP of Sales Operations & Development

On Green Shoots: [Corporate travel] has grown exponentially over

the last several weeks and months. We measured our last 14 days, and week over week,

it’s up over 90 percent. At one point, it was very small numbers, but there are

more companies traveling with relatively significant numbers, albeit on a different

baseline. Transportation, manufacturing, automotive, those are the industries trending

considerably up week over week. We’re watching all the different verticals.

Entertainment and production is starting to see an uptick. Roughly 90 percent

of our corporate customers have travelers flying.

On Boosting Corporate Confidence to Travel: Confidence is the No. 1 thing we are trying

to instill in our customers and employees. We are following CDC guidelines and

protocols, and we’re spending a tremendous amount of time talking to corporations

about everything we’re doing to keep their travelers safe.

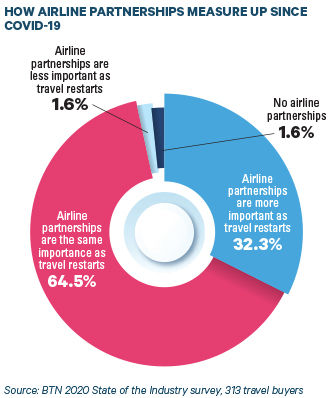

On Contract Flexibility: Right now, a lot of [corporate customers]

are looking to extend agreements. Those [looking for] RFPs are looking at

forward growth for their companies as well. Our goal is to [enable them to]

book, change and cancel plans with peace of mind. We’ve refunded over 4 million

tickets to the tune of about $6 billion. Not only did we permanently eliminate

change fees but also extended waivers on fees for newly purchased tickets. We

were one of the first carriers to extend SkyMiles status and extended the

expiration of travel credits. We were the first airline to offer flexibility

for those tickets through Dec. 31, 2022. We announced the ability to have

multiple changes to tickets covered by the travel exception policy. We even put

a travel exception policy binder in for agencies to help their corporations

manage those unused tickets. We have offered UATP as an alternative, so we’ve

come up with some alternative solutions to companies based on changing needs

they have.

On What Gives Them Hope for the Future: We’re really proud of our corporate customers

that have donated unused tickets for medical flights. Several corporations we’re

working with have [done so], and we’ve used those towards the hundreds of

medical flights we’ve provided for personnel dealing with the pandemic.

LOOK WHO’S TALKING...

Jo Lloyd, Nina & Pinta Partner

On Recovery Trajectory: When we look at the disruption and impact of

Covid-19 on the travel industry and aviation, it’s been absolutely devastating.

When we look at how things are likely to recover, the general consensus is that

it’s going to take four years to get back to 2019 levels.

On How That Impacts Contract Strategy: That does lend itself to transitioning to a

much more dynamic approach when it comes to contract management. One thing I’d

suggest buyers do now is engage with internal stakeholders and see what this

means in relation to their return to travel scenario, what will be coming back—at

least their best guess. Traditionally, airlines have used historical data to

project what spend is likely to be, and some of them are still doing that now.

The problem is we’re basing it on a market that doesn’t exist anymore. It might

be time to be taking a more fluid approach and looking at projected spend

rather than historical data.

On Observing the Market Before Jumping In: Most customers aren’t traveling

internationally right now, so that gives us a minute to see what happens with

the schedules and network coverage. This is a supply and demand business, so

the pricing will fit in relation to that. The best thing to do is to look at an

active, ongoing dynamic program that lets you ride the wave of the market and the

curve of the pricing.