Consumer demand for air travel may be soaring, but customer satisfaction with carriers has dropped for the second year in a row, according to the J.D. Power 2023 North America Airline Satisfaction Study, released Wednesday.

Overall passenger satisfaction is at 791 on a 1,000-point scale, down seven points from 2022, which had seen a 22-point year-over-year decline. The biggest driver behind this year's drop is cost and fees, the customer ratings for which fell 17 points from last year, according to the research company.

"If yield management were the only metric airlines needed to be successful in the long term, this would be a banner year for the industry, because they are operating at peak economic efficiency," J.D. Power travel intelligence lead Michael Taylor said in a statement. "From the customer perspective, however, that means planes are crowded, tickets are expensive, and flight availability is constrained. While these drawbacks have not yet put a dent in leisure travel demand, if this trend continues, travelers will reach a breaking point, and some airline brands may be damaged."

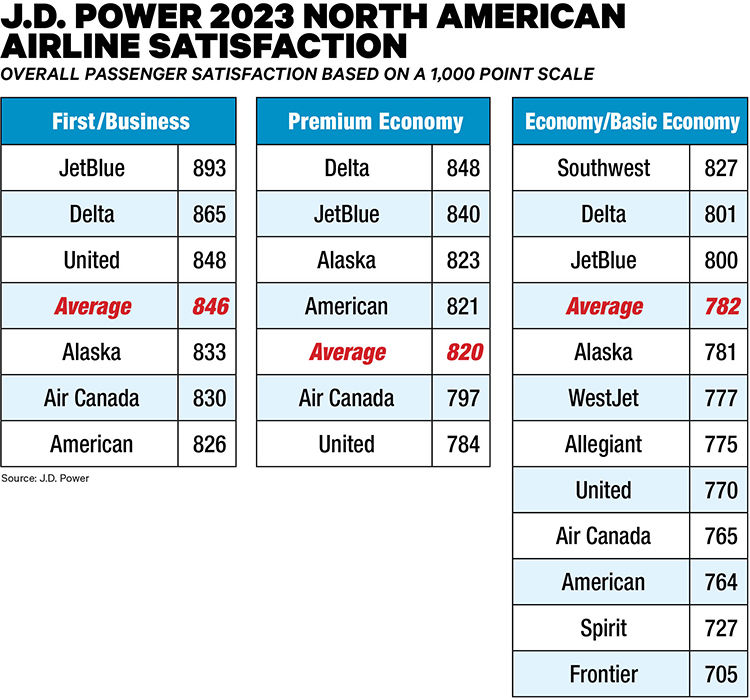

This year's report included scores based on cabin class: first/business, premium economy and economy/basic economy. Overall scores are based on responses from 7,774 passengers who flew on a major North American airline no more than a month before completing the survey, which was fielded from March 2022 through March 2023. There were 4,812 respondents for the economy/basic economy survey, 1,700 for premium economy, and 1,262 for first/business, according to J.D. Power.

The eight factors considered were aircraft, baggage, boarding, check-in, cost and fees, flight crew, in-flight services and reservations.

[Report continues below chart.]

Annual declines in passenger satisfaction were most pronounced in the economy/basic economy segments, according to the report. Satisfaction with cost and fees for this segment dropped 19 points from a year ago, and of the 11 carriers ranked, WestJet was the only airline to show an improvement, moving from 751 to 777, or to fifth place from last place in 2022.

Still, Southwest Airlines had the leading score for a second year in a row with 827 points. Delta Air Lines was next with 801, followed by JetBlue with 800. The segment average was 782, down 10 points from last year's 792.

One element with scores that improved significantly this past year is food and beverage, which climbed 12 points from 2022, according to J.D. Power. This rebound was particularly notable in the first- and business-class segment, where it gained nine points year over year, as many services were reinstated for upper-class cabins in the post-pandemic period.

JetBlue once again took the top spot for this upper-class segment with 893 points, followed by Delta (865 points), which was third last year, and United Airlines (848 points), which moved up from fifth with a score of just 822 in 2022. The segment average was 846, an improvement over last year's average of 837.

For the premium economy segment, Delta and JetBlue traded places from last year, with Delta on top with a score of 848 versus JetBlue's 840. Third again was Alaska Airlines (823 points). The segment's average dropped to 820 from 822 last year.

RELATED: Satisfaction Drops 22 Points in J.D. Power Airline Survey