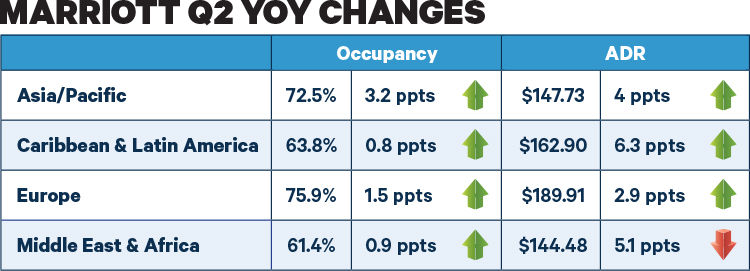

Marriott International saw year-over-year increases in both occupancy and average daily rate during the second quarter. Occupancy rose 1.3 percentage points to 76.4 percent, and ADR grew 2.1 percent to $162.94.

In North America, where revenue per available room rose 3.1 percent year over year, the company reported continued healthy demand from corporates, particularly across the energy, retail and professional services sectors. Transient RevPAR rose 2.5 percent, and group RevPAR rose 4.5 percent. Marriott president and CEO Arne Sorenson said the company expects transient business will grow faster than group in the near term, given the current high occupancy in the region.

As geopolitical concerns, such as possible trade complications with China, crop up, Marriott's topline forecast nevertheless is "steady as she goes," according to Sorenson. The company provided a full-year comparable systemwide RevPAR guidance of 3 to 4 percent growth on a constant dollar basis for the remainder of the year.

The company added 23,000 rooms during the second quarter, 10,900 of which are in international markets. As of the end of the second quarter, Marriott's worldwide development pipeline stood at 466,000 rooms, 25,000 more than at the end of the second quarter of 2017. The company is removing more rooms from its system than it anticipated, with deletions up about 2 percent year over year so far in 2018. Sorenson attributed that to contract expirations from legacy Starwood properties, to earthquake and hurricane impacted properties and to the economics of individual hotels. The pace of deletions is expected to slow in 2019.

Net income for the quarter grew 25 percent year over year to $610 million.

RELATED: Marriott Q1 Earnings

RELATED: Marriott Rewards & SPG Become One on Aug. 18