As new hotel brands have crowded the market over the past few years, traditional brands have associated themselves more closely with their parent companies. Fairfield Inn & Suites is now Fairfield by Marriott. Hampton Inn is now Hampton by Hilton. Also at play is the increasing importance of hotel rewards programs, which hotel companies use to encourage direct bookings over online travel agency bookings and to build loyalty, especially across a company's myriad brands. Best Western has seen business from loyalty members increase from 5 percent when David Kong stepped in as CEO in 2004 to 48 percent today.

Another trend in midscale comes from the upscale playbook. "No longer are guests willing to accept that just because they are not paying $500 per night doesn't mean they'll accept poor design," said Marriott International global brand officer and luxury portfolio leader Tina Edmundson. "And customers expect it when they are going to their hotel and spending $100 a night; they still want a high-design sensibility." Best Western chief marketing officer and SVP Dorothy Dowling agreed: "What the traveler wants today—including breakfast, a fitness center, a loyalty program, value creation—transcends different categories. What has transpired in the upper-upscale and upscale segments has become common place in the midscale brands."

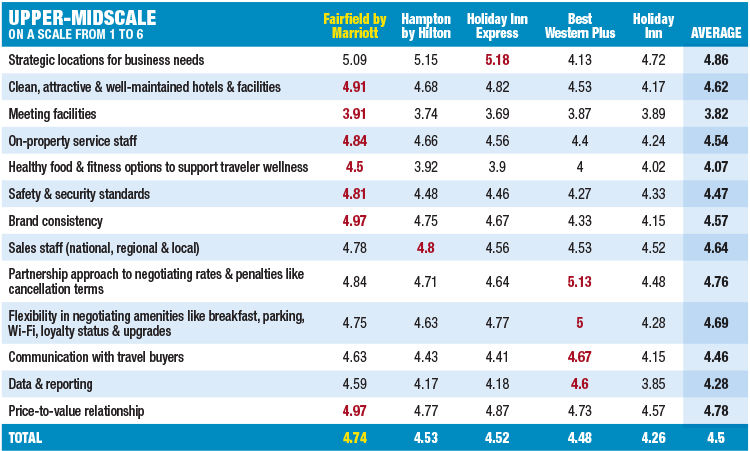

Upper-Midscale

Fairfield went from fifth place last year to first this year and earned top marks for seven of the 13 categories, including brand consistency, price-value relationship, on-property service staff and clean and attractive facilities. "We have a very keen focus on operations and service elements, and we have an excellent training program that was refreshed and re-rolled out," Edmundson said. "Second-most important is that we've had a ton of new openings. The brand passed 1,000 hotels this past year … which is a huge benefit for the corporate buyer." Fairfield has another 408 properties in its development pipeline.

Coming in second was Hampton by Hilton, up from third last year. It earned top marks for its sales staff. "Hampton was the first to introduce complimentary hot breakfast and on-the-go breakfast bags, and that has resonated with the business travel market," said sales, customer engagement and industry relations SVP Kelly Phillips. "It also has a wide footprint and is at a great price point, adding value for our business travelers."

Improving this year in both score and placement, InterContinental Hotels Group's Holiday Inn Express took the top spot for strategic locations and scored second for clean and attractive facilities, flexibility in negotiating amenities and price-value relationship. "Holiday Inn Express is in the midst of a transformation that has been in the works for the past six or seven years," said IHG SVP of global marketing Heather Balsley. "It started with the launch of a new design program that is really reaching scale in the market, and we're absolutely seeing really positive feedback from business travelers." Over the past 18 months, the brand also has rolled out new sleep and breakfast experiences. Breakfast is free for all guests. Updating "that offer to ensure it's also really high quality has been an important investment for us, and we are very confident that those investments are resonating with business travelers," she said.

The global sales team also has expanded its coverage of key vertical markets for business travel, Balsley added, and it's been more than a year since the company introduced IHG Business Edge for small and midsize enterprises. "Across IHG, we are very focused on relationships with corporate travel buyers and delivering an outstanding buying experience … and we continue to invest in how we lean into the power of the IHG Rewards Club to complement our corporate travel managers' travel programs."

Though it placed fourth, Best Western Plus finished first in categories important to travel buyers, including communication with travel buyers, negotiating and data and reporting.

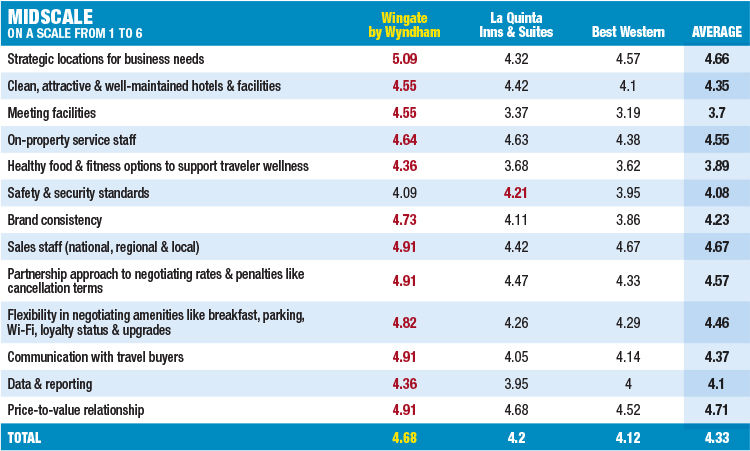

Midscale

Only three brands garnered enough use by corporate travel programs to place this year, compared with four last year. Wingate by Wyndham took the lead, while La Quinta Inns & Suites improved from fourth place to second. Since being purchased by Wyndham, the company has rebranded as La Quinta by Wyndham and has moved from midscale to upper-midscale. Based on the dates for which BTN asked respondents to rate hotel brands, however, it will remain in the midscale segment for this year's survey.

Wingate cleaned up in the midscale segment, earning top marks for 12 of the 13 categories. It came in second to La Quinta only for safety and security standards. "The brand has been very consistent and earned, five straight years in a row, the J.D. Power guest satisfaction award," said Wyndham group VP of global sales Carol Lynch. "It's very guest-centric and delivering the best services available. We're also expanding the brand into different regions around the world." The first Wingate in China opened in mid-2018, and Asia is Wyndham's fastest-growing development region, Lynch said.

The La Quinta acquisition and integration finished in April, and Wyndham thus doubled the number of sellers for Wingate, La Quinta and its other brands, said Lynch. "With that increase in sellers, we were able to create three different teams of sellers that focus on different segments within business travel." She noted industries like finance, IT, manufacturing and oil and gas. "We're able to really focus on different types of buyers and what their needs are and what amenities their travelers are looking for. [The sellers] are able to become experts in their specific segments of business."

Lynch also noted that Wyndham is upgrading the free Wi-Fi at many of its brands, a popular move among business travelers, and the company is piloting in-room casting technology that will allow guests to use their phones to watch TV. Wyndham also is introducing a dual-brand prototype for La Quinta and extended-stay brand Hawthorne Suites.

Best Western placed third this year and earned strong marks for strategic locations and for sales staff. Companywide, Best Western's business travel room nights have increased 10.8 percent year over year, year to date, compared with 2018. Dowling credits the maturation of the organization's team. "The relationship value creation compounds over time," she said. "There are different individuals and components of the branding strategy and team that have been building in terms of value proposition, and we have tenured individuals with us for a number of years." She also credits the commitments that property owners have made to the company's product and design evolution and their work with the rewards program. "It's also about delivering top-notch service to guests. It's a combination of all of those things … that puts our team at a high level in terms of business outcomes delivered to be able to win that business." The core Best Western brand operates 1,983 properties globally and has 147 in its pipeline.