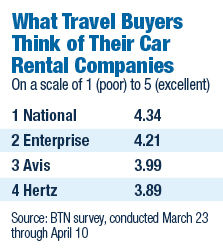

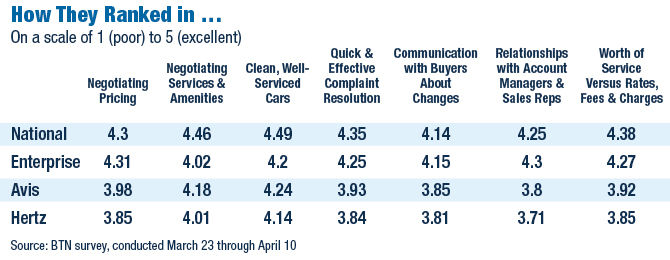

National Car Rental and sister brand Enterprise earned the

highest marks from travel buyers in BTN's annual Car Rental Survey, as they

have since the survey launched in 2015. Avis Car Rental and Hertz ranked third

and fourth, respectively, as they have since the survey's inception, as well.

Though scores decreased for all brands in most of the survey's criteria, buyers

did not report a decline in customer service. A third said their car rental

suppliers' customer service has improved since last year, and only 8.4 percent

said it had gotten worse.

National, which maintained a healthy lead over its two top

competitors, is "wildly successful," said Abrams Consulting

Group president Neil Abrams. "Since Enterprise [Holdings] acquired National, they've

done a really good job in building and using those brands strategically and

tactically to bring the best value proposition at a number of levels to the

corporate customers," he said. "They've done an excellent job in

developing the one-two punch to the corporate buyer, with the high-end bells

and whistles and a secondary more value-oriented offering that can be presented

so the buyer has options."

Enterprise and National have a few advantages. For one, they

are owned by a private company, which lets them make decisions and develop

strategies without being under the microscope of investors, Abrams said. The

brands also benefit from their policy of promoting from within. Sales

executives generally come from the branch management level, said Enterprise

Holdings VP Don Moore, who oversees the North American business and corporate

accounts. "It gives us an advantage in the marketplace because we know

what we can offer and do as a team. They know what they have already done as a

rental employee in the past."

Survey respondents praised Enterprise and National's

communication. One said their National account manager "is always helping

us make the best financial decisions for our company" in addition to

providing quarterly updates and reviews. Another buyer was pleased that

Enterprise set up a Chick-fil-A-catered breakfast meeting for all employees to

discuss the company's corporate rental agreement.

The lion's share of buyer commentary in the survey, however,

centered on pricing. One buyer said National had decreased negotiated rates

across the board and included insurance coverage, and another complimented

Enterprise's "tremendous flexibility in extensions of contracts" as

new contracts were negotiated.

Though car rental rates have been stagnant over the past few

years, travel buyers continued to complain about their car rental partners'

pricing and costs in general, mostly around upselling services and amenities at

the counter. "Service is very good, but pricing is all over the map with

fees and surcharges," one buyer said. "It's faster and cheaper to hop

in a Lyft and expense that than to fiddle with after-the-fact receipts with

charges that were not authorized." Thus, another buyer praised National

for enabling travel managers to block unneeded extras.

Avis, however, was the only brand that improved its score

for flexibility in negotiating transient pricing. Additionally, several buyers

cited problem resolution as a key satisfier. One said Avis offered a smart

solution after a traffic accident impacted a business traveler. Another noted

the company was quick to change processes and staffing to improve a service

issue in the buyer's top car rental market. Abrams said Avis remains a "great

brand," noting that it "is being very aggressive in enhancing

customer service and rental transaction processing based on new technologies."

Avis Budget Group SVP of sales Beth Kinerk said expansion of

the company's connected cars program will improve service. Those cars provide

real-time data on maintenance needs, so issues are addressed before a rental

hits the road. The real-time data also includes fuel consumption, making

billing more precise.

Avis Budget also is improving its team's ability to

communicate with clients, she said. "We continue to invest in our

employees so as to better equip the dedicated account team with the tools they

need to deliver a customized mobility solution. This includes a suite of

reporting tools so that corporate travel buyers have the right insights into their

travelers' rental patterns, as well as informational materials and advice on

how to best optimize their travel program."

Hertz, meanwhile, has been improving customer service, as

well. EVP of sales Robert Stuart said that includes training for customer-facing

employees and standardizing sales processes and quarterly business reviews.

Several buyers praised Hertz's customer service team, including one who said

its response to issues was "the best of all travel providers we work with."

Another was impressed when Hertz scheduled an in-person visit to apologize for

a problem that occurred with a rental.

The Hertz sales team also is relying more on data to help

buyers tailor their car rental programs, Stuart said. "We're looking to be

real consultants for them and help them from a total cost perspective,"

including comparing costs for car rental versus mileage reimbursement for

personal cars.

Methodology

From March 23 through

April 10, 2017, BTN surveyed 252 travel manager and buyer members of the BTN

Research Council and a randomly selected subset of qualified subscribers of BTN

and Travel Procurement. Equation Research hosted the survey and tabulated the

results. Respondents graded only those car rental companies with which they had

negotiated contracts or booked meaningful amounts of business in the past year.

Brands that did not reach a minimum usage threshold were disqualified from the

survey. BTN averaged the category scores to create an overall score for each

car rental company. Participants who did not respond to questions for a

particular category or brand were not included in that category or brand's

average.

Over the past 16 months, Hertz has refreshed its fleet

significantly. The vast majority of its fleet now includes such amenities as

Bluetooth, rear-facing cameras and USB ports, Stuart said. Additionally, the company

has invested in new car-washing equipment.

Though Hertz posted a $223 million net loss in the first

quarter of this year, it remains an "excellent company that provides an

excellent service," according to Abrams. "They clearly have a lot of

work to do, but the problems have been more internal problems, more subtle than

the customer understands or cares about," Abrams said.

National, Avis and Hertz all improved their

survey scores for services and amenities. All three brands have tapped

technology to make the car rental process more touchless. National continues to

enhance its Emerald Checkout process, through which travelers can begin the

checkout process through the app, VP of marketing Rob Connors said. Hertz is

expanding its Ultimate Choice, in which renters pick their own vehicle, and

expects to double its availability to at least 50 locations by the end of this

year, Stuart said. And Avis is tapping into its connected fleet to facilitate

the car rental process through its app, as well, Kinerk said.