With business travel down significantly due to the pandemic, coupled with recessions in a few markets, average per diem prices decreased across Latin America in 2020, with only a few exceptions. Hotel prices led the trend, with more than a third of the region's markets covered in this report posting declines of nearly 20 percent or more.

"It's a difficult year for numbers and a forecast," said CWT director of North Latin America Fernando Michellini. "Air and hotel prices are down. We saw reductions of 35 percent in air prices compared to 2019. Hotel prices reduced almost 27 percent." CWT's car rental prices, on the other hand, were up as demand has been mostly domestic. "Borders are closed, making business for international trips really difficult at this time."

Air routes and capacity were disrupted as well, with three of the region's major airlines filing for Chapter 11 bankruptcy in 2020: Latam in May, with its subsidiary Latam Argentina ceasing operations in June, and Latam Brazil filing bankruptcy in July; Avianca also filing bankruptcy in May; and Groupo Aeromexico filing in June.

The latest Global Business Travel Association BTI Outlook report estimated a 45 percent drop in business travel spend in Latin America, to $27.5 million in 2020, compared with a 51.5 percent average drop globally.

Price Volatility

The most expensive market in the region once again was San Juan, Puerto Rico, with an average per diem of $327.33, a 20 percent increase from 2019. Next in line, also with a 20 percent increase, was San Jose, Costa Rica, at $271.60. These gains were offset by larger business travel markets showing declines, including Sao Paulo, Brazil, down 21 percent to $203.28; Bogota, Colombia, which closed its borders for much of the year, down 25 percent to $137.73; and Buenos Aires, Argentina, which is in a recession, down 30 percent to $171.19.

Colombia made some changes to its tourism law that eliminated the value added tax for hotels, restaurants and bars to support the industry, said American Express Global Business Travel general manager for Latin America and the Caribbean Jose Camarena. "That might be one reason why you are seeing such a decrease [in Bogota]," he said. "In the case of Buenos Aires, there's been an important [economic] denigration the last 24 months and that continues to impact local pricing."

Another potential impact on the decline of business travel to Argentina: Coca-Cola moved its offices from Buenos Aires to Brazil in 2020, Michellini said. "That impacts pricing."

The cost to get from the airport to the city center in the 14 markets covered was split equally between gains and losses, but the differences varied widely. Guayaquil's cost doubled to $12.50, and Mexico City's increased 44 percent to $15.17. Buenos Aires' cost fell 70 percent to $7.20, while Sao Paulo's was more than halved to $18.47.

The cost of a meal increased in 10 of the 14 cities, but the price shifts were more moderate, save for Bogota and Buenos Aires, which saw steep declines. Cities with price increases from 20 percent to 30 percent include Guatemala City, Mexico City and San Jose.

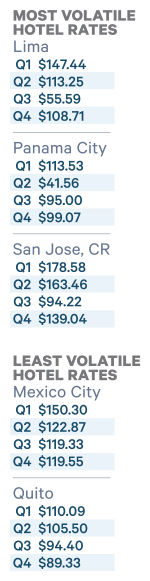

Hotel prices, however, declined year over year in 11 markets, and showed the most volatility. Panama City, for example, reported quarter-over-quarter corporate booked rate changes ranging from a decline of 63 percent to gains of 129 percent. Looking at the granular data, a sudden decline in booking volumes combined with a tendency of certain business to book at lower or higher service tiers may be responsible for that swing. Overall, the first quarter, pre-pandemic, showed mostly healthy increases for the region. But the second and third quarters indicated not much corporate travel was happening, with many markets reporting no bookings in certain hotel service tiers. The data shows bookings and rates picking up again in the fourth quarter.

"Most hotels are really just open with limited capacity," said BCD Travel VP sales and marketing for Latam Rolando Robles. "We've been looking at the business that has come through us and there is [an overall rate] drop because the largest volume is domestic. That will bring your average down," he said, indicating that domestic bookings trend toward limited service and lower tiers when compared to international bookings.

Pandemic Update

One of the challenges during this pandemic is that the situation in countries changes constantly, and it's particularly challenging in Latin America. "There's no question the situation [in Latin America] has not improved in the last few months, and if anything, it's gotten worse," said International SOS SVP and global medical director Dr. Robert Quigley, who stressed the importance of not calling out any particular destinations as the information available "is very fluid" and changes almost daily. "I'm concerned about what is going on down there despite the fact that most of the countries have adopted the mitigation best practices, but the results are not that good."

While countries in the region have begun to administer Covid-19 vaccines, "many countries have limited health care infrastructure," Quigley said, noting that there aren't necessarily the resources or technology to distribute the shots as quickly as in the United States.

He also cautioned that just because Covid-19 case levels may ease up, other pre-pandemic concerns remain, such as the zika virus, denge, malaria and crime. "Just because you've been vaccinated, you still have to keep your guard up about drinking water, endemic diseases and crime," he said.

Still, the vaccines and testing have brought hope to the region. "Vaccinations have started to be applied in most countries now … and some governments have implemented medical certificate requirements or PCR tests to travel to or from the country," Camarena said. "We believe long-term both vaccinations and government travel policies should have a positive impact for the traveler. They should feel more confidence with the new precautions and protocols."

Signs of Life

In addition to the vaccine providing hope, there are signs of life when it comes to business travel in the region.

"In the case of Mexico, oil and gas, and health care and telecom are leading the way based on trends we've seen," Camarena said. "In Colombia, medical research is starting to increase at a faster pace, combined with oil and gas. We are also seeing the trend of higher bookings in hotels in all the countries. Hotels are recovering faster than air, which may be driven by domestic travel. Some companies are sending employees by ground transport."

Another sign is an increase in bookings from small and midsize companies "in Mexico and Argentina, and we're starting to see that in Colombia and Brazil as well," Camarena said.

Michellini agreed. "Small companies keep doing business, which is completely different from the big companies," he said, adding that agriculture in the region is doing really well, as are construction companies and factories that produce iron and equipment for construction. "And financial services are doing well," he said.

For gross domestic product, the numbers were flat in 2019, and once the official numbers come out for 2020, they will most likely be down. But "for 2021, I have seen reports that are more optimistic, from 3 percent growth in Brazil to around 3.8 percent in Mexico, which are two of the largest markets in the region," Robles said. "Those alone are almost 60 percent of the GDP for Latin America. But January and so far in February have been slow, so we'll probably have to push expectations [of a greater recovery] to August or September 2021."

Further, companies are reviewing their travel policies. "First it was to stop travel, then to allow for urgent business," Michellini said. "Now we are starting to have conversations to see what we can do with the policy for when business is back, what [companies] can do for health measures for travelers."

Robles added that BCD also is seeing clients review their travel policies, "which have not been reviewed in 10 years," he said. "They are making sure they are up to date. This is positive for our region, because many times, travelers felt that their policy was too large and complex and very outdated."

Some companies also are looking at incorporating sustainability practices into their policies, Camarena said. "We are pleased to see that," he said. "In Mexico, we found that more than 20 percent of the companies we work with have taken at least one or two sustainable actions in their corporations. If you asked me two years ago, I would say that zero companies were taking sustainable actions."