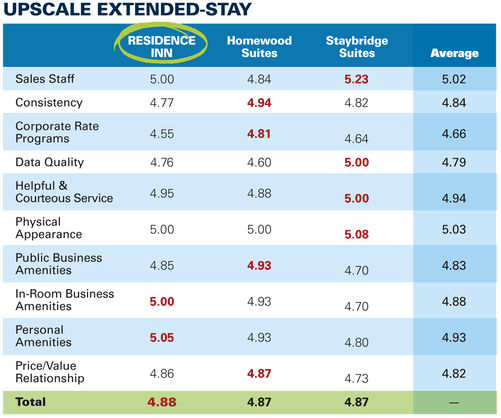

Marriott's Residence Inn brand reclaimed the top spot in BTN's

2016 Hotel Survey upscale extended-stay tier after falling from first to second

place in 2015. In the midprice extended-stay segment, Extended Stay America

overtook InterContinental Hotels Group's Candlewood Suites to win.

Extended-stay brands are following the rest of the hotel

industry by focusing on updated property designs, enhanced communications and

technology and open, communal spaces in lobbies, according to Mark Skinner,

partner in extended-stay research firm The Highland Group. "Obviously the

buzzword is 'Millennials,' but a lot of what is being designed suits other

people, as well: lighter colors, more lighting and natural light, more hardwood

floors."

Residence Inn, which also came in second place in this year's

J.D Power North American Hotel Guest Satisfaction Study, certainly fits that

model. The brand in recent years has launched new lobby designs, has updated

room amenities and has introduced programs like Residence Inn Mix, a

three-nights-a-week social that incorporates local food and beverages.

The brand earned the top scores in its segment in BTN's

survey for in-room business amenities and in-room personal amenities. "If

you think about those scores, I think they're largely pointing to our full

kitchens, our grocery shopping service, the way that we communicate with our

guests about the social aspects that they can engage in," said Marriott

senior vice president of select service and extended-stay brands Janis Milham. "It's

doing more of the same as in recent years, but we continue to deliver those

things consistently and really well."

This summer, Residence Inn upgraded its breakfast offerings

and launched RI Runs, a partnership with Under Armour Connected Fitness that

provides customized running routes near Residence Inn properties. Guests can

access the program through UnderArmour's MapMyFitness app. During the fourth

quarter of 2016, Milham said, Marriott will begin rolling out mobile service

requests to its extended-stay and select-service brands. They're already

available at full-service properties through the Marriott mobile app. In 2017,

Residence Inn also will launch a new decor package for properties getting

upgrades and for new ones. The brand has over 220 hotels in its pipeline. "We're

setting the table for another great year next year," Milham said.

IHG's Staybridge Suites and Hilton Worldwide's Homewood

Suites tied for second place in the upscale extended-stay segment. Staybridge

earned top marks for sales staff, data quality, helpful and courteous service

and physical appearance. This year, Staybridge has continued to focus on its

Urban Guest Room Design, according to Jennifer Gribble, vice president of

Holiday Inn Express, Staybridge Suites and Candlewood Suites for the Americas.

The design, unveiled last October, features modern amenities like mobile desks,

built-in shelving and storage and separate dining and work areas. The brand is

growing, too, with 128 hotels in its pipeline.

Homewood Suites received the highest score for consistency,

corporate rate programs, public business amenities and price/value

relationship. Homewood has completed renovations through its Take Flight

program at about 20 percent of its properties. The property-upgrade initiative,

launched in 2013, provides modern social spaces like outdoor kitchens and fire

pits.

"So far, Take Flight has been an absolute success,"

said Adrian Kurre, global head for Homewood Suites and Home2Suites by Hilton. "Once

the hotel gets back open and guests experience that lobby and the public areas

with all the things that we've done, it's been absolutely wonderful. We look to

be making an even stronger statement over the next couple of years as we

complete the rest of the brand."

Kurre said Homewood has more than 140 hotels in its pipeline

and its entire portfolio will be new or completely refreshed by the end of 2018

or early 2019.

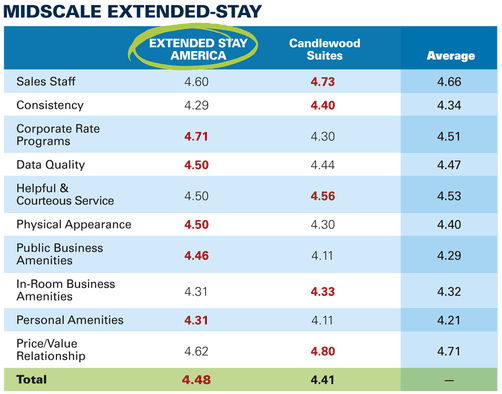

Midprice Extended Stay

Extended Stay America, meanwhile, is garnering praise in the

midprice segment for its own revitalization efforts. The brand finds itself at

No. 1 for the first time since 2005. It earned the highest scores for corporate

rate programs, data quality, physical appearance and in-room personal

amenities.

The brand is completing a years-long renovation effort, with

80 percent of its 629 properties finished and renovations expected to wrap in

2017. According to chief marketing officer Thomas Seddon, the company's

TripAdvisor property ratings have increased as much as 1.5 points following

renovations.

Beyond property improvements, ESA in the past year has

introduced a new revenue management system; reorganized its sales team,

focusing more on the corporate segment; and launched its Extended Perks loyalty

program, all under the helm of new CEO Gerardo Lopez. "It feels like we

have experienced more positive change in the last 12 months than we have in the

last 20 years," Seddon said.

In June, the brand also announced ESA 2.0, a five-year

strategic plan to build new hotels for the first time in almost a decade and

open the company up to franchisors for the first time ever. With the new

properties, ESA will introduce fresh design featuring open-concept lobbies with

social spaces and mobile room furniture and amenities.

Rounding out the segment in second place, Candlewood Suites

scored highest for sales staff, consistency, helpful and courteous service,

in-room business amenities and price/value relationship. Gribble said both

Candlewood and Staybridge have continued to score extremely well in service

through IHG's internal metrics, and positive online property reviews have cited

some staff members by name. The brand currently has 103 hotels in its pipeline.

The extended-stay space overall is experiencing a supply

boom. At the midyear point of 2016 more than 40,000 extended-stay hotel rooms

were under construction in the United States, a high-water mark not seen at any

midyear or year-end point for at least 17 years, according to The Highland

Group. Midyear supply levels across all extended-stay segments grew 5 percent

from 2015 to 2016, while demand for the same period grew only 4.8 percent,

contributing to a 1.2 percent decrease in occupancy year over year. "With

the level of supply coming in, it will need a significant uptick in demand

growth in '17 for occupancy not to fall further," Skinner said.

Nevertheless, extended-stay hotels have

increased average room rates by 4.9 percent during the first half of the year

to $96.40. And revenue per available room is expected to outpace that of the hotel

industry overall for 2016.