As brands across the industry work to keep up with the changing

tastes and expectations of modern travelers, those in the luxury segment must provide

the same personalized service and premium products as always without alienating

modern travelers for the sake of tradition.

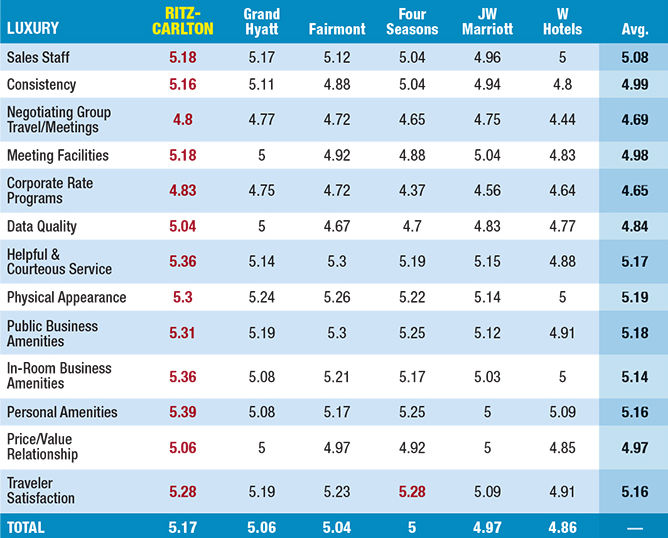

Ritz-Carlton, which took the top spot among luxury brands in

BTN's Hotel Brand Survey for the second year in a row, in recent years has renovated

lobbies and guest rooms and revamped food and beverage offerings to better suit

modern standards of luxury. "It wasn't that many years ago when every Ritz-Carlton

had mahogany wall paneling, oriental rugs and English hunting scenes," said

Bjorn Hanson, a clinical professor at the New York University School of Professional

Studies Tisch Center for Hospitality and Tourism. "It didn't matter whether

it was in Hawaii or New York. Ritz-Carlton now has a little bit more contemporary

look."

Ritz-Carlton earned the highest score in every category in the

luxury segment. It also took second in the J.D. Power 2017 North America Hotel Guest

Satisfaction Index Study.

Since last year's BTN survey, parent company Marriott International's

acquisition of Starwood Hotels & Resorts has boosted the brand. Now, members

of Ritz-Carlton Rewards, Starwood Preferred Guest and Marriott Rewards can link

their accounts, transfer points and receive status matching. And while Ritz-Carlton

now has more luxury bedfellows in the Marriott International suite of brands, it

still demands the highest revenue per available room of any of the company's brands.

On a six-point scale, No. 2 Grand Hyatt finished just 0.01 points

behind Ritz-Carlton in terms of sales staff. Grand Hyatt offers significant public,

meeting, restaurant and event space. Hyatt Hotels Corp. VP of global sales for the

Americas Gus Vonderheide said the line between travel professionals who manage transient

and those who manage group is blurring. "Folks are being asked to do more,

and many times they're taking on responsibilities outside of their norm, and we're

prepared and ready to step up ... through digital concierges, through our billing

process on group bills, through our mobile apps," he said. "All these

things are being created with a number of different customers in mind."

It's been one year since AccorHotels acquired FRHI, parent of

third place finisher Fairmont Hotels. In that time, Accor has made some additions

to Fairmont, while Fairmont has inspired changes to the Accor organization, as well.

Accor recently introduced two new beds: Sealy developed the Fairmont

Bed, and for Fairmont's Gold guest rooms, Stearns & Foster developed the Fairmont

Gold Bed. Fairmont tested them at select hotels during the past year. The addition

is a nod to the luxury SoBed at Accor's Sofitel brand. The Fairmont Fit program

also gained Technogym's Wellness Ball Active Sitting exercise ball as a new amenity.

In last year's report, BTN highlighted Fairmont's service training, and now Fairmont

has guided Accor's Heartist programming, which trains employees to provide service

from the heart.

While Ritz-Carlton and Four Seasons have battled for the top

spot in this survey over the years, Four Seasons has fallen down the ladder in recent

history. Nevertheless, Four Seasons and Ritz-Carlton tied for high score for traveler

satisfaction. Hanson suggested it's not that Four Seasons has fallen in quality

but that the brand may have an optics problem with the BTN audience, which formed

the survey's respondent pool. The brand has in recent years heavily promoted its

Four Seasons Explorer product. "You have corporations trying to implement cost

savings programs and stricter enforcement of corporate travel policy. You know,

to have executives staying in hotels that also have yachts and private jets …"

Hanson's inference may be bad news for Ritz-Carlton, which plans to launch a yacht

collection in 2019.

From January to July, the luxury segment's average

daily rate increased 2 percent year over year to $322.06, according to STR. Occupancy

increased 0.1 percent to 74.7 percent.