If the stakes are high across the hotel industry to deliver

service and keep up with shifts in guest preferences, no segment feels that

pressure more than the luxury tier. The top luxury brands in BTN's 2016

Hotel Survey found that balance, embracing technological enhancements and

modern aesthetic standards and delivering on personalized service.

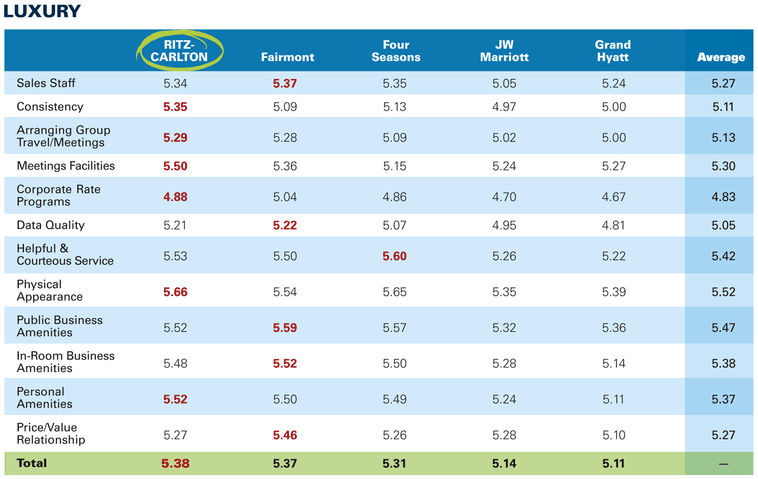

Ritz-Carlton took the No.1 spot among luxury brands in this

year's BTN survey and also finished first in J.D. Power's 2016 North

America Hotel Guest Satisfaction Study. "Once you establish yourself as a

luxury brand that's going to deliver and execute on service, then you have to

not only deliver on expectations but exceed them," said Ritz-Carlton vice

president of sales John Harper.

Ritz-Carlton performed well in consistency, physical

appearance and in-room personal amenities. Harper said it has completed

renovations around the world. The Ritz-Carlton, San Francisco, for instance,

just gave a face-lift to its rooms, meeting spaces and lobby to meet "modern

standards of luxury."

The brand also received high marks for ease of arranging

group travel and meetings, its meetings facilities and its corporate rate

programs. Harper said the brand in recent years has emphasized engagement with

meeting planners and meeting attendees, as well as technology. "Technology

has become so critical to the success of events that you have to continue to

evolve and advance your tech—and that means being smarter with the sales

process and the [meetings and conference] process—and then when they're on the

property the customer having the confidence in our ability to execute,"

Harper said. "The expectation in the luxury space is that you're the best

at it and that you get it."

Second place Fairmont Hotels & Resorts finds itself

among the top three luxury brands for the first time since 2010. It earned top

marks for sales staff, data quality, public business amenities, in-room

business amenities and price/value relationship.

Fairmont, known for iconic properties, has to modernize

while preserving hotels' historical integrity. It's a challenge vice president

Jane Mackie said the brand has embraced, renovating about 75 percent of its

portfolio in recent years and integrating modern business needs in the process.

"Wi-Fi is probably the No. 1 thing that we've addressed

over the last 24 months," she said. "But it's also having more data

ports. Fairmont Royal York, for example, where we have 1,325 keys, is about the

equivalent of three New York City blocks and 20 stories high, so obviously we

need more data ports. Just buying more bandwidth in one section of the building

is not going to feed and provide enough access to the extreme ends of the

building."

The brand also addressed tech amenities in the guest rooms,

putting in "what we think is the right number of electrical plugs in the

right places … and then adding another 20 or 30 percent more plugs, because you

can never have too many."

Fairmont has also revamped its Service Promise training,

particularly as it relates to working with corporates. "The training

focuses on four key things: understand, anticipate, engage and deliver, which sounds

very simple," Mackie said. "But ... it's making sure … we have all of

the data available to share with them, [that] we've already pulled it together,

taken the time to understand and interpret it for the customer and then

anticipate what their needs may be."

In key markets where it lacks a presence, Fairmont expects

steady growth thanks to parent company FRHI's recent merger with AccorHotels.

Hotels in the luxury tier received the highest

scores in BTN's survey, but the tier's U.S. revenue per available room

growth from January through July was the weakest of any segment, up just 1

percent versus 3 percent for the industry overall, according to STR. The mild

RevPAR growth is partly the result of a drop- off in occupancy, which fell 0.7

percent year over year to 75.7 percent. Luxury hotels make up only 4.6 percent

of the total U.S. hotel rooms under construction in the United States,

according to STR, yet the segment is still running into the same issue as other

industry segments: supply growth outpacing demand growth.