As the business travel industry's most wrenching year draws to a close without a vaccine for the virus that has battered suppliers of all sizes and with a full return of corporate travel seemingly years away, suppliers have turned to government and private sources to secure the funding necessary to stay afloat. Some say they've maxed out cost-cutting efforts, and some warn of calamity without more support in an environment where current business travel revenue levels simply aren't sufficient.

The stakes are as high as they come. Hundreds of thousands of business travel industry jobs are in the balance. And though some suppliers have expressed confidence that their efforts to control costs and secure outside funding will enable them to ride out the rest of the pandemic, others aren't so sure.

There have been business casualties. Hotels have closed permanently. Tens of thousands of employees have been furloughed or laid off. Some smaller companies have sought the shelter of an acquisition by a larger firm.

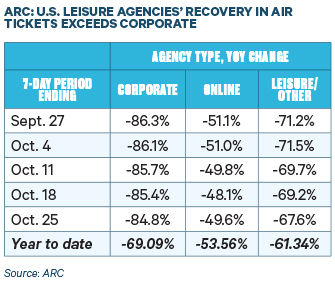

And though some suppliers have pointed to perking-up domestic leisure travel as something of a lifeline for now, the prospect of increased higher-revenue business travel remains a dim, fuzzy light on a distant horizon: Airlines Reporting Corp. weekly data still show year-over-year declines in air tickets booked by corporate travel agencies exceeding 85 percent, with only marginal improvement from the summer.

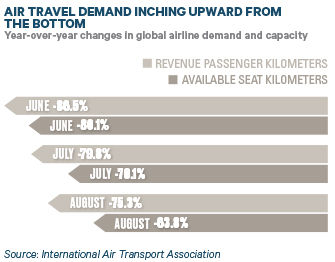

While the overall air passenger demand environment has crept up from their springtime depths, International Air Transport Association director general and CEO Alexandre de Juniac called August traffic "disastrous" with international recovery "virtually non-existent."

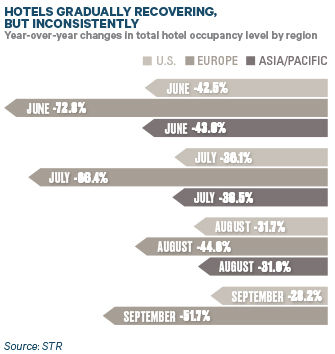

Hotels' performance hasn't been quite that dire, with year-over-year decline in monthly occupancy rates in the U.S. and the Asia/Pacific region easing each month through September, according to STR, although European occupancy has been less consistent.

With new Covid-19 cases increasing at an alarming rate in the United States and parts of Europe, many suppliers feel insecure. In fact, more than six in 10 suppliers and travel management company members surveyed Oct. 12-17 by the Global Business Travel Association indicated it's at least likely their companies will undergo another round of furloughs or layoffs without more government support. Nearly one in 10 think it's likely their companies would go under, according to the survey of 353 respondents.

"There definitely are some concerns about the financial health of many of the suppliers," said Mark Williams, managing director of the Americas for business travel consultancy Nina & Pinta. "Those that were fortunate to go into the Covid-19 situation with better than average balance sheets should be fine. On the other hand, those with marginal or suspect balance sheets in March are struggling and may not survive. I think we will see more consolidations in the TMC space, and it is likely we will see some bankruptcies—some Chapter 11, but some Chapter 7."

No major U.S. business travel company has ceased operations as a result of the pandemic, although several have declared bankruptcy in the U.S., including Hertz Corp. and foreign carriers like Virgin Atlantic and Latam, among others. (It's not a supplier, but the Association of Corporate Travel Executives also ceased operations.)

Individual hotels have closed, including high-profile urban properties, and the American Hotel & Lodging Association has warned there will be more without additional government relief. About half the hotel owners the group surveyed in September indicated they are in danger of foreclosure.

"As an industry, we've had a bumper decade of growth without the need to overtly worry about financial health, so this period is concerning," according to Festive Road managing partner Caroline Strachan. "We can see some natural shaking up of the ecosystem, with those backed by investors buying up entities to progress their strategy at a faster pace, no doubt at a bargain price."

Federal Appeals

The government relief sought by AHLA as well as several other supplier organizations, notably the U.S. Travel Association, Airlines For America, the International Air Transport Association and the American Society of Travel Advisors, among others, could serve as a lifeline for countless hotel owners, smaller travel agencies and ground transportation operators to help keep their operations afloat and employees paid.

Nearly every large country's federal government has extended some level of financial support to their travel industry suppliers. In the United States, the Coronavirus Aid, Relief, and Economic Security Act, better known as the CARES Act, established a variety of loan programs suppliers could access, and many did. But no deal has been reached on a second round of legislation (see sidebar).

Other countries have extended loans, as well. Just to name a few, the United Kingdom through its Covid Corporate Financing Facility extended loans worth hundreds of millions of pounds each to British Airways, RyanAir and Intercontinental Hotels Group, among others; and Lufthansa negotiated a €9 billion loan from the German government.

In the U.S., the CARES Act established the Treasury Department's Payroll Support Program, which afforded airlines loans provided they retain employees on the payroll. But that expired Oct. 1, leading to tens of thousands of furloughs by some carriers.

"My focus is on getting the payroll support extended. That is Plan A," Southwest Airlines CEO Gary Kelly said during an Oct. 22 earnings call. "And I'm optimistic that still could happen. And if it does … I think it puts us in a very good position where we don't have to ask any of our people for a pay cut, much less seek a furlough."

American Airlines CEO Doug Parker during an Oct. 22 earnings call defended his airline's push for more support. "There's another question we sometimes hear, which is, 'Well, okay, that's all well and good, but if things won't be better six months from now that you're going to need it again.' I don't think so," he said. "I think six months from now certainly you'll see a better environment than we have today irrespective of what may or may not have happened as it relates to the pandemic itself, because people are getting more and more comfortable with travel and cities are opening up and business is returning somewhat."

It's unclear, given continuing negotiations, whether airline support in a second round would take the same form as the first. "The unknown is how much stimulus the industry will ultimately receive from the federal government," Williams said. "The initial round of airline stimulus probably saved some bankruptcy filings."

Midsize and Smaller Concerns

Small and midsize U.S. suppliers are in a far different position than major carriers, but have taken similar actions to weather the pandemic. Most have cut costs and many of those with fewer than 500 employees have sought U.S. federal loans under the Paycheck Protection Program, established by the CARES Act. For some, that's sufficient for the moment to stay the course.

"We've been fortunate that we've had a strong balance sheet going into this, not having to answer to Wall Street or to any venture capital," said primarily corporate travel agency Fox World Travel CEO Chip Juedes, who co-owns Fox with his father, David. Fox qualified for a PPP loan, Chip Juedes said, which "lengthened our runway," but he said keeping costs low has been the key.

"My father and I, as the only two owners of the organization, have saved for a rainy day … and we are now in the rainy day that we didn't see before," Chip Juedes said. "We're taking the opportunity at Fox to come out of this stronger, which is the same thing we did after 9/11 and in the 2008 [downturn], and really we went into this lean. And as we saw in both of those situations, those that went in lean were able to come out lean."

Fox hasn't made permanent reductions in its workforce, but has implemented temporary furloughs, Juedes said.

Some smaller companies, particularly tech suppliers that focus on the business travel industry, have had a trickier time going it alone. Several have been acquired by larger firms since the beginning of the pandemic, including 30SecondsToFly by American Express Global Business Travel, Freebird by Capital One, WhereTo by Flight Centre Travel Group, and Rocketrip by Mondee Holdings.

"When the pandemic hit, it decimated our revenue," WhereTo founder Ryan Wenger told BTN portfolio mate The Beat upon the company's acquisition. "We had a choice. We either had to hibernate and let go of a huge amount of our company or get acquired."

Whatever the next steps for the industry's suppliers, they're preparing for a hazardous 2021, with one eye on the bottom line and the other on the development of a vaccine and additional testing protocols. In the meantime, their financial status could complicate their relationships with travel buyers, who now must consider their suppliers' viability when maintaining their own splintered travel programs.

"I do see buyers taking supplier financial viability into account when going to market. While no one wants to see suppliers fail, the fact is some will," said Nina & Pinta's Williams. "Buyers will need to source most categories in the near term; there have just been too many changes to allow agreements in existence in 2019 to survive going forward. And buyers should take all of this into account in working with suppliers."

Added Digitravel Consulting managing partner Susan Lichtenstein, "This is the right time to determine goals and strategies in this new norm and what you need from your program. We've never had time to look at our programs and make adjustments because we were always processing transactions. Don't just accept new fees at this time. Now is the time to reassess your overall corporate travel program and precisely the value your program brings to you and your travelers."

Analysis: The Politics of Relief

When President Donald Trump on Oct. 6 abruptly ended via tweet further negotiations with House Democrats on another U.S. federal Covid-19 relief package until after the Nov. 3 presidential election, a stunned business travel supplier community reacted with alarm and dismay. Supplier associations issued delicately worded statements, not criticizing Trump or any other official by name but beseeching officials for aid and imploring action, and by day's end Trump had reversed course, calling instead for an airline bailout package, again via tweet.

The episode proved only a sidenote—negotiations continued, and Trump made no further threats—but it illustrates what has been a chaotic and, for travel suppliers, frustrating and thus far fruitless process. At press time one week before the election, no deal on a new relief package between the two primary negotiators, Treasury Secretary Steven Mnuchin and Speaker of the House Nancy Pelosi (D-Calif.), had been reached, much less one that also could gain the votes of enough Republicans in the Senate to pass that chamber.

The results of the election will have a significant effect on the legislation. Should Trump win reelection—and polls suggest he's an underdog—there's no guarantee the administration will keep their proposal on the table as-is, with the election in hand, particularly given Senate Majority Leader Mitch McConnell's (R-Ky.) stated discomfort with its $1.8 trillion price tag. Should former Vice President Joe Biden win the presidency, there would be little incentive for Democrats to deal with a lame-duck Trump administration, particularly if Democrats capture a Senate majority. While Mnuchin and Pelosi theoretically could strike a deal in the lame-duck period, the prospect of them reaching one that also satisfies Senate Republicans seems vanishingly unlikely.

Biden has said a relief package would be an immediate priority for his incoming administration, and it may well be that the industry would need to wait until after a Jan. 20 inauguration for federal action on additional loans and aid packages.

But other terrain could shift in a Biden administration, as well: One of Pelosi's primary objections to Mnuchin's proposal is its included protections from liability for employers whose employees catch Covid-19 on the job. That's a key issue for travel suppliers, and may well represent their next fight.