Payment Pathways

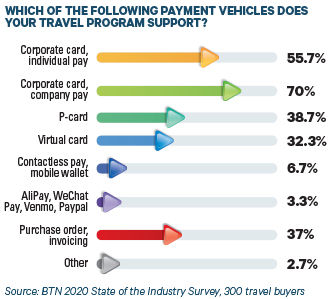

Driven by demand from spending managers for greater security and better cost controls, and bolstered by increased acceptance from end-suppliers, virtual cards have carved out a significant market share in corporate payments—though plastic corporate cards remain the most dominant payment tool, followed by other traditional methods including P-cards and invoicing.

Virtual cards and mobile wallets have been touted by many as a natural pairing to extend v-cards' functionality to in-trip purchases and solve the longtime problem of hotel front-desk friction, but it seems that combination has yet to gain major ground, due mainly to an overall low penetration of mobile wallets as a whole. However, hygiene concerns stemming from the Covid-19 pandemic have put a premium on contactless payment methods and are widely expected to drive more mobile wallet usage.

Meanwhile, mobile-based P2P payment services like AliPay and Venmo have managed to carve out a small but significant foothold in the corporate T&E sector, which could lead to further penetration of those consumer tools.

Look, No Hands

Given the widespread acknowledgement that hygienic concerns will be top-of-mind for corporate travel managers in the wake of Covid-19, the results here were a bit surprising. It's possible that the more than half of respondents who hadn't increased their focus on contactless simply have bigger issues to deal with at the moment—like getting travel up and running again, dealing with supplier shortfalls amid the ongoing pandemic and navigating financial headwinds within their own organization. Others—especially those supporting mobile wallets—may already have been prioritizing contactless.

It's also possible that the demand for contactless options hasn't yet registered on the travel management radar. Once employees begin to travel in earnest and realize how many payment touchpoints they have along the journey, the demand for touchless corporate payment options could spike.

Expense Technology Strategy

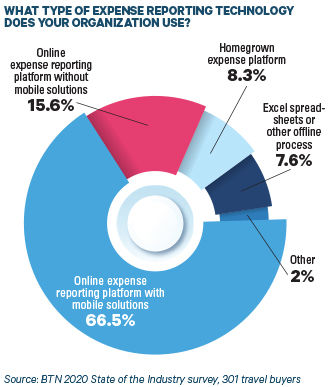

Given the advances that have been made over the past

decade in expense management technology, it's hardly surprising that

more than 80 percent of respondents were leveraging such tools—nor that

the vast majority of those also support a mobile component. For the 7.6

percent still clinging to low-tech methods such as Excel

spreadsheets—especially small companies with little T&E to

manage—that model may work just fine on the surface. But with ever-more

online solutions designed—and priced—with the SME segment in mind, it's

the rare company that won't be able to reap at least some benefit from

modernizing their processes.

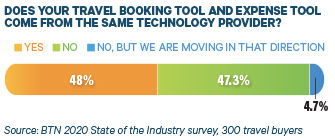

SAP Concur got the ball rolling on the unified booking and expense model with its acquisition of Outtask in 2006. The idea has become steadily more popular since then, with an ever-growing roster of providers offering both services under one roof. Survey respondents were close to being evenly split on the matter right now; however, future intentions of a few respondents show a move in the direction of combined system. No one indicated they would be moving away from a combined travel and expense technology.

The next step in the evolution of the integrated model could be the addition of native payment tools. Several expense and booking players are working to complete the trifecta, offering all three core T&E services on a single platform, touting a simplified tech stack, breakdown of data silos and a single client-vendor relationship to manage as among the key advantages of a fully unified model.

Travel Intelligence

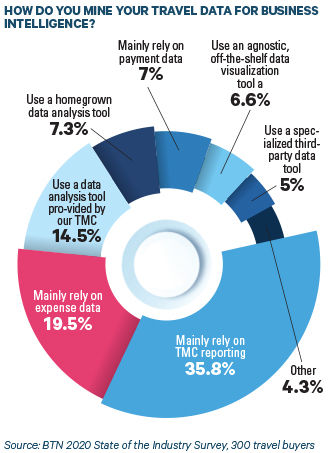

Travel data analysis continues to be among the most time-consuming tasks for travel managers, and they are using a plurality of tools and strategies to get the job done. The percent of travel managers that relies exclusively on reporting offered by a single data source—either the travel management company or expense provider—continues to fall. More buyers are bringing multiple data sets to the table to get a better view of their total travel program, but this group is still not a majority. Taken all together, about 68 percent of travel managers still rely mainly on a single data source; this includes a handful who are using more advanced data tools offered by their TMC (as opposed to static reports) but that only include agency data.

Some agencies are offering an assist in diversifying the data set. Among the 14.5 percent of buyers who said they use TMC-provided data tool, 57 percent said their agency brings in more than one data source. This is most likely a payment feed—though BTN didn't directly ask survey respondents this question. A handful of TMCs have recently adopted off-channel data capture partners to offer their clients a more holistic view of total travel, not just itineraries booked within the channel. Adding this data to the mix may prove eye-opening to travel managers. The industry may see more TMCs beefing up their intelligence tools as a differentiator and to automate previously manual tasks performed by their data teams.

Nearly one-fifth of surveyed buyers is more advanced data analysis tools, whether homegrown, off-the-shelf tools like Tableau, Domo or Power BI or from specialized travel intelligence data providers like PredictX, Data Visualization Intelligence or Cornerstone.