Pricing pressure from ridesharing competitors is cutting

into corporate travel buyers' satisfaction with chauffeured suppliers, even

though buyers rank safety and security at the top of their priorities.

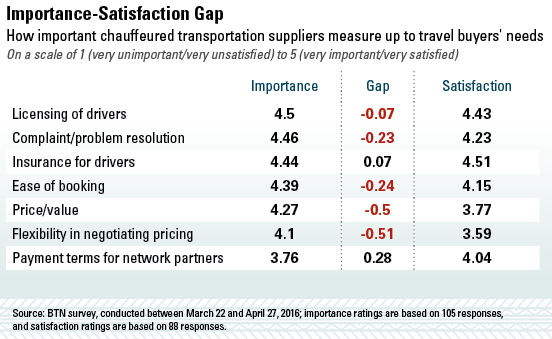

In a survey conducted alongside BTN's 2016 Car Rental

Survey, buyers named licensing, problem resolution and insurance as the most

critical components of their chauffeured programs. Those also were the three

areas in which buyers were most satisfied with their preferred chauffeured

suppliers, though complaint/problem resolution lagged behind the other two.

Buyers' emphasis on those areas is not surprising, as they tie into a company's

liability for employee safety, DK Consulting CEO Dave Kilduff said. "When

choosing ground transportation, your first choice should be safety, proper

background checks, drug and alcohol testing, proper liability, making sure the

vehicles are safe and the drivers have good training," He said. "You're

covered and you're safe; you can't do more than that."

The greatest differential between importance and buyer

satisfaction, however, appeared in pricing: a half-point gap for each negotiating

transient pricing and overall price/value. Sharing economy suppliers like Uber

and Lyft were a clear factor, as several buyers cited those services' lower

prices. "A lot of our travelers are choosing to use Uber Black due to the

lower cost for a similar product," one buyer said. "I would prefer to

use our current company for these services, so I would love to see similar

pricing." Kilduff countered that duty-of-care considerations like FBI

background checks for drivers contribute to that extra cost: "You have to

pay for safety." He also said the price differential isn't that big

between high-tier ridesharing services and chauffeured suppliers, not to

mention surge pricing.

BTN found a smaller gap between the importance of and

satisfaction with ease of booking chauffeured services. Buyers wanted suppliers

to improve technology not just for bookings but also for other areas, such as

billing and reporting. One lamented that it "still seems very much mired

in a 1970s paper mindset."

While large suppliers like Carey International have invested

in technology, including new apps and websites, the industry remains quite

fragmented with small suppliers that do not have the budgets for large-scale

investments. Even larger companies often use affiliates that might have

separate technology platforms, Kilduff said. "They're far behind rental

cars, which is a much smoother booking process because they're all on one

system," he said. "Much more is being done manually on the limo

side, and when things are done manually, breakdowns can happen."

Some travel managers told BTN their travelers' use of

ridesharing services has ticked up slightly over the past year, while others

reported larger increases, including some that said executives were using ridesharing

in lieu of black cars and that they are looking to add such services to their

managed programs. Meanwhile, there are still holdouts. "We are still leery

of the legality of these services, and we have duty-of-care concerns due to the

gaps in their insurance and inability to properly vet drivers," one buyer

said. "However, employees do use them, despite restrictions."

Kilduff said those who are not putting in

policies around ridesharing are doing so at their own peril. "This is the

most ignored category because it's hard to manage properly and a lot of

corporations are not willing to mandate it, but it's something you have to do

to protect people in a corporation," he said. "It's like herding

kittens, but you need to herd them."