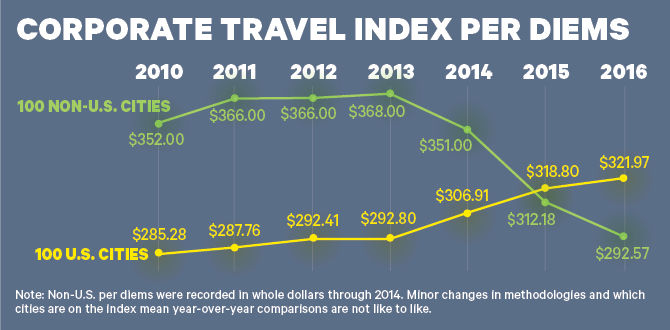

In its annual Corporate Travel Index, BTN tracks per diems

in 200 cities, and those rates wobble every year as they ride political

currents, oil-price flows and currency-rate waves.

Low oil prices worldwide are influencing demand for travel

to oil markets, from Canada to Scotland to the Middle East. But in Caracas,

Venezuela, a power-hungry executive branch has added to the economic damage

caused by oil prices so much that in 2015, inflation had pushed the cost of

three square meals to $1,127.07 in U.S. dollars. The city had become too

extreme a statistical outlier but also an unlikely destination for business

travel. Thus, BTN removed it from the 2017 Corporate Travel Index, which tracks

2016 per diems.

Egypt, too, has had an unstable government for years, and

many locals rely on remittances from Egyptians who live in Middle East markets

limping from low oil prices. It all added up to this: Consumer prices in Egypt

rose 30.2 percent year over year in February, according to Trading Economics.

Cairo's food prices in this year's index don't reflect that higher cost, likely

because the Egyptian pound was more than twice as powerful against the U.S.

dollar when the researchers began collecting prices in October than when they

converted them to U.S. dollars on Dec. 2.

Political uncertainty, however, is pressuring

per diems in stable areas, as well. London's per diem fell 15 percent from 2015

to 2016, thanks to the drop in the pound against the dollar after the Brexit

vote. And thus the cycle of uncertainty begins for 2017 costs. As HRG's

Margaret Bowler noted in the Corporate Travel Index's analysis of EMEA, "Four factors will make 2017 volatile

and much harder to call: Trump, Brexit, currency fluctuations and security

concerns." That, in turn, raises the question of whether even the steady

rise in the average U.S. per diem could go off script.