"We want to understand their sentiment: Why they

travel, do they enjoy it, what's important, how do they travel? That is the

starting place. Fundamentally, a travel program starts with the traveler."

That's the advice of Festive Road managing partner and

former AstraZeneca global travel management lead Caroline Strachan, who said

clients have engaged her consulting firm for "listening exercises"

more often in the past year. "We are doing this for a number of clients.

Our goal is to show the industry that if you will listen to your travelers and

build a program around that, you don't have to worry about compliance."

That may be an uncomfortable proposition for companies that

have approached travel management from a rules-centric, cost-saving position.

As managed travelers have more choice at their fingertips and higher

expectations—in terms of personalized customer service and work-life balance,

for example—companies are moving slowly toward a traveler-centric model.

A recent study from the Association of Corporate Travel

Executives and American Express Global Business Travel suggested that companies

with a younger average employee—think technology companies and large accounting

and consulting firms, among others—lead the way in injecting HR-oriented

perspectives into travel policies and processes.

Nearly one-third of these "younger" companies

considered recruitment and retention strategies part and parcel of the travel

program strategy. Among "older" companies, i.e., those with an

average employee over 40 years old, that HR-orientation for travel dropped to

just 11 percent.

That's not to say that 30 percent of these "younger"

companies are putting travel management in the hands of HR, though some

undoubtedly do. It's simply that these companies, especially those in

competitive industries, align travel with bigger-picture goals rather than focusing

on savings at all cost.

That "bigger-picture" transformation is underway

for one Festive Road pharmaceutical client, according to Strachan. Struggling

with leakage and rogue travelers, the company took a step back. After the

in-depth listening exercise, "the company realized they were going to have

to fundamentally shift the focus of their program," said Strachan. "For

example, their hotel contracts were not with the types of suppliers their

travelers were interested in. And it wasnt that they wanted luxury; they weren't

expecting Four Seasons or Ritz-Carlton. They just wanted things like convenient

locations to their meetings and onsite gyms. So progress wasn't about spending

more, it was about understanding more."

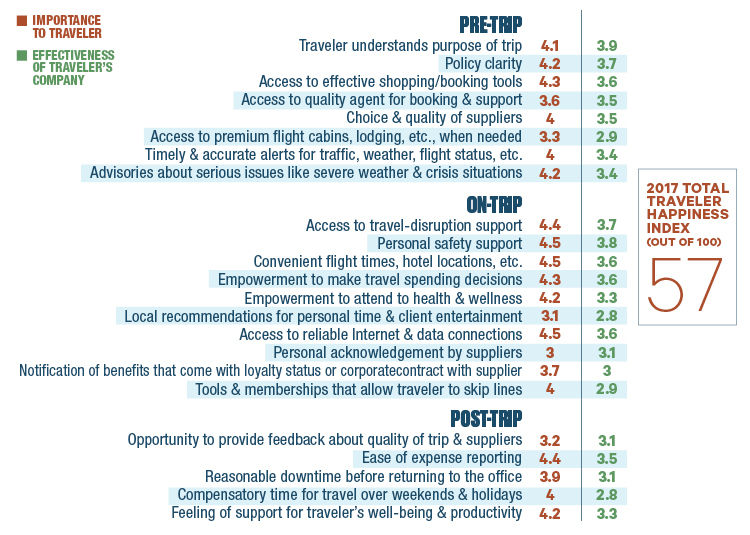

Methodology & Interpreting the Index

Business Travel News launched its online Traveler Happiness

Index survey on May 23, 2017, and collected data from 844 travelers representing

33 companies through Sept. 15. The survey remains active here.

The Traveler Happiness Index measures managed traveler

satisfaction wth their companies' travel programs. It shows the most important

factors along the lifecycle of a business trip from travelers' point of view.

It also shows travelers' perception of how effective the managed program is in

delivering on these factors. Using a formula weighted on the importance of each

trip factor, the Traveler Happiness Index produces a score on a scale of 1 to

100, in which 50 is neutral. This year's total score of 57 reflects an industry

that has focused on travel management necessities but has not put the policies,

processes and technologies in place to achieve traveler satisfaction or meet

growing expectations for relevance, convenience and productivity.

Key areas in need of improvement: booking tools,

pre-trip notifications of serious travel advisories, convenient flight times and

hotel locations, health and wellness support, reliable Internet access, expense

processes and comp time for business travel spanning holidays and weekends.

The Traveler Happiness Index

In May, BTN launched an online survey tool to help travel

managers listen to the voice of the traveler. An extension of the 2016 Traveler

Happiness Index that BTN fielded to a list of qualified business travelers, the

tool allowed BTN to target the managed travel segment more specifically.

Each qualified travel manager registered for a customized

link to the online survey that allows his or her business travelers to rate the

importance of 23 "trip factors" along the pre-trip, on-trip,

post-trip lifecycle to discover what that travel population cares about most.

Further, the survey asks travelers to rate their companies on the "effective

delivery" of each trip factor, giving travel managers insight not only

into what is important but also into delivery gaps that need to be addressed

the most.

Ultimately, each participating company is assigned a

Traveler Happiness Index score on a scale of 1 to 100, based on all survey

respondents from that company. An index of 50 indicates "neutral"

satisfaction. Each participating travel manager accessed his or her own

confidential survey results through the tool. The tool remains available and

the survey is ongoing, and BTN used total results from all participating

companies as of Sept. 15 to offer a snapshot of managed traveler happiness

overall in this issue.

Having aggregated the ratings of all participants in the

2017 Traveler Happiness survey, BTN found that managed travelers pegged their

happiness at 57 on the index. This shows that many companies have not yet

adopted some of the more traveler-centric practices in structuring programs and

policies. This year, BTN dug deeper into the Traveler Happiness survey,

segmenting results in five different ways: by policy strength, by trip

frequency, by international trip volume, by age and by gender.

The least happy travelers among this year's participants

were the ones who had the least support. This group indicated they had few or

no policy guidelines. They painted a picture in which they were casting about

for the tools and processes needed to book and execute a business trip. Given

that BTN surveyed only managed travelers, this group was small at just 2.5

percent of all participants. They seemed to lack awareness of an existing

program, despite the fact that many of them traveled regularly—and that their

travel managers sent them the survey!

Clear concerns emerged across the board, though. Namely, the

lack of quality shopping and booking tools for business travel, the desire for

more convenient travel choices, an easier expense process and a nagging desire

for better work-life balance. (Story continues below.)

2017 Traveler Happiness Index Results

The Voice of the Traveler

Survey numbers can go only so far in offering insights into

travelers' true motivations. With that in mind, BTN engaged 30 business

travelers themselves in a series of in-depth interviews to understand not only

how they travel and what frustrates them about their companies' required

processes and programs but also about what they appreciate in terms of business

travel and what would make their traveling lives better.

Aggregation of this feedback showed vast differences in

corporate attitudes toward travel, from the relative luxury travel afforded to

finance executives to the scrappier budget-oriented programs that govern

journalists going after a story and even draconian policies heaped on an HR

professional whose job has him on the road nearly 90 percent of the time,

including weekends.

Many of the travelers' comments reflected similar issues to

those revealed in the online survey. Their stories are just as important,

though, showing the real-life effects of travel programs that the survey could

not show and clearly projecting how a company's policies and processes around

travel influence an employee's satisfaction with his or her job.

The travelers' stories also reveal a drive to be productive

contributors to the businesses of which they are a part, and in some cases they

have practical recommendations for their companies to support that drive. So

travel managers, HR professionals and procurement officers need to listen and

work together to design travel programs that meet business needs, support

productivity and offer some personal choice for travelers. The big question is

how. What is the most effective way to listen to travelers?

BTN's Traveler Happiness Index tool is one good place to

start. It's free. Internal social media communities also can be a positive,

low-cost first step. PwC, Salesforce, Liberty Mutual Insurance, Microsoft and a

host of other companies have built active online feedback channels that

encourage travelers to communicate with the travel department or even assist

other travelers who crowdsource questions.

Microsoft and IBM are taking the voice of the traveler

concept to the next level. Both are engaging with HR on retention and

recruitment issues and both are leveraging sophisticated technologies to

support their leading-edge efforts.

Microsoft is harnessing multiple sources of data—including

traditional travel, card and expense data; supplier data; and even unstructured

data from its social media channel—and applying machine learning to the mix.

The ultimate goal is to use the data to create a "digital picture" of

the technology giant's 75,000 travelers and then segment them into four

traveler types. Microsoft plans to use these traveler types to negotiate

relevant contracts and special offers with suppliers that will support and

motivate each group. Microsoft also has launched a destination

experience platform that leverages and distributes individual traveler

knowledge to the broader Microsoft traveler community.

BTN's Traveler Happiness Tool

The Traveler Happiness Index tool is

confidential and free. Get a customized link here and

send it to your travelers at any time; your data remains confidential. You

receive a line-item breakdown of the results with key impact areas and the

index benchmark against which to measure your program. Participating travel

managers have praised the tool for its unbiased approach and for shining a

light on key questions that companies should be asking their travelers.

IBM is concentrating on a chatbot

concierge powered by Watson's artificial intelligence. The idea grew out of

a traveler forum the company created as a communication vehicle to support a

large change management initiative. Now, it will be dedicated to supporting the

traveler experience.

Discovery Communications is taking a different approach,

global travel services VP Yukari Tortorich told a recent audience at The Beat

Live conference. She's actively engaging groups of travelers in pilot programs

to test emerging technologies for the travel program, thereby giving them a

voice in some exciting transformation opportunities that are manageable in

scale but still meaningful.

There's no single path to success, but

continuing to overlook the traveler as a fundamental stakeholder will leave a

travel program going nowhere fast.