The concept of tracking travelers became more prominent

following 9/11, when companies realized they couldn't account for their

travelers, said Jeff Winton, senior sales director and channel manager for risk

analytics firm PlanetRisk. The importance companies placed on it, however,

dwindled following the 2008 financial crisis, said Reed & Mackay SVP of

global strategy and consulting DeAnne Dale. "It was always discussed, but

it wasn't a key focus," she said. "But with the political unrest and

terrorism we've had [of late], it's gone up the ladder [in importance] again,"

Dale said. "Duty of care has taken a much more prominent stage in the

global request for proposal process for companies."

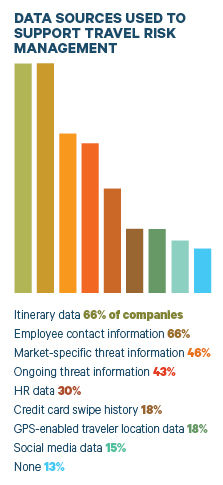

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Corporations used to ask a single question in the RFP for

travel management companies. Now, Dale said, companies ask much more detailed

questions about TMCs' offerings and put more weight on the offering when

choosing one.

TMCs and travel risk management providers also have stepped

up solutions, offering more integrated tools and incorporating more data types.

Booking data, for example, indicates the general city and hotel where a

traveler should be, but it doesn't account for the time spent traveling between

airports and hotels or time spent at offsite meetings. Other suppliers have

launched solutions to fill the gaps or integrate with travel risk management providers

to deliver off-channel booking data.

Travel Risk Management Through the TMC

Companies can track travelers by sending and approving

travel requests through email, but that can become overwhelming, especially in

crises. The most effective way is for a TMC to integrate with a corporation's

travel booking-and-request process to gather the data, said iJet VP of

operations George Taylor. When a natural disaster or terrorist attack occurs,

the TMC can provide reports on where travelers should be, based on booking

data. He suggested consolidating to three TMCS at most to keep the reports

manageable. TMCs also should be able to provide booking data to third-party

travel risk management providers through direct feeds or Excel reports.

Some TMCs offer more sophisticated tools for extra fees,

such as map dashboards or two-way messaging tools. Most large TMCs also partner

with third parties to provide medical and security assistance. Carlson Wagonlit

Travel partners with International SOS, while BCD Travel partners with Anvil.

Reed & Mackay's IQprotect tool is part of the TMC's

standard offering, according to Dale. Clients pay a one-time setup fee for the

entire portal, including the online booking tool, mobile app, IQprotect and

other offerings. Customizations, though, cost extra.

When travel managers or agents log in to IQprotect, they see

a world map with iJet's country risk ratings and with pins for travelers'

locations, based on itinerary information, Dale explained. And from the time an

employee books travel through the end of the trip, the traveler receives

notifications of any events that could affect the trip. While iJet supplies the

map and emergency alert intelligence, Dale said it otherwise is not involved.

If an incident occurs, travel managers can geocode an area and send blast

emails or texts to travelers who may be impacted, asking them to check in by

replying. Reed & Mackay also trains clients to have their travelers check

in through the TMC's app proactively. The app then sends the travelers'

locations back to the system. The TMC, however, avoids tracking travelers via

their phones' GPS, owing to privacy laws, Dale said. The platform tracks who

has checked-in and who is still unaccounted for.

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Source: BTN survey of 229 travel managers, travel buyers & corporate safety & security managers, conducted Feb. 2 to Feb. 28, 2017

Additionally, Reed & Mackay has a six-person, 24/7

Incident Management Unit whose "sole responsibility is to monitor world

events, send out timely alerts and identify impacted clients," explained

Dale. The IMU sends the information to the TMC's after-hours emergency team of 24

agents, which helps reaccommodate travelers.

TMCs typically work with each client to establish

communication protocols for when something goes awry, whether the travel

manager runs the operation, the TMC starts by contacting the travel manager,

they work together or they follow another arrangement, such as contacting the

company's security or risk department. Reed & Mackay also may kick

attempted bookings to specific countries to travel managers for approval if the

countries' security level increases, Dale said.

In addition to the travel booking data TMCs absorb, they

typically receive HR feeds. Reed & Mackay also can take an expense

management tool feed, which usually includes the credit card feed, Dale said.

This is atypical for a TMC, however, which will often rely only on booking

data, but the space is evolving with more advanced business intelligence tools.

Before Takeoff: Low-Tech & No-Tech Checklist

HR feeds are the

best way to keep information 100 percent up to date because they're the most

accurate, according to iJet VP of operations George Taylor. But there are other

low-tech and no-tech safeguards, too:

Travel Policy:

The first step in tracking travelers and keeping them safe is a travel policy

that governs how travel is booked and approved. A travel policy not only helps

companies manage costs but also allows them to "develop a culture around

the process [and], at the basic level, allows some awareness internally of

where people are traveling and when," said Taylor.

Communication Protocol: Before travelers take off, companies should develop plans for

emergencies and rehearse them with travelers, he emphasized. This includes a

protocol for a travel manager to reach out to potentially affected travelers or

for travelers to check in by calling, emailing or texting a designated person

or hotline. Two-way messaging tools, typically provided by travel management

companies or third-party travel risk management providers, can automate this.

Cell Phone Number: When asked to supply the contact number at which they can be reached,

some travelers provide their home or office numbers or an emergency contact.

That doesn't help in emergencies, when employers need to reach travelers

directly. Pre-trip approvals also are a good opportunity to ensure each

traveler has provided a preferred-contact method in his or her HR file, which

typically feeds to a TMC or a travel risk management provider.

Alternate Contact Route: Companies also should

be open to alternative forms of contact, such as Skype or WhatsApp, Taylor

said. "One of the shortcomings is that the people in charge of the

programs assume that every traveler has the same ability to communicate ...

when they travel, but not every traveler has a data plan," he said. It's

pushing it to list Facebook as a preferred contact method, though; he's seen

mostly younger travelers do this. Facebook Safety Check allows users to mark

themselves as safe in crisis situations, but companies typically can't see

their employees' Facebook pages.

The Evolving Concur Solution

In March, Concur upgraded its Risk Messaging tool. Among the

changes: It now lives in Concur's T&E solution and offers more data feeds.

For a fee, it also offers a 24/7 Active Monitoring program powered by HX

Global. Concur provides travel managers a map that includes traveler locations

based on data from its booking tool. Beyond what most TMCs can pull together,

Concur additionally integrates data from TripLink, Tripit, expense, credit

cards and e-receipts from integrated partners like Airbnb and Uber. Beyond the

location map, Risk Messaging enables two-way communication capability so travel

managers can message potentially distressed travelers en masse. Travelers can

also check in through the Concur app, and the Risk Messenger map interface will

display which travelers have checked in or not.

Concur EVP of global products Tim MacDonald claimed that

before Concur clients sign up for Risk Messaging, "our customers don't

know or don't see a travel plan for anywhere between 20 and 50 percent of their

employees," if they are pulling only booking data from their TMC. "That's

a real duty-of-care issue," he added. "We're leveraging all the

location data that customers already have in Concur expense, e-receipts from

our different platform partners, via credit card charges and check-ins from our

mobile app, in addition to TripLink data."

This capability, according to Concur, eliminates the need to

stream multiple data feeds directly into a full-service provider (which Concur

does not do). Instead, the client company can deliver positive traveler

identification and location information wherever the client needs it to

go—primarily to an on-the-ground assistance provider.

"You need an assistance provider for a duty-of-care

program," said MacDonald. "That can be International SOS, iJet, HX

Global—it can be anyone—so when an employee is in trouble you have boots on the

ground who can help them out."

Without Risk Messaging, MacDonald said, access to TripLink data

is still possible with Concur's partner TMCs (which include the likes of

Adelman, Christopherson Business Travel and Gant Travel). "Our TMC

partners have either written to our API to pull that TripLink itinerary

information, put it in their processes and combined it with GDS itineraries

that are pushed to the assistance provider, or they're using our mid-office

technology and through that they're combining the two data sets and pushing to

the assistance provider," he explained.

Full-Service Travel Risk Management Providers

When building a travel risk management program, a

full-service provider would be roughly analogous to hiring a general contractor

when building a home: an individual could hire builders, electricians and

plumbers on their own, but a general contractor has the relationships and the

know-how to manage all the pieces, plus brings expertise to the table.

Firms like Anvil, ISOS and iJet bring with them data aggregation

capabilities, tracking tools, map interfaces and two-way messaging, check-in

functions and panic notifications. They offer 24/7 risk monitoring and they are

often the ones supplying TMCs with their emergency alerts, country-level risk

ratings and traveler mapping technologies. Further, they bring knowledge about

insurance requirements, local medical ratings and, very importantly,

relationships with a network of on-the-ground assistance providers and

evacuation experts.

That said, full-service providers aren't always the right

fit, but they are especially helpful for companies with considerable traveler

volumes or those with travelers regularly on the ground in higher risk markets.

The reality is: Some organizations don't have a very big

shop or a security shop. Whoever is handling this type of thing is maybe a

one-person show," iJet's Taylor said. "The mix-and-match approach

works if your magnitude of travelers … is fairly small and you can juggle some

tools. But what if you had 300 people like in Paris?" That would quickly

become overwhelming for a travel manager or even a security department to

handle without an established and coordinated team. That's what a full-service

provider brings to a crisis situation.

Additionally, companies are also realizing they need to

track all employees, not just travelers. More full-service travel risk

management providers are looking at the mobile distributed workforce, not just

travelers, said Winton.

Ripe for Integrations & Innovation

The travel risk management arena has evolved quite a bit,

but there's plenty of room for more change. Some of the latest updates:

ISOS & Uber:

Last July, ISOS partnered with Uber to combine their technologies to "enhance

the visibility and duty of care for global enterprise companies," and ISOS

promises "enhanced duty-of-care features," for joint customers, but

the companies didn't specify further.

Airbnb Upgrades:

Airbnb for Business enables travel managers to see where their travelers are

via the management platform. It is unclear whether Airbnb can directly feed its

data into a travel risk management provider, but it can provide e-receipts to

Concur to inform Risk Messaging.

Dataminr & Social

Media: Startup Dataminr is an annual-subscription data feed that monitors

Twitter for mentions of emergencies and unexpected events that could impact

travelers. Its corporate clients, which include Fortune 500 companies, have

access to the intelligence through desktop apps, integrated notifications,

mobile apps and an application programming interface, explained VP of corporate

security Dillon Twombly. It doesn't integrate with any TMCs, travel risk

management providers or Concur, but Twombly said they're "exploring

integrations with select third-party platforms."

Next Gen &

Predictive Tools: GeoSure, which launched in 2013, uses proprietary and

nonproprietary data from organizations like the Centers for Disease Control and

Prevention, Interpol, World Bank, World Health Organization, the United Nations

and human rights organizations to rate more than 7,000 cities and neighborhoods

on a 1-to-100 scale on physical harm, theft, basic freedoms, disease and

medical, women's safety and an overall score down to the neighborhood. "Trying

to understand country-level safety is almost irrelevant to the travel community

[because] it's very difficult to stick one number on a [whole] country,"

said GeoSure CEO Michael Becker. "We go into not just the city level but

also into the neighborhood level." GeoSure also has developed analytics

and safety ratings for specific traveler demographics, such as females, and is

working on safety ratings specifically for LGBTQ travelers.

Related: Personalizing Travel Risk Management

Planet Risk functions similarly, with access to

broad data sources and use of algorithms to track granular safety scores. Its

algorithms can incorporate historical data to identify activity patterns that

indicate emerging threat levels. The move to predictive analytics for travel

risk management is the next generation of innovation.