Wellness won the day among the upscale segments, as Marriott International’s Westin brand and Hyatt Hotels Corp.’s Hyatt Place brand both earned the highest scores in their segments for support of traveler wellness and led their segments overall.

But what does wellness mean to today’s travelers? According to Steven Dominguez, VP of global brands for Hyatt Place and Hyatt House, it’s more holistic than simply ensuring that a property has a fitness center. More brands, Hyatt Place included, are providing programming around not just fitness but also mindfulness and are finding new ways to support healthy sleep and dining experiences.

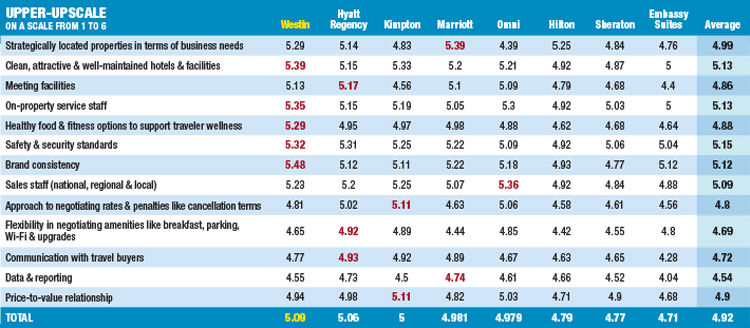

Upper-Upscale

Westin, which placed first in the upper-upscale segment, has long been synonymous with wellness. Its Wellness at Westin program features signature offerings like the Westin Heavenly Bed; a workout gear lending program; fitness studios featuring Peloton bikes; fresh juices and smoothies; and SuperFoodsRx dining.

This year, the brand took the idea of wellness to new levels by introducing sustainability and charitable giving initiatives, such as a partnership with Charitable Miles for Global Running Day and the launch of ThreadForward to upcycle bed linens into children’s pajamas.

The brand also scored highest for its clean, attractive and well-maintained hotels/facilities; on-property service staff; safety and security standards; and brand consistency.

As of June 30, Westin had 219 properties in its portfolio, 91 of which were in international markets. Marriott intends to debut the Westin brand in the U.K. in 2020.

Hyatt Hotels’ Hyatt Regency benefits from the strength of its global sales organization, as the brand earned top marks for flexibility in negotiating amenities and for communication with travel buyers. It also scored the highest within the upper-upscale segment for meeting facilities.

Bjorn Hanson, industry consultant and adjunct professor at the New York University School of Professional Studies Jonathan M. Tisch Center for Hospitality and Tourism, said the unique architecture of each Hyatt Regency property helps drive satisfaction with the brand, as both guests and on-property associates feel they’re “at a really special hotel.” Signature features include versatile properties and meeting venues, 24/7 dining with on-property restaurants and grab-and-go items, and premium fitness and spa facilities. As of June 30, the brand had 185 properties in its portfolio globally.

Another boon for the Hyatt Regency brand is its parent company’s ventures in the wellness space. Hyatt Hotels acquired well-being brands Miraval and Exhale last year and is learning from their expertise and infusing a wellness mind-set across its portfolio of brands. The company announced in early October it would integrate Exhale into the World of Hyatt loyalty program, allowing members to earn and redeem points for spa therapies and fitness classes.

InterContinental Hotels Group acquired Kimpton Hotels & Restaurants back in 2015, and since that time, the pioneer of the boutique hotel concept has remained somewhat autonomous while providing the IHG portfolio with a certain flare, even sparking IHG competitors to launch their own boutique and lifestyle brands. This year, however, IHG brought Kimpton into the fold like never before—Kimpton Karma Rewards became one with IHG Rewards on Jan. 1, and Kimpton’s global business program merged with IHG Business Edge, which fully launched in August. The result is that this year’s survey respondents scored No. 3 finisher Kimpton highest in the upper-upscale segment for its partnership approach to negotiating rates and penalties, as well as overall price/value relationship.

Kimpton Hotels & Restaurants VP of sales Telesa Via said its deeper connection to IHG has made the brand more accessible to a larger and more diverse audience of travel managers and business travelers. The brand’s footprint also is growing, particularly internationally. It opened its first property outside North America in May 2017 and has openings coming up in Barcelona, Taipei and Bangkok, plus four new properties in the U.K. and a recently announced Paris property set to open in 2020. “We pride ourselves in creating unique hotel experiences, living by the motto that there is no ‘Kimpton in a box,’” Via said. “Each hotel is design-led and concepted from a blank slate, standing as a ‘brand of one.’ While no two hotels look the same, they feel the same because they share a common thread of heartfelt hospitality anchored by Kimpton’s devotion to its guests and desire to create uniquely memorable experiences.”

From January to August, the average daily rate for the upper-upscale segment increased 2.3 percent year over year to $178.48, according to STR. Occupancy increased 1 percent to 76.7 percent. Demand growth for the segment, 3.3 percent, outpaced the 2.3 percent supply growth.

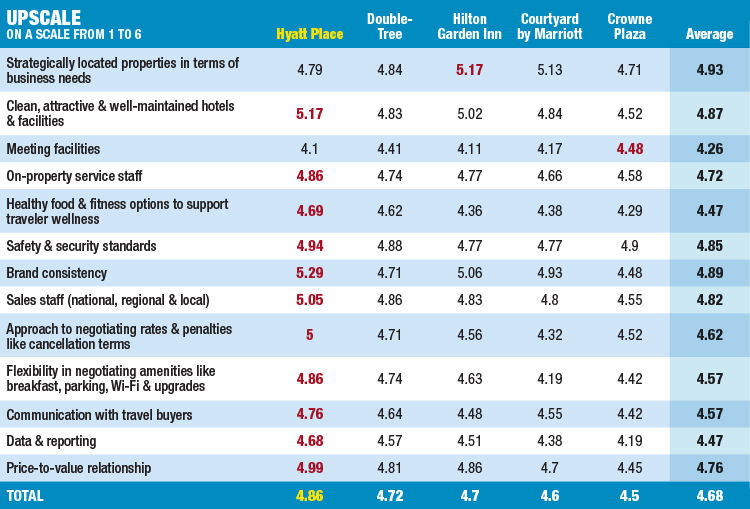

Upscale

Hyatt Place won the upscale segment by a significant margin and repeated its victory from 2017. It earned the highest scores in 11 of the 13 criteria for which the brands are ranked, including meeting facilities; on-property service staff; safety and security standards; sales staff; a partnership approach to negotiating rate and penalties; and communication with travel buyers.

The select-service brand stands out for its fresh design, larger guest rooms, 24/7 dining options with an elevated breakfast experience and its versatile meeting spaces. But key to pushing the brand to the top of the rankings, in Hyatt Place & Hyatt House VP of sales Kevin Kelly’s mind, is the superior training for brand associates across marketing, operations, revenue management and sales, as well as its philosophy in working with corporate customers.

“We do not want to be a transactional seller; we want to be consultative seller,” Kelly said. “We want our customers to know that we are here to help them solve whatever problems or challenges they have.” That messaging is in line with Hyatt’s launch this year of Hyatt Leverage, which provides tools and rate discounts to small and midsize enterprises and connects travelers to The World of Hyatt loyalty program. Kelly believes that when corporates can get travelers within their hotel programs aligned with World of Hyatt, two main benefits emerge: Hyatt can better serve business travelers because it knows them better, and travel managers can strengthen compliance within their hotel program.

Hyatt Place serves as a key growth brand for Hyatt, as it and extended-stay counterpart Hyatt House comprise 40 percent of Hyatt’s global development pipeline. As of June 30, the brand’s portfolio was comprised of 314 properties.

Second-place DoubleTree by Hilton has in recent years invested in its meetings programming, working to make its meeting spaces more dynamic with flexible setups and the latest built-in technology.

The full-service brand is marrying wellness and sustainability with meetings and events through parent company Hilton’s Meet with Purpose offerings. DoubleTree global head and SVP Shawn McAteer said the program reinvigorates essential business activities to boost meeting outcomes, exceed client goals and meet the needs of attendees. An example is the Yoga & Yogurt package, which features an expert-led yoga class for attendees and then a yogurt parfait bar for a wellness-focused breakfast.

DoubleTree is the fastest-growing brand for Hilton, with more than 535 properties in its portfolio and more than 200 hotels in its pipeline. Ten years ago, McAteer said, DoubleTree had 160 hotels in one country. Now, the brand is present in 43 countries and almost half the hotels in its pipeline are slated for the Asia/Pacific region.

Hilton Garden Inn may be third among BTN survey respondents, but the brand finished first in the upscale segment in J.D. Power’s 2018 North America Hotel Guest Satisfaction Index Study. BTN readers ranked the brand No. 1 for strategic locations for business needs. Hilton Garden Inn global head John Greenleaf said the brand boasts almost 790 hotels across 38 countries and territories. Its pipeline stands at 316 hotels worldwide, more than half of those pegged for development outside the U.S. With each development and opening, the brand is “building on its commitment to anticipate and cater to the evolving needs of today’s modern traveler, providing ‘simple things on another level’ at every corner of the world,” Greenleaf said.

The brand revamped its dining menu as part of a comprehensive global brand refresh in 2017, and launched a Sophisticated Bites campaign this summer to crowdsource new menu items. The new food and beverage offerings across Hilton Garden Inn’s portfolio address shifting customer preferences toward healthier, more organic menu choices, new flavors with a local slant, availability 24/7 and more social settings for restaurant and bar service.

With its brand refresh, Hilton Garden Inn is also enhancing its hotel designs and its brand culture, deploying prototypes that marry consistency with local-market customization. “This approach to design provides owners with the ability to tailor the property to meet their needs and drive guest loyalty by creating attractive guest room designs, food and beverage offerings, redefined meeting spaces and guest-centric social spaces while maintaining the light, bright and airy atmosphere of Hilton Garden Inn,” Greenleaf said.

From January to August, ADR for the upscale segment increased 2.1 percent year over year to $142.41, according to STR. Occupancy increased 0.3 percent to 77.7 percent. Demand growth for the segment, at 5.2 percent, continues to outpace supply growth, which stands at 4.9 percent.