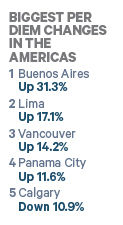

It was a turbulent 2016 across Latin America. Some countries

were wracked by political instability and unstable currency while others were

far more stable. While business travel per diems in some Latin American cities

increased sharply, others declined steeply. Meanwhile, per diems in Canada

generally increased, sometimes significantly.

Brazil, Argentina and Venezuela have faced political

challenges and recession, but Peru sported solid economic growth and a stable

currency versus the U.S. dollar. Lima, Peru's capital and largest city, was the

most expensive city in the Americas outside the U.S. Its per diem rose almost

18 percent from 2015 to 2016 to $303.61 in U.S. dollars, even though its

currency, the sol, weakened slightly versus the dollar.

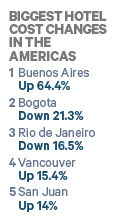

Lima's average hotel cost also topped the non-U.S. roster of

Corporate Travel Index cities in the Americas. The $193.40 represents a 13.4 percent

increase from 2015. According to Advito, the number of hotels in Peru is

growing, but most of the rooms are midscale. BTN's Corporate Travel Index

tracks only upscale hotels in non-U.S. cities, and Peru boasts little in the

way of upscale development.

Argentina

Lima's per diem increase is hardly representative of its

Latin America neighbors. In fact, only one city's costs in the Americas outside

the U.S. exceeded it: Buenos Aires. There, the $260 per diem represented more

than a 31 percent increase from 2015 to 2016.

Under a new presidential administration at the end of 2015,

Argentina removed currency controls around the peso, inflating local prices

skyward. The Corporate Travel Index tracks hotel stays that occurred between

January and November, so the 2015 numbers did not include that inflation. Even

though the peso became far weaker against the U.S. dollar, prices nevertheless

increased enough to raise per diems from those 2015 numbers.

Argentina estimates its GDP declined 2.5 percent in 2016,

but pointed to signs of improvement in the closing months of the year. Advito,

too, considers an exit from recession possible, and forecasts a 2 to 4 percent

increase in corporate hotel rates in 2017, the largest jump in the region.

Brazil

Per diems in only a handful of non-U.S. cities in the

Americas declined in 2016. One is Rio de Janeiro's $212.50, which dipped 1.3

percent. Sao Paulo, the other Brazilian city in the index, increased less than

a percentage point to $256.42.

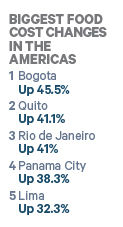

Many factors affected Brazil's travel prices: the Summer

Olympics, Zika and the impeachment and removal of the president. Most relevant

is the fact that Brazil remains mired in a recession, keeping demand for

business travel low. Airfares have dropped significantly. While Advito projects

Brazil's 2017 corporate hotel rates to increase 2 to 4 percent, the country

estimates its GDP declined 3.6 percent in 2016, according to Reuters.

Canada

The largest per-diem decline in the Americas outside the

U.S. belongs to Calgary, where oil represents a significant part of the

economy. Low crude oil prices helped drive Calgary's per diem down nearly 11

percent to $251.54.

Per diems in the other four Canadian cities in the Corporate

Travel Index, on the other hand, all increased. In Vancouver and Montreal, they

rose by double-digit percentages. Domestic air service and routes to the U.S.

are on the rise, per Advito, so 2017 prices should again increase, and Advito

expects hotel rates to increase 2 to 4 percent.

Outlook

A Note on Caracas

Previous editions of this index included the Venezuelan capital of Caracas. Given the difficulty of traveling there during the current political and economic crisis and the withdrawal of international air service, BTN has replaced it with Guayaquil, Ecuador's largest city.

Given the economic malaise and unstable

currencies of Latin America, Advito principal and VP Bob Brindley said travel

prices there should remain soft in 2017, though pockets will increase. He also

noted, though, that some Latin American hoteliers are pushing U.S. buyers to

deal with them in U.S. dollars, a maneuver he recommended buyers resist. "Part

of it is that [hoteliers are] showing an attractive rate to the U.S.

corporation in dollars and it ends up getting accepted," Brindley said. "This

is viewed as the less risky or more assured rate because of less fluctuation in

the dollar."