As U.S. Business Travel Gets Busy in 2022, Expect Higher Costs

BY TERRI HARDIN

Pent-up demand for travel from two years of Covid-19 doldrums is bringing hotel rates in the United States within reach of—and often beyond—2019 performance levels.

"The U.S. was tracking close to pre-pandemic levels" when the country in November lifted its ban on international travel, said BCD Travel VP and hotel practice lead Laura Kusto. "In December, we saw that gap close,” she added.

Even with the unsteady start to 2022, thanks to what American Express Global Business Travel EVP David Reimer termed the "omicron hangover," travel demand revved up again around President's Day weekend in February. That said, leisure travel so far has driven the lion's share of travel recovery. As the omicron variant wanes in North America, companies get back to their offices and mask mandates and other restrictions are lifted—Hawaii was the final state in the U.S. to lift its indoor mask mandate, which will expire on March 25—business travel is poised for a comeback.

But recovery won't be smooth for all North American markets.

Progress Projected in 2022 for Lagging Gateways

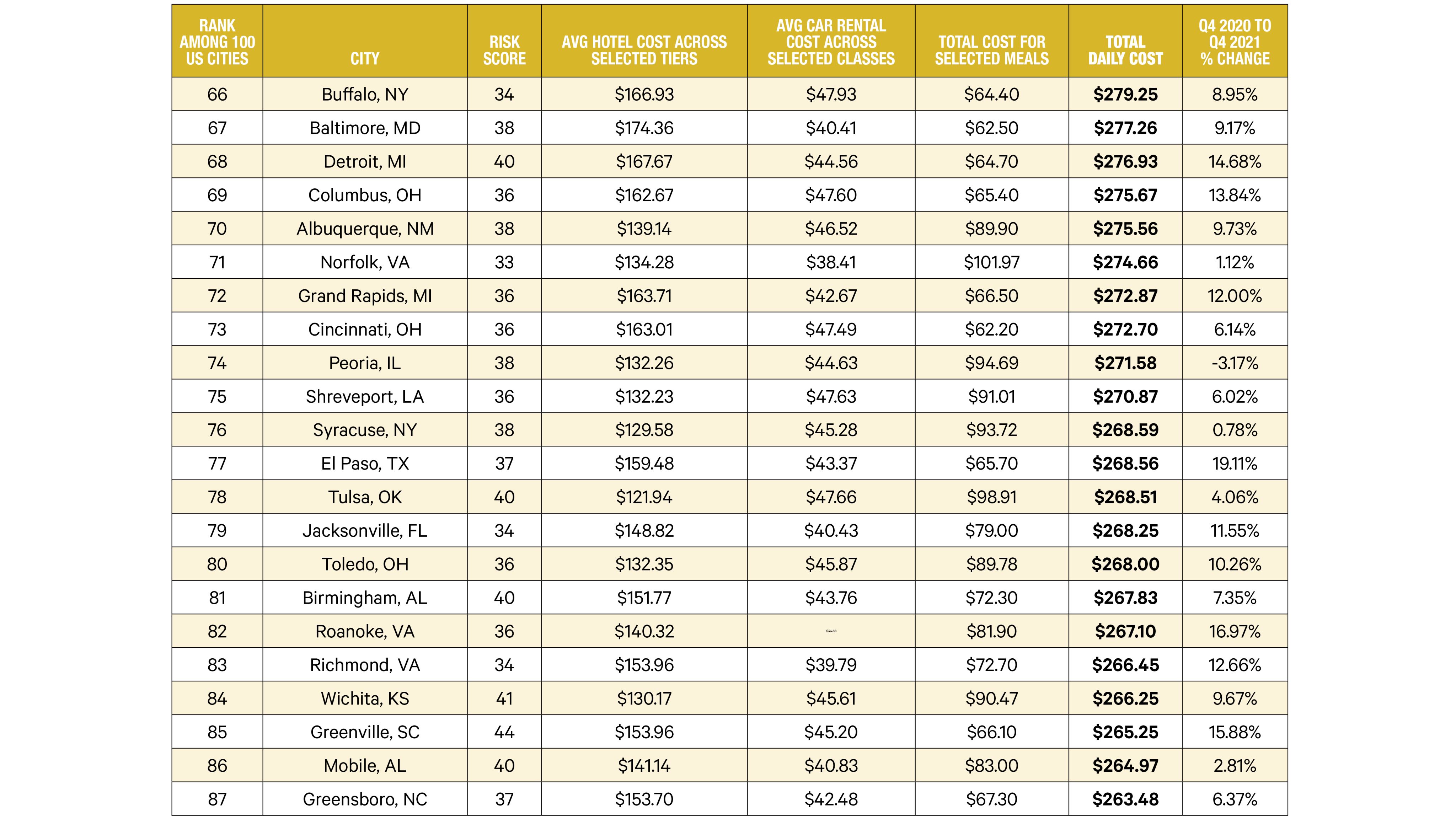

Hoteliers in recent earnings calls have highlighted business travel recovery patterns thriving outside major gateway cities, and BTN's 2022 Corporate Travel Index reflects similar trends. Secondary cities like Cleveland and Columbus, Ohio; Indianapolis; Louisville, Ky. and Tulsa, Okla., among others, have met and surpassed fourth-quarter 2019 corporate booked hotel rates by double-digit percentages.

Traditional gateway markets that rely heavily on business travel—and on inbound international travel of all kinds—have suffered deeper losses, and many are still lagging their 2019 fourth-quarter corporate booked hotel rates. Boston's fourth-quarter 2021 corporate booked hotels rates ran 6.9 percent lower than 2019; Chicago was down a little more than 10 percent still in Q4 2021; New York remained off its 2019 corporate booked rates by 6.9 percent and Philly was off by slightly more than 10 percent as well. Washington, DC posted Q4 2021 corporate booked rates, according to BTN's index, 12 percent lower than 2019. Seattle was 9 percent off Q4 2019. All these cities, though, were comfortably ahead of Q4 2020 hotel rates.

BTN's index did show some bright spots for rate recovery in major cities. Dallas in the fourth quarter of 2021 was up more than 6 percent from its 2019 hotel rates, with Miami up nearly 23 percent. Los Angeles was up nearly 16 percent.

"We're not seeing that bounce with [with San Francisco]," Shor said. "It's more conjecture than anything, but a lot of the dot-coms obviously have not returned to the office with any type of gusto.”

Some of that bounce, according to Corporate Travel Management chief partnership officer Erik Shor, was tied to early and eager lifting of local Covid-19 restrictions.

“Texas and Florida, from both a leisure and a business travel perspective, have held up better than other [markets]. Houston, Dallas, Miami, Tampa—we saw a bit more resilience in those markets," he said. "But now we're seeing more resilience in some of the more traditional business markets, like New York, Washington and Boston. Some of these more traditional markets do seem to be staying off the bottom."

That's not the case for San Francisco. According to BTN's index, San Fran posted a $379.17 corporate booked hotel rate in the fourth quarter of 2019. It fell to $184.56 in Q4 2020 but had recovered just to $246.98 by the fourth quarter of 2021—still behind its Q4 2019 corporate booked rate by nearly 35 percent.

"We're not seeing that bounce with [with San Francisco]," Shor said. "It's more conjecture than anything, but a lot of the dot-coms obviously have not returned to the office with any type of gusto.” And some have sent workers packing to new centers in cities like Austin, Tex., which—related or not—has seen corporate booked hotel rates return to pre-pandemic levels. That said, San Francisco remains the third-most expensive U.S. city in BTN's index, despite hotel rates lagging further behind 2019 highs.

North America

THE HIGHLIGHTS

- Indoor mask mandates have been lifted or are set to in all 50 states—with Hawaii, the final holdout, planning to lift its mask directive on March 25. Masks still are required on airplanes and public transportation. International travelers to the U.S. still must provide proof of Covid-19 vaccination to enter the country.

- Second-tier cities have shown faster and more robust hotel rate recovery than most major gateways, thanks to stronger domestic travel trends compared with international.

- Major gateways in Texas and Florida have had a faster recovery than those on the East Coast and Midwest, possibly due to earlier lifting of Covid-19 restrictions. That said, most gateways have a good outlook for 2022, with many posting better corporate booked hotel rates since omicron receded, according to TMC executives.

- As prices are likely to rise and shape into a sellers' market, buyers should keep an eye on pipeline to guide forward negotiations in major cities.

- The U.S. market will continue to be challenged by car rental shortages and potential high pricing in 2022. However, TMC execs say this is still a very competitive market and the players will want to keep corporate clients that have real volume.

In Canada, Vancouver hotel rates are similarly slow to increase as San Francisco, with fourth-quarter 2020 and 2021 corporate booked rates within pennies of each other, at $139.95 and $139.19, respectively. In 2019, the fourth-quarter rate was $180.75. In contrast, Toronto’s $176.71 average fourth-quarter 2021 corporate booked rate was just 2 percent shy of Q4 2019.

"There's a lot of positivity around domestic travel" within Canada, said Reimer, "Internationally, too, as testing restrictions ease. Canada's lifting their requirement to test from February 28. We've also seen announcements with offices reopening and a bigger push to get back to work. That will have a very direct impact on which way travel demand and volume go."

As a seller's advantage shapes up for many markets in 2022, Shor suggested buyers should pay close attention to the hotel pipeline. "Understand where inventory is coming on the market," he said, noting Atlanta, Dallas and New York as some of the top-tier markets with strong pipelines that might make them more open to negotiations.

Top Destination of 2022: The Office

During the pandemic, "in the discussions we kept having with clients," said Shor, "the one trend we kept seeing was that they kept pushing back-office reopenings." Both Shor and Reimer agreed domestic business travel will only really normalize when people get back to the office.

"It's the foundational catalyst," Shor said.

But Reimer cautioned, “Not all offices are opening at the same place at exactly the same time. I think that's something to look out for on a restart, because there's no alignment and it’s going to have to be worked through.”

In lieu of open offices, “satellite meetings,” in which a team or small number of workers meet at a central location with or without the benefit of technology, was mentioned recently in hotel earnings calls, most notably by Accor chairman and CEO Sébastien Bazin. It’s something that Shor has also heard described as “collaborative travel.” As more companies normalize remote working configurations, he said, “there's going to be a need for people who may not have traveled [at all at one time] to get together in person on a steadier basis.”

"There's a lot of positivity around domestic travel [within Canada]. Internationally, too, as testing restrictions ease. Canada's lifting their requirement to test from March 28."

Car Rental Woes?

Car rental costs may have been challenged by supply issues in 2021. "We've seen a jump of about 7 percent to 8 percent in the total from 2020 to 2021, which is certainly not insignificant," said Shor. He pointed out that the highest increases were in the compact and the economy tiers, not for full-size and intermediate vehicles that, "for many clients, is their sweet spot." Increases in average daily rental rates in those tiers, he said, mostly were limited to 3 percent to 4 percent.

The Corporate Travel Index found corporate booked 2021 car rental rates—at least in the index's 100 U.S. cities—had dropped slightly on average from Q4 2020 and were largely in line with Q4 2019 rates. Anecdotally, travel managers told BTN that availability has been a bigger frustration than price. How those issues will shake out in 2022 is uncertain.

When negotiating for car rental, however, Shor suggested buyers stay strong. “Know all your volume, not just your agency book volume. You want to you want to make sure you're getting volume reports from your car rental providers, so you get a real full picture about what's being done.” Then: “Stick to your guns. Car rental companies do not want to lose good customers, and the competitors are hungry for new business. Even with all the challenges it's still a hot market,” he concluded.