Overall business travel spend plunged 58 percent in Western Europe in 2020 and 50 percent in Eastern Europe, according to the Global Business Travel Association's BTI Outlook. Given the almost total collapse in business travel demand between publication of the BTN Corporate Travel Index in March 2020 and this year's edition, buyers might reasonably think costs per trip have also tumbled in recent months.

Yet, for European cities at least, while the pricing picture in US dollars is certainly down overall, that is far from telling the whole story. Of the 20 most expensive European destinations in 2020's CTI, no fewer than eight are actually dearer in 2021 in terms of the average costs for trips executed.

There are a few likely reasons for this apparently counter-cyclical phenomenon. Perhaps the most important is exchange rates. In the 12 months between benchmarking of prices for the 2020 and 2021 indices, the value of the US dollar fell from €0.91 to €0.83 in the euro zone, from parity to 0.90 Swiss francs and from £0.77 to £0.75 in Sterling. The decline of the dollar explains why in several cities taxi and meal costs, which are less subject to demand volatility, grew at the same time that more demand-elastic hotel rates fell—and there appears to have been an element of local currency inflation for taxis and meals as well.

Another possible driver of per diem increases is that even Covid has not been enough to check the longer-term pricing growth of some destinations. Zurich, for example, is now the second most expensive city outside the U.S., behind only Tokyo. Its per diem had jumped 17 percent in 2019 over 2018 and is up another 19 percent, according to 2020 data. Similarly, Lyon grew 11 percent both in 2019 and in 2020, thrusting its per diem, at $409, into the top 10 of non-US cities.

Zurich, home to many leading and upmarket banks and insurance companies, has by far the highest daily meal costs of any city at $265. Only two other European destinations have meal costs north of $200: Paris, which is Europe's second most expensive city ($205), and Basel ($225). Switzerland is clearly a challenging country for business travelers on tight budgets, with Zurich, Geneva and Basel all featuring in the top six priciest cities outside the U.S.

Destinations where per diems have fallen in line with the Covid-induced demand slump include London. Europe's most expensive city in 2020, it has slipped three places owing to its per diem falling from $514 to $476.

Some falls have been far more dramatic. Spain was hit early and hard by Covid, affecting not only business but leisure demand. As a result, Barcelona's per diem has plunged from $401 to $271, taking the Catalan capital from the No. 10 position in 2019 to 54th in 2020. Other big fallers include Oslo, down from $425 to $339; and St. Petersburg, down from $233 to $168.

Right at the bottom, Europe's cheapest city, Bucharest is now also the cheapest anywhere outside the U.S. It has fallen from 89th position last year to 100th this time around. The average corporate booked hotel room ran $90 per night in 2020, while a taxi from the airport is less than $8 and meal costs for 24 hours are $36. Bucharest is one of four European destinations with a hotel rate below $100, the others being Moscow ($97), Bratislava ($92) and St. Petersburg ($82). A decade ago, Moscow was the most expensive city in the Corporate Travel Index.

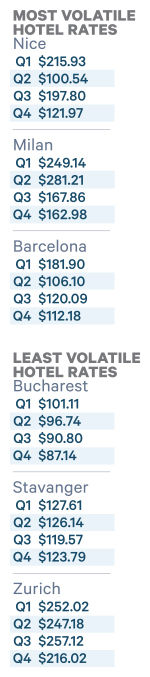

Drilling deeper into the CTI data for the extraordinary year that was 2020, distinct trends emerge in the fluctuations of hotel rates from one quarter to the next. Compared with the final quarter of 2019, Q1 of 2020 showed mixed fortunes, with some European cities experiencing rate rises and others falls, according to the trajectory they were on before Covid hit and how early they felt the impact of the pandemic.

The second quarter saw rates fall heavily almost everywhere as the travel tap was firmly switched off. The third quarter was a mixture of rate recovery in some cities and continued declines in others. Then rates fell ubiquitously again in Q4 as recovery was snuffed out by the winter resurgence of the virus and the emergence of more infectious variants.

Paris is a typical example of this general picture. In Q1 rates rose 7 percent, then plummeted 20 percent in Q2, recovered 15 percent in Q3 and reduced 1 percent in Q4. London fits the same story, albeit with rate decline in every quarter, down 2 percent in Q1, 17 percent in both Q2 and Q3, and another 8 per cent in Q4.

The Index's hotel rate story aligns with how American Express Global Business Travel experienced European travel volumes in 2020. Bookings dropped towards the end of Q1, then went into freefall in Q2. "Across Europe we started to see some recovery in Q3 but then Q4 of 2020 and Q1 of 2021 brought us back to minus 95 percent levels," said senior vice-president and general manager EMEA Jason Geall. "There have been a few exceptions. Nordic has been the shining light in Europe, thanks to some large marine travel customers."

What little travel has taken place has been more domestic than international and typically by skilled laborers rather than "people who look at laptops," said Philip Stewart, founding director and head of intelligence for travel risk consultancy Tapis Intelligence. "Travel has never stopped but it needs closer risk management," he added. "Effectively everywhere has become a high-risk destination."

As to how Europe will perform for the rest of 2021, "we don't foresee any change for the first two quarters of this year," said Geall. Amex GBT is working on the assumption that there will be marginal improvement in the second half of the year, followed by a period of hyper-growth in 2022 when long-haul travel will join prompter recoveries in short-haul journeys. The big switch-on could come sooner if national vaccination programs prove successful.

Whenever the rush to resume starts, said Geall, the European travel industry—including airports, airlines and travel management companies—needs to prepare now for scaling up at speed. "Even if we took ourselves up to 50 percent of pre-pandemic volume in two months, that would be monstrous growth," he said.

Stewart also thinks recovery will not come until late in 2021 at the earliest because of fear of Covid variants undermining vaccination successes. "New strains are going to take hold in a number of countries," he said. "Infection rates are falling in Europe but relaxation of entry requirements is not being talked about because the UK strain is spreading and is likely to lead to a surge in many countries.

"As the UK reopens domestically, it will keep its borders under close watch too, so travel restrictions could go in the wrong direction initially. The fantastic UK vaccination program will eventually allow it to lift restrictions, but it won't be like that for most of Europe for the rest of the year, and not for many countries outside Europe for longer than that. It will get easier, but it's not all done and dusted."

The key determinant of controls on travel, Stewart argues, will shift from infection rates to vaccination rates, because infection will become less of concern if, as hoped, symptoms prove minor in vaccinated individuals. As a result, he believes European countries could create air corridors as they reach mutually agreed vaccination targets.

Stewart considers the introduction of vaccine passports for travelers as "inevitable" (a word also used by Geall), in spite of deep-seated European beliefs in the primacy of data privacy. "European governments all understand the massive economic impact and want to get travel opened up," said Stewart.