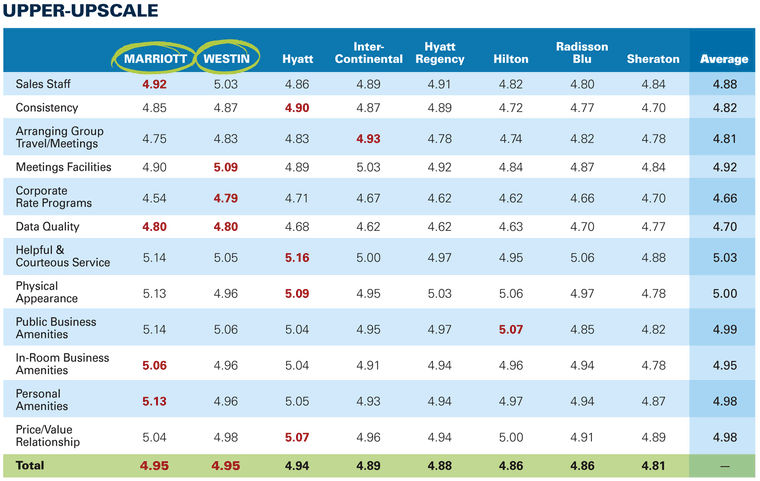

The upper-upscale segment proved to be the most competitive

tier in this year's survey. Starwood Hotels & Resorts' Westin brand tied

for first place with future bedfellow Marriott Hotels, while Hyatt Hotels Corp.'s

flagship Hyatt brand finished just 0.01 points behind to snag third. Still, the

top scores for each criteria were spread across several brands beyond the top

three.

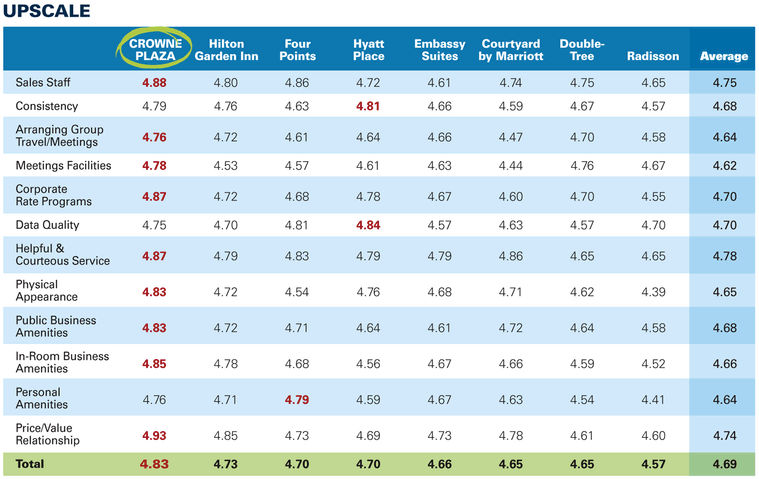

In the upscale tier, InterContinental Hotels Group's Crowne

Plaza Hotels & Resorts brand moved from eighth place last year to first

place this year, securing the highest scores in nine of the 12 criteria. Second

place Hilton Garden Inn also moved up significantly, jumping from last year's

sixth place. The upper-upscale and upscale tiers showed the largest

year-over-year increases in scores, as the lowest-scoring brand in each tier in

2016 nearly matched or bested the top scores from 2015.

Bjorn Hanson, a clinical professor at the New York

University School of Professional Studies Tisch Center for Hospitality and

Tourism, suggested the rise from last year could be the result of a record

amount of spending by the U.S. lodging industry on capital expenditures in

2015, particularly within the upper-upscale and upscale segments. According to

Hanson, spending in the upper-upscale space focused on items that had been

deferred from 2009 to 2014 and on property upgrades to meet brand standards and

keep up with competition from the upscale and upper-midprice tiers. Spending in

the upscale segment, meanwhile, contributed to noticeable changes in lobby

spaces, fitness centers, breakfast areas and high-speed Internet capacity.

Westin, which also placed first last year, shifted its brand

identity from renewal to wellness, moving from soft pastels to bold colors and

active imagery on its room keys, menus and marketing materials. It earned the

highest scores for meetings facilities, corporate rate programs and data

quality.

As part of its meetings initiatives, Westin enhanced its

Tangent workspace offering, now available at almost 60 locations globally.

Tangent features videoconferencing and Steelcase's Media:scape furniture and

technology setups. Brian Povinelli, Starwood senior vice president and global

brand leader for Westin and Le Meridien, said Phase 2 will bring Bluetooth

connectivity.

Building on its running concierge program for groups and

meetings guests, Westin introduced "sweat-working" happy hour runs in

June. It also added other fitness concierges, such as the surfing concierge at

The Westin Los Angeles Airport and the hiking concierge at The Westin Bear

Mountain Golf Resort & Spa, Victoria in British Columbia. "We're

introducing more experiential opportunities for our group business that not

only reinforce our positioning as a brand in the wellness space but really get

to what we're hearing meeting planners and corporate accounts are looking for,"

Povinelli said.

Marriott, which took the No. 1 spot in BTN's 2014

survey and third place in last year's, garnered the highest scores for sales

staff, data quality and in-room amenities, both business and personal. This

past year, the brand focused on appealing to modern travelers, both through its

guest room update program, Marriott Modern, and through app enhancements like

digital check-in, service chat and alerts that notify guests when their rooms

are ready.

"Making sure that a holistic full-service hotel

experience is being delivered to our guests in a very compelling, exciting and

modern way is a huge focus for the brand," said Matthew Carroll, vice

president and global brand manager for Marriott Hotels. The Marriott Modern

renovations introduce updates to the guest rooms like hardwood floors and

multipurpose work surfaces. The brand has also focused on enhancing its food

and beverage offerings and modernizing public spaces.

Year-to-date average daily rate for the upper-upscale

segment as of the end of July increased 2.3 percent year over year to $179.62,

while occupancy dipped 0.3 percent, according to STR. Though pure upper-upscale

occupancy was high at 75.5 percent, supply growth for the segment, 1.5 percent,

overtook demand growth, 1.2 percent, which means occupancy could continue to

drop off in the months or years ahead.

Upscale

"Business travel is changing, and we're evolving the

brand, the products, the services that we offer to meet those changing needs,"

said Eric Lent, vice president of the Americas for Holiday Inn and Crowne

Plaza. The brand shifted its focus to connectivity, productivity

and wellness for its guests in 2015. IHG Connect, for example, enables a single

Internet sign-on process that follows guests from property to property. The

brand also multiplied bandwidth. In-room, the brand enhanced device-charging

capabilities and introduced a wellness dining menu. It also has increased the

sales staff that's devoted to corporate sales in order to be more responsive to

requests for proposals. In June, IHG announced it would invest $200 million in

Crowne Plaza in the Americas to further appeal to business travelers.

Upscale's No. 2, Hilton Garden Inn, too, is enhancing its

product for business travelers, which are 70 percent of its guests, according

to senior vice president and global brand head of Hilton Garden Inn John

Greenleaf.

"Hilton Garden Inn feels like a full-service hotel,"

Hanson said of the brand. "There's a restaurant, [so] there's a place to go

that isn't just hanging out in a lobby."

The brand has capitalized on Hilton Worldwide's digital

initiatives, including loyalty member discounts, free Wi-FI and digital check-in

and room selection. Hilton Garden Inn also will push out a prototype for the

Garden Market with expanded food and beverage options. Additionally, the brand

is enjoying a healthy level of growth, having just opened its 700th hotel and

boasting a pipeline of more than 250 signed deals.

The upscale segment has seen a boom in supply in

recent years. As of July, it accounted for the largest share of U.S. hotel

rooms under construction, 34.7 percent, according to STR, and supply growth

outpaced demand growth for the first half of the year.