A bit of a shake-up occurred in the BTN Hotel Survey upscale categories this year, as fewer upper-upscale brands qualified for the survey, based on usage. Hilton's Embassy Suites vaulted from eighth place in the upper-upscale segment last year to second this year, as the brand improved its scores in nine of the 13 categories. Meanwhile, Choice Hotels' Cambria Hotels debuted on the survey within a hair's breadth of the upscale segment's top spot.

The wellness trend from 2018 continued into 2019, but with more personalization and mindfulness options for guests. Westin, long a leader in wellness hospitality, introduced a culinary program that increased the number of responsibly sourced and organic items offered where possible and increased choices for guests to better meet their dietary needs and preferences. M Clubs at Marriott Hotels introduced the Mind Menu, with snacks like the Brain Booster or the Slumbershot that use "active ingredients to enhance the mind and body," according to the company.

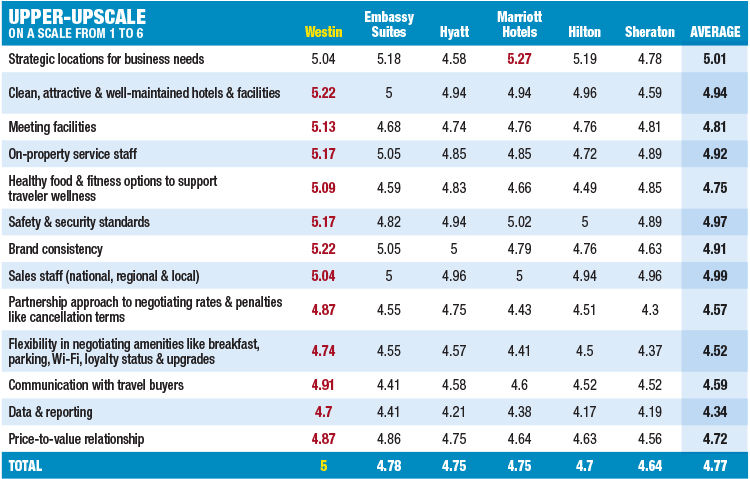

Upper-Upscale

Westin carried away this segment, earning top marks for 12 of the 13 categories. It also is the only brand across the entire BTN Hotel Brand Survey to repeat its No. 1 position in its segment from last year. Westin's competition wasn't nearly as close as in 2018, either. The only category where the brand didn't dominate was in strategic locations for business needs, which went to its sister brand, Marriott Hotels.

Two things made the difference this year, according to Marriott International global brand officer and luxury portfolio leader Tina Edmundson: "We are doubling down and doing a fair amount of work to refresh the core pillars for the brand, which is all about wellness." She added that Westin has enhanced its healthy menu items and by early 2020, all Westin hotels in North America will have Peloton bikes. "With the strength of the combined portfolio, the education with our salespeople with corporate buyers has increased."

Westin has 49 hotels in the pipeline globally, most of its growth in Asia, though Europe is doing well, too, Edmundson added. The Westin London City opening in late 2020 will be the brand's first London hotel, and the 618-room Westin Anaheim Resort in California is due to open next summer and will be adjacent to the Anaheim Convention Center.

Embassy Suites came in at No. 2. Though it didn't win any categories, it scored well in strategic locations for business needs, clean and attractive hotel facilities, on-property service staff, brand consistency and sales staff. "We've been reenergizing the lobby space with an atrium refresh program," said Hilton SVP of sales, customer engagement and industry relations Kelly Phillips. That initiative launched in 2014 but is ongoing. "The lobby space is a point of entry and welcome for guests. There also have been innovations around the food and beverage experience, specifically the new dining concept of Brickstones Kitchen & Bar," a full-service restaurant launched in early 2018 at select Embassy Suites properties.

Embassy Suites also is expanding globally; 253 properties are open and 43 are in the pipeline, according to Phillips, who called attention to Latin America and the Middle East. "We are expanding in areas that are helpful and necessary for business travel. Our customers who are used to staying [with us] in the U.S. are looking for the same brands in other parts of the world."

Tied for third place this year are Hyatt and Marriott Hotels, but each scored just three-hundredths of a point behind Embassy Suites. Marriott Hotels scored highest for strategic locations. It also did well with sales staff and safety and security standards. "Marriott Hotels is often a first choice in markets for both booking on the sales side and for safety and security for our customers," said Edmundson. "Additionally, the global appeal of the brand allows the customer to know exactly what they are getting no matter what the location may be."

Marriott Hotels has 155 properties in the pipeline, including Austin and the brand's first hotels in each Tunisia, Albania, and Bosnia and Herzegovina. Edmundson added that the Marriott Hotels brand is also "deeply entrenched in the convention network, and with so many new brands to sell, many of our customers stay with the brand that they have been with over the years. Because of this, much of our business is repeat business."

Hyatt scored well on brand consistency, sales staff and clean and attractive facilities. "We are successfully personalizing our guest experience to have [guests] be comfortable coming back, and the Hyatt brand does that very well," said global sales VP Gus Vonderheide. "Personalization is a big buzzword with us right now, and I like the comment, 'You win an account one traveler at a time.' Getting an organization to choose your hotel in their program doesn't guarantee you a room night. We need to make sure we are addressing each individual guest and finding a way to attract them and connect with them, and that's how you win an account."

Hyatt connects with travel buyers with flexibility in pricing models and willingness "to create a variety of different programs that work for each organization based on their culture and their needs," Vonderheide said. "One size does not fit all. We believe a hybrid pricing model is probably the best approach we can help create from the ground up, and we like to partner with our customers in doing so."

The company also holds a Transient Sales Workshop, training corporate sellers on trends in the marketplace and what to do at the property level to attract more business and show Hyatt off as the brand of choice. "This is a very important segment for us," Vonderheide added, "and we just continue through regional and corporate-sponsored training opportunities to recognize the value of these Hyatt sellers on property and above property to make sure they are best in class."

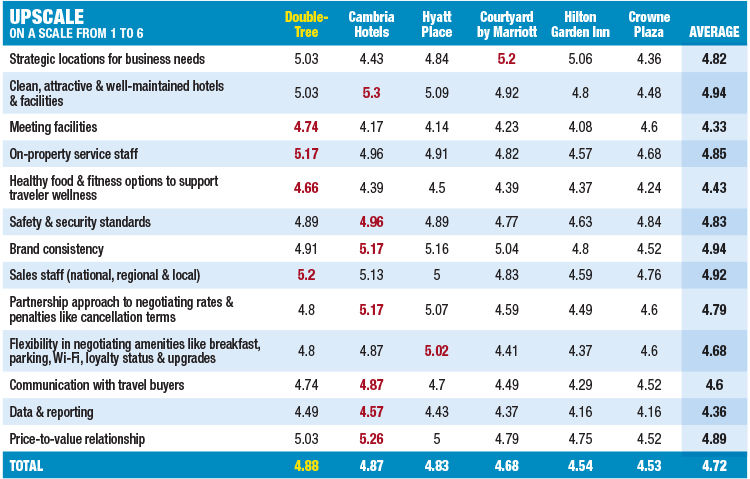

Upscale

The top three brands in this segment were so close that only five-hundredths of a point separated No. 1 DoubleTree from No. 3 Hyatt Place. No. 2 Cambria took top honors in seven of the 13 categories.

DoubleTree by Hilton garnered top honors for its meeting facilities, on-property service staff, supporting traveler wellness with healthy food and fitness options, and sales staff.

Sales, customer engagement and industry relations SVP Kelly Phillips said DoubleTree is community focused and that this resonated with buyers and business travelers over the past year. "Customers want to spend money with brands that share their values," she said, and each DoubleTree has a Care Committee of team members from all departments and levels seeking ways to improve. Beyond that, relationships matter, and she said consistency is crucial. She stressed that it's Hilton's "connections with our customers that make the biggest difference, not just our sales professionals to our buyers but also our hotels delivering on that promise with each traveler that walks through our doors."

Enough travel programs used Cambria over the past year for the Choice Hotels brand to debut on the survey this year, and it very nearly took top honors in the upscale segment in the process. It scored highest in seven of the 13 categories rated, including many that are important to travel buyers, such as a partnership approach to negotiating rates and penalties, communication with travel buyers, data and reporting, and price-value relationship.

"We've been making a concerted push [toward] corporate travel buyers for the past several years," said Choice chief commercial officer Robert McDowell. While Choice has traditional global and regional sellers, it also has Cambria field sellers dedicated to the brand's hotels and serving as a link between the property and the corporate travel buyer. "We worked closely to get Cambria noticed by corporate travel buyers who might not be aware of the brand as [its properties] opened in their markets."

Choice also has an advisory council of buyers. "We go to them before we launch programs to really understand how the business is evolving, what tools they are using, what are their issues and opportunities," said Choice SVP of upscale brands Janis Cannon. "They play a big role in helping us with our overall strategy."

Two other factors may have played a role in Cambria's placement in the survey this year: meetings and its loyalty program. "When some companies were reducing commissions, we went the other way and enhanced our groups and meetings offer," Cannon said, adding that the brand specializes in meetings with as many as 25 attendees. "That's been really appreciated by corporate travel buyers who also do meetings."

Choice Privileges offers a "status jump" program: "No matter what level you are at with a competitor, after your first stay at a Cambria, you go to our highest level," Diamond status, Cannon said. In addition, Choice Privileges members who stay at a Cambria get a $10 credit they can use on property for food and beverage. And the company recently doubled the instant rewards at check-in to a $10 Starbucks card, $5 for Uber and $5 for Amazon. "We've been working closely to understand what it is corporate travel buyers are really looking for from a brand perspective and to differentiate Cambria and also add value," Cannon said. "It's starting to pay off." The brand has more than 45 U.S. locations open and will reach 50 by the end of 2019.

Hyatt Place dominated the upscale segment in last year's survey, taking top honors in 11 of the 13 categories. This year, the brand fell to third, though barely. It scored on top only for flexibility in negotiating amenities, which is a key point for buyers. It also scored well in other important categories, including a partnership approach to negotiating rates and penalties, as well as price-value relationship. "The Hyatt Place product is growing rapidly and is a very special brand for us that is giving us the opportunity to expose the Hyatt name in new markets," said Vonderheide. "[It] has been consistently scoring well in both room product and F&B offerings, and we continue to attract the traveler who is looking for a really well-appointed product at a good price point in places where they need us to be."

The brand falls into the select-service category, he said, but "it punches above its weight." He added that its rooms are good sizes, "the breakfast is phenomenal, and there are nice gathering spaces in the galleries and lobbies."

World of Hyatt members are entitled to free breakfast at the brand's properties. They can sign up for the loyalty program at check-in and get the meal the next morning. "It really gives you a nice advantage and product," Vonderheide added. He also said: "It's a consistent product in the right places … and we are keeping the product fresh. We make sure we've got many of these properties near transportation around the area. It's a home away from home."