For the sixth year in a row, Delta Air Lines soared above

its competition in BTN's annual Airline Survey, but the results gave all

carriers room to boast, as buyer satisfaction levels rose nearly across the

board. All four U.S. carriers that had enough corporate use to merit inclusion

in the survey improved their overall scores. More impressively, each one

improved its score in all 10 categories with only one exception: United

Airlines dropped four-hundredths of a point on a five-point scale in buyers'

rating of its distribution channels.

Despite concerns following years of consolidation, these

scores indicate that competition remains strong among the largest carriers.

FINRA manager of corporate travel services Carol McDowell said that

post-consolidation, she's seen airlines work harder to set themselves apart

from one another to earn corporate customer loyalty. At the same time, U.S.

carriers have continued to rake in healthy profits in 2016, which they are investing

back into their own products and services. "All of the airlines are doing

quite a bit to ensure they keep our business," McDowell said. "They're

asking more of what they can do on their own, and at the rep level, they're

open to listening and ideas and taking that back to their senior management."

With scores up among all carriers, Delta lost only a slight

edge in its premium over the other three carriers. Its total score was 0.77

points above its closest competitor, compared with a 0.9-point difference last

year.

Rankings of the other three carriers, a much closer race,

moved around this year. American Airlines, whose overall score improved the

most, moved up to second place, pushing both United Airlines and Southwest

Airlines down one spot in the rankings compared with last year.

Delta Builds on Success

As in 2015, Delta Air Lines improved its operational

performance, an area in which it has staked particular pride. Nov. 8 marked its

200th day in 2016 without a canceled flight. It had only 161 such days in the

full year of 2015 and zero in 2010. That "relentless focus on operations,"

according to Delta senior vice president of global sales Bob Somers, factored

into the carrier's once again dominant performance this year, including its

operational guarantee, in which corporate customers earn compensation should

Delta's on-time and cancellation performance fall below that of both American

and United on an annual basis. In May, Delta added international and regional

flight performance, uncontrollable delays and cancellations and mishandled

baggage complaints to the guarantee.

Survey respondents cited the products and services Delta has

developed for corporate travel clients, including its Corporate Priority

program, which offers benefits and protections to corporate travelers

regardless of frequent-flyer status. At the recent Association of Corporate

Travel Executives Global Summit in Amsterdam, Microsoft group manager of

strategic sourcing Georgie Farmer, when asked to name an airline that is doing

well on the personalization end on a global basis, said, "Definitely Delta

from a corporate perspective, in how they recognize [corporate travelers] in

travel disruptions: not to get bumped off and a whole bunch of other areas, as

well."

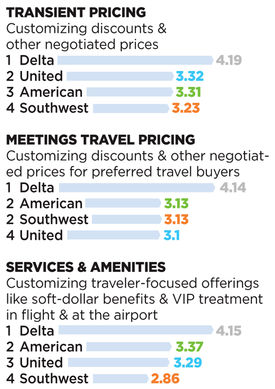

Buyers also singled out the Delta Edge reporting program,

which expanded to include meetings spend this year. In meetings pricing, Delta

beat its competitors by more than a full point in BTN's survey, the

biggest victory margin of any individual category. "The last five years has

been a series of 'the next big first' and building beyond contract value that

takes our relationship to a different level," Somers said. "We will

continue to innovate and use customer feedback to see where we should be next

in investing time, effort and technology."

This year, Delta also worked to reduce the length of its

contracts by cutting down legal terms and conditions and simplifying its

pricing table, which also came as a request directly from customers, vice

president of sales operations and development Kristen Shovlin said.

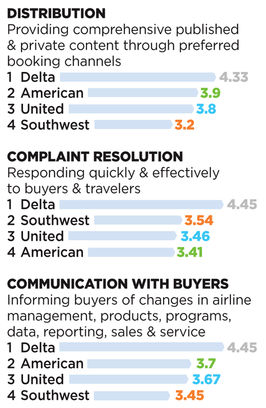

Delta's highest scores were in client communications and

complaint/problem resolution. The carrier suffered a bit of a black eye in

August when a power outage caused a systemwide operations shutdown followed by

thousands of cancellations and delays. Respondents to BTN's survey,

however, mentioned the incident in a positive light, praising the carrier's

handling of the situation, including "constant communication" and

compensation for affected travelers.

In another problem scenario, one of a Delta client's top

travelers had booked an international flight at the last minute, but a travel

agency ticketing error forced him to take a different flight that included a

double connection. Thus, he arrived later than he needed. The company's account

manager at Delta reached out to the agency behind the error and sent a letter

of apology and gift basket to the traveler. "I felt they went out of their

way to rectify the situation, and the traveler was fortunately very

understanding and remains loyal to Delta today," the buyer said.

Shovlin said the key in maintaining high scores in BTN's

survey has been spreading awareness for the corporate travel experience across

the entire team. Delta highlights its BTN Airline Survey honors with

stickers on the sides of its aircraft, and staff across all functions are eager

to keep the streak going, she said. "Every one of the 80,000 strong have a

piece in this overall traveler experience, making sure that it shines across

every touchpoint," Shovlin said. "The entire travel journey has been

invested in."

American Gains Ground

American Airlines increased its score by 0.26 points, more

than any other carrier. Some of American's most significant improvements came

in the three categories related to negotiations: transient pricing, meetings

travel pricing and services and amenities. Last year, the carrier received

fewer than 3 out of 5 points in each of those categories. This year, all

increased comfortably above that mark, and American moved from last to second

or third in each.

The carrier has made several tweaks throughout the year to

simplify negotiations, managing director of strategic account sales Hank

Benedetti said. In September, for example, it expanded the number of fare

classes available for corporate discounts, letting buyers get more

opportunities for discounts and more capability to capture travel under their

contracts, he said.

The carrier also has worked with its partners in the

Oneworld alliance to create more seamless pricing and discounts, senior vice

president of sales Alison Taylor said. In August, the carrier tapped low-cost

carrier VivaLatinamerica CEO Joe Mohan as vice president of alliances and

partnerships to deepen relationships and create a seamless, common set of

policies.

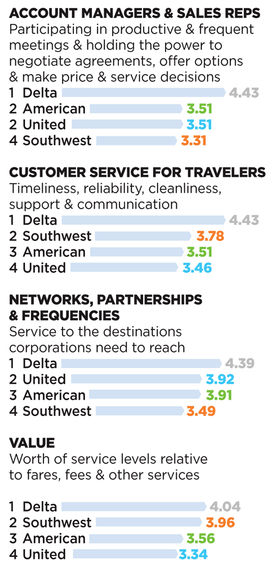

Networks, partnerships and frequencies was American's

highest-scoring category. The carrier has built up its network to the

Asia/Pacific region, moving from third-largest U.S. carrier network serving the

region to second-largest in a short time, Benedetti said.

Buyers praised American's Flex Funds, through which buyers

and agents get around-the-clock access to fee waivers without the need of

approval. The carrier is looking for more products, both buyer and customer

facing, to continue to boost its scores. In October, for example, it became the

first carrier to fly with a true premium economy cabin, a distinct cabin rather

than a section of the economy cabin with more legroom, which has provided more

opportunities in contracting. "This has been a year where, instead of

digesting a merger, we started immediately hitting the things that buyers

wanted," Benedetti said.

United's Turnaround

Analysts and observers agree: It's a new day at United

Airlines, and a little more than a year into his job, president and CEO Oscar

Munoz deserves a good deal of the credit. While the carrier slipped a place in

rankings, it made significant gains in complaint resolution, communication with

buyers and customer service for travelers. After a few years of struggling following

its merger with Continental, United's operational reliability has improved this

year. Like Delta, United has introduced an operational guarantee to buyers and

is on track to meet that guarantee this year.

Despite being sidelined by a heart attack and transplant

early in his tenure, Munoz has made an indelible mark on morale. Analysts have

noted a change in employee attitude at the carrier. Munoz said investing in

service has played a role in that, mentioning a flight attendant who told him

that she was tired of saying, "I'm sorry," to customers.

Munoz has green-lighted initiatives to address obvious

shortfalls, but not without cost. "You roll out pretzels and a couple of

snacks, and it's a $100 million total tab," Munoz said. "It's simple

to take those off, and I recognize that, but we were so underinvested for so

long. We can bring customers back and make them feel good about United."

Munoz has also initiated organizational change. The carrier

now has a single team to manage all customer-facing functions and create a

consistent experience for travelers across the United network. Kate Gebo, who

ran Munoz's office, leads the team as senior vice president of customer service

delivery.

With larger improvements ongoing, the carrier has sought to "reintroduce"

United to the corporate market, Americas vice president of sales Jake Cefolia

said. The carrier gained $85 in corporate sales for every $1 it lost this year,

a striking improvement over 2015's $5-to-$1 ratio. "Given the advances made

in operating reliability, products and services, putting us on par with major

competitors if not ahead, this was the year to go out and win business,"

Cefolia said. "It demonstrates the important measures and changed culture."

One change that boosted customer service scores was a new

escalation desk within the sales support organization, he said. Opening that

desk has cut back on the backlog of problems like baggage issues and refunds.

Additionally, United has made sales support services more

efficient by reducing demand for them, Cefolia said, including giving travel

agents more leeway in rebooking travelers after schedule changes or irregular

operations.

Now the carrier is comparing the biggest drivers of

satisfaction with where it needs the most improvement. One of biggest gaps

appears to be service support automation, Cefolia said. The carrier is beta

testing a self-service portal on which agents and buyers can self-service on

waivers and favors. "It's not the dollars and cents of the deal but how

flexible we are with the service and how much automation is put in,"

Cefolia said. "We'll be making up ground there next year."

Southwest's Value

While Southwest trailed its competitors in total score, it

also was the only carrier to come within firing range of Delta in any

individual category: In overall price and value, it scored only

eight-hundredths of a point below Delta.

That score plays right to Southwest's core proposition,

manager of business development Dave Harvey said. The carrier has held a hard

line on not charging bag fees, the only major U.S. carrier not to do so in some

fashion, and in not charging change fees. In the past few months, it also

allowed A-List and A-List Preferred status members who arrive early to go on

standby for earlier flights without paying the fare differentials.

Southwest has staked its reputation on being the lowest-cost

major carrier, but it often costs the least only if counting lack of bag fees

and change fees. Still, for some buyers, the absence of those fees is a

significant benefit. "We use mainly Southwest Airlines because we have

changes in staff schedules and they are so helpful making changes and not

charging an additional fee," one buyer said. "Also, we enjoy not

having to pay for baggage fees. It helps our budget."

Besides the price-value relationship, Southwest scored

highest in communications with buyers and complaint/problem resolution. One

reason is that Southwest gave account managers more autonomy to take care of

problems when they arise, Harvey said. Southwest also benefits from simpler

contracts, which tend to be five or six pages, compared with 30- or 40-page

contracts offered by competitors, he said. And the carrier recently has been

doing more custom contracting for buyers who need something outside the

standard template. "As far as our deals, discount structures and waivers

and favors, we now sit down with companies when coming up with preferred

agreements and look at the overall system level and geography to come up with a

workable solution," Harvey said. "That's a model we would like to

scale."

Even so, the simple template remains the predominant choice

for most corporate buyers. For some, it's a benefit. "They keep it simple,"

McDowell said. "Domestically, I've asked each of our airline partners to

go to a revenue-based program rather than a marketshare program. Take all that

complication away."

Southwest trailed the competition in the category of

networks, partnerships and frequencies, but it has built significantly in that

area, Harvey said. It grew from Dallas following the expiration of the Wright

Amendment two years ago, and it has acquired extra slots out of Washington,

D.C., and is seeking more corporate business through service in California.

Southwest has begun international service in recent years, and while the

majority is to leisure destinations, it sees significant corporate traffic on

its routes to Mexico City and San Jose, Costa Rica, he said.

Travel buyers for global programs may look at Southwest

differently next year, however, when the carrier switches to a new reservations

system. Among its benefits, the system will allow Southwest to partner and

codeshare with international carriers. "Our vision is to be the most

flown, loved and prosperous carrier around the globe," Harvey said. "Thinking

about destinations in Asia, Europe or deeper South America, while we won't be

flying our own metal there anytime soon, via a direct partnership we can unlock

that to some of our managed corporate business to win."

Methodology

BTN's Airline Survey measures the way corporate travel buyers perceive airline performance. From late August to late October, BTN collected 311 responses from travel manager and buyer members of the BTN Research Council and subscribers of BTN and Travel Procurementand 23 responses from travel agents. Twelve percent spent $500,000 to $1.9

million on U.S.-booked air volume in 2015, 37 percent spent $2 million to $12 million and 51 percent spent more. BTNdeveloped the categories with travel buyers, corporate travel agency managers and airline sales executives. It averaged scores in each category to create an

overall score for each carrier, weighing each category equally. Respondents graded only those airlines with which they negotiated a contract or booked a meaningful amount of business in the past year. Participants who offered no response for a particular category or airline were not included in that

category or airline's average rating. The survey listed the largest domestic airlines as identified by the U.S. Department of Transportation, excluding regional affiliates of major carriers. Alaska Airlines, Frontier Airlines, JetBlue Airways and Virgin America elicited responses from less than 25 percent

of the final survey sample and therefore were excluded from this report. Equation Research hosted the survey and tabulated the results.