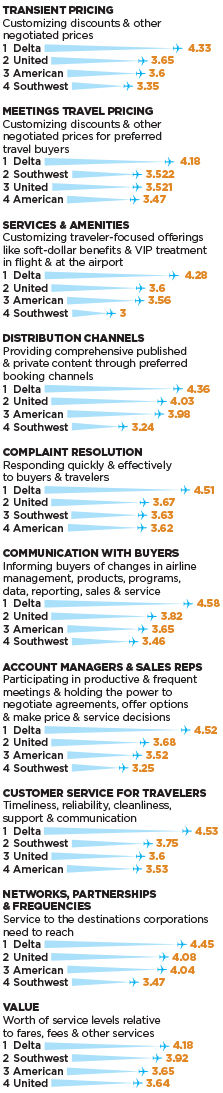

Delta has beaten its own record, winning BTN’s Airline

Survey for the eighth consecutive year. All its competitors, however, have

upped their game. In BTN’s 2018 Airline Survey, fielded among corporate travel

managers and agents, Delta once again earned the highest score in every single

category by a healthy margin. Meanwhile, United, American and Southwest each

improved on their 2017 scores in every category. For United, that improvement

was enough to overtake American for second place. It’s the first time United

has outscored American since 2015. The survey scores each airline in each

category on a five-point scale, and United and American each broke the

four-point barrier in a handful of categories, the first time either has done

so in their post-merger states. Southwest remained in fourth place, but its

total score improved more than any other carrier, up from 3.21 in 2017 to 3.46

this year.

Delta Aims to

Globalize Success

Although it might be tempting to interpret this year’s

results as a crack in Delta’s seemingly impenetrable armor, it’s a crack one

would need a magnifying glass to see. Delta’s scores remained more or less the

same as last year; generally, its scores in individual categories were within a

few hundredths of what it scored in 2017, and its overall score was 4.39, one

hundredth of a point down year over year. Still, the carrier still maintains a

healthy premium over its competitors; the gap is wider than 0.6 points in all

but three categories.

Eight isn’t enough for Delta executives, of course, who

still want to push its scores higher. “Our goal is to keep an open dialogue

because it will always be a journey in how to add value,” VP of sales

operations and development Kristen Shovlin said. “Since the merger [with

Northwest]—and the 10th anniversary just happened [in October]—we’ve put an

emphasis on how we take our business and transform it back to a time when it

was about relationships and partnerships.”

Some travel buyers taking BTN’s survey praised Delta for

hosting events that enabled travel professionals to tour airports and fleets so they could better understand operations and the

business. Others praised consistent and helpful communication from their sales

reps. Communication with buyers was Delta’s strongest individual score, as it

was last year, and the airline also scored well for its account managers and

sales reps. “Our rep with Delta is amazing,” one buyer said. “He is always in

touch, lets me know what is coming, helps whenever I need it and makes sure our

travelers are happy and comfy and responsive at all times.”

Resolving complaints was another high-scoring area for Delta

and the one where its gap from competitors was the largest. “When and if an

issue becomes a problem for one of our travelers, I do not need to get in panic

mode,” another buyer wrote. “Our Delta account manager and [the] Delta

executive desk solves the issue, and if they can’t, they provide an alternative

solution.”

Delta has been concentrating on spreading some of its best

practices to its joint-venture partners, making it a more seamless experience

for corporate travel buyers. Part of that has centered on the bigger

picture—having Virgin Atlantic’s fare structure line up better, for example, or

making check-in and seat selection available across partner portals—but it also

has involved some of the tools and services particular to the corporate space.

This summer, for instance Delta and Air France-KLM aligned corporate travel

benefits in their Corporate Priority Program, which gives corporate travelers

across all the carriers access to better seats, priority boarding and priority

for rebooking during irregular operations. It is globalizing its Delta Edge

portal for travel professionals, as well. “It’s been very clear the future is

global, so we’ve decided a differentiator will be our relationship with our

partners, making it more integrated than the rest of the industry,” SVP of

global sales Bob Somers said. “Our core strength is our domestic business, but

our goal is for our global footprint to account for 50 percent of revenue

coming from around the world.” Right now, that revenue ratio is about 70

percent domestic and 30 percent international, Somers said.

As it aligns those products, Delta is clearing regulatory

hurdles to bring its alliances with Virgin Atlantic and Air France-KLM into a

single mega JV. It also kicked off its JV with Korean Air this year as it

cleared the necessary regulatory hurdles and now is seeking approval for a JV

with Canadian carrier WestJet.

Delta also continues to leverage its record of operational

excellence. As of early November, the carrier has had 208 days with a 100

percent completion factor on its mainline flights, compared with 193 days at

this point last year. Across the entire Delta brand, which also includes Delta

Connection flights, Delta has had 118 days with 100 percent completion,

compared with 64 at this point in 2017.

The carrier pioneered operational guarantee agreements with

corporate customers a few years ago, in which it promised compensation should

its operating statistics fall below both of its chief competitors. This year,

it further refined its reporting metrics to show customers completion and

on-time data based on their specific travel footprint, not just overall

performance.

United Soars to

Post-Merger High

This year, United earned its highest score in the BTN survey

since its 2010 merger with Continental, as buyers praised the corporate

travel-focused products the carrier has launched over the past few years.

“[United] has really stepped up to the plate and offers a best-in-class

program—finally!” one buyer remarked.

In particular, buyers complimented the Jetstream portal for

corporate customers and travel management companies, released last year. One

buyer noted that it has “given us more control over our services fund and

United as a whole has done a tremendous job of streamlining or enabling

self-service for our TMC to take care of our travelers.” Others praised the

carrier’s Corporate Preferred program, launched this summer, in which corporate

travelers get priority consideration for upgrades and reaccommodation. One

buyer called it “long overdue but the right step towards providing their valued

corporate accounts with more priority, protection and amenities.”

In addition, United launched a new corporate discount

program, Propel, this summer for midsize travel programs. For those with at

least $250,000 in annual spend, it offers five tiers of discounts based on the

program’s market share. It also is including discounts on its JV partners—Air

Canada, ANA and Lufthansa Group—for travel with a point of sale in the U.S. or

Canada.

United SVP of worldwide sales Jake Cefolia, who has taken

the mantle from longtime sales leader Dave Hilfman in advance of Hilfman’s

retirement at the end of the year, said the improvement in United’s score

indicates that “the investments we’ve made in servicing our customers as well

as making sure we have a compelling value proposition to those customers … is

being recognized.” The carrier intends to pick up the pace and is creating a

“sales laboratory,” a small selling team that will test out new products and

services for customers and determine what should be scaled up from there, he

said. “The last few years, we’ve been launching one new product per year on

average,” Cefolia said. “Frankly, I think we could be launching three to five

new products a year.”

The meetings arena has been another focus for United. While

flexibility in negotiating meeting pricing was United’s lowest score, that’s

also one of the areas in which United improved the most, up to 3.52 compared

with 3.16 last year.

Cefolia said his team has increased attendance at

meetings-focused industry events and “has spent a lot more time working with

the contracted corporate customers to better understand where opportunities

reside and introduced more competitive pricing in markets on standard

agreements.”

United’s highest score—and the highest individual category

score for any airline on the survey besides Delta—was for its networks,

partnerships and frequencies. The carrier has significantly bulked up its

domestic network this year, adding about 40 domestic routes and several new

international routes despite some grumblings from the profit-focused investment

community. In addition, United has been working on tighter integration with its

JV partners, Cefolia said. Besides including them in Propel, United has made

boarding passes from partners available through its mobile app and this year is

adding partners’ flight statuses to its app, he said.

United’s score in communications with buyers boasted the

highest premium over American and Southwest. The carrier has created regional

advisory boards on top of its larger corporate customer advisory board; it just

conducted the first in California, and one is on the way in New York, Cefolia

said. “We take pride that we have a team that is really out there, very visible

with the customers and spends as much time listening as talking—and we have a

lot of great stuff to talk about,” Cefolia said.

American Hones Focus

on Communication

Like United, American Airlines this year earned its highest

post-merger scores, and the carrier has put a heavy focus on building up its

sales team and improving communication with corporate customers, SVP of global

sales and distribution Alison Taylor said.

Since 2017, American has added 136 sales associates and

introduced a new training curriculum for its sales team, she said. In addition,

it has launched a new newsletter for its corporate customers and has

significantly increased the volume of communications to them; they are not

getting just news about major events like hurricanes but “know about the great

things we are doing on our journey to be the easiest company to do business

with,” Taylor said.

One buyer cheered the “constant contact” from the company’s

American Airlines representative. “She listens to our needs and acts on them

and is very responsive to any issues,” the buyer said. “We understand that

while we are not American’s biggest customer, we certainly are very important

to them, and I credit that feeling to our rep.”

Product has been another focus for American, Taylor said,

including increasing Wi-Fi availability across its fleet and expanding

availability of its Flagship Lounges, which offer high-end dining options. The

next is scheduled to open in Dallas early next year. The carrier also is on

track to become the first North American carrier to have a dedicated premium

economy cabin across its widebody fleet by May 2019, Taylor said. “We haven’t

seen travelers buying down from business,” American Airlines sales strategy

manager Anthony Rader said. “We’re seeing it as an upsell [from economy] to a

great product and great meal services.”

Distribution, one of the carrier’s highest-scoring

categories, has been front and center at American, as well, particularly as it

has developed strategies around the International Air Transport Association’s

New Distribution Capability standard. As yet, the carrier is the only one in

North America to offer incentives for segments booked on NDC connections, and

there will be “NDC-powered content delivered to the corporate marketplace”

starting next year, managing director of strategic account sales Hank Benedetti

said.

In October, American went live on SAP Concur’s TripLink,

enabling corporate travel buyers to capture data booked directly on the

airline’s website. Taylor said “many great companies are lining up” for trials

with the technology, including Google.

Like its competitors, American is solidifying its global JV

strategy. It is “getting closer” to getting its necessary approvals for a JV

with Latam and took a small stake in China Southern last year. This year, it

also announced it would once again seek a joint business agreement with Qantas;

the U.S. Department of Transportation rejected such an agreement in 2016.

Next year, American will launch a data portal called

SalesLink Insights that will enable corporate travel buyers to monitor contract

performance, spending—including on nonairfare items like checked bags and

change fees, Benedetti said—and operational data. American is testing the

portal with high-profile agencies and corporate customers, Taylor said. One

buyer said that tool would be “valuable in program management.”

Southwest Sees Fruit from

Corporate Business Investment

Southwest has significantly built up its corporate sales

efforts as its scores improved on BTN’s survey. Meanwhile, many of its weakest

scores this year are areas already tapped for investment in the near future.

Over the past year and a half, Southwest has grown its

corporate sales organization from about 25 to more than 80, including doubling

the number of sales employees in the field and developing teams focusing on

specific segments, such as government travel. The carrier is on track to

quadruple the number of new contracts from 2017 to 2018. “[Southwest seems] to

be focusing on the corporate market more than I have seen before, so I look

forward to that positive change,” one travel buyer said.

Southwest VP of corporate sales Dave Harvey said the airline

is “starting to see the fruit” of its investment into the corporate market,

noting one of the strongest gains on BTN’s survey was for account managers and

sales reps, up from 2.96 last year to 3.25 this year. “We’d heard a lot in 2017

[from customers] that they were not seeing enough of us,” he said. “We’ve now

been getting more active in building those relationships.”

The carrier is making “major investments” in its Swabiz

business platform, Harvey said, which should improve scores around distribution

channels, traditionally one of Southwest’s weaker areas in the survey. For

example, travelers cannot book international travel through Swabiz, and its

reporting needs improvement. Harvey said reporting will be addressed in “major

announcements” around the end of the year. “We were the first to market with

that direct booking tool in the space 15 years ago, but we hadn’t put the

investment in it,” Harvey said. “Now, we’re not only playing catch-up, but

we’re going to move ahead of the competition.”

While negotiating services and amenities pulled in

Southwest’s lowest score this year, it also was among the biggest gainers, up

from 2.68 last year to 3 this year. The carrier has worked to be more flexible

with its contracts, such as enabling travelers to get higher loyalty tier

benefits from the beginning and status matching, Harvey said. It is exploring

personalization strategies, as well. For example, Southwest is looking at how

it can use data for “surprise and delight techniques,” like a traveler who had

a bad experience on a previous trip receiving a drink coupon on the next trip,

he said.

Networks, partnerships and frequencies is another area where

Southwest could make gains. It has built up its network, particularly out of Cincinnati

and for intra-California travel, Harvey said. Additionally, it is getting close

to launching its service to Hawaii—not a major business destination but a big

one for meetings and incentives—and Southwest will be the sole carrier to take

on Hawaiian Airlines on routes between the Hawaiian islands. Southwest’s recent

switch to a new reservations system has enabled codesharing, which the carrier

has indicated will be a future strategy, as well.

As it did last year, Southwest outscored both United and

American for each its customer service and its overall value. The carrier has

stood firm in not charging change fees or fees for checked baggage, and it is

exploring ways to add more value. Late last year, for example, it added a

same-day standby benefit for A-List and A-List Preferred travelers.

Airline Survey Methodology

Methodology fom September to October, BTN

collected 527 responses from travel manager and buyer members of the BTN

Research Council and subscribers of BTN and Travel Procurement and 74 responses

from travel agents. Seventeen percent of the travel buyers spent less than

$500,000 on U.S.-booked air volume in 2017, 13 percent spent $500,000 to $1.9

million, 35 percent spent $2 million to $12 million, and 35 percent spent more.

BTN developed the categories with travel buyers, corporate travel agency

managers and airline sales executives. It averaged scores in each category to

create an overall score for each carrier, weighing each category equally.

Respondents graded only those airlines with which they negotiated a contract or

booked a meaningful amount of business in the past year. Participants who

offered no response for a particular category or airline were not included in

that category or airline’s average rating. The survey listed the largest

domestic airlines as identified by the U.S. Department of Transportation,

excluding regional affiliates of major carriers. Alaska Airlines, Frontier

Airlines, JetBlue and Virgin America elicited responses from less than 25

percent of the final survey sample and therefore were excluded from this

report. Equation Research hosted the survey and tabulated the results.