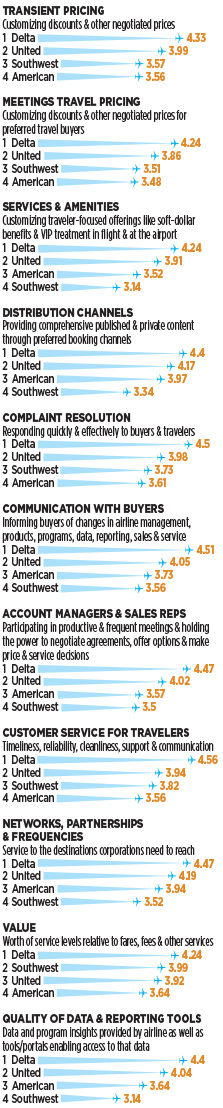

Delta extended its record-long reign at the top of BTN's Airline Survey, earning the top overall score from corporate travel buyers and agents for the ninth consecutive year and once again leading in every individual category measured in the survey, including quality of data and reporting, which was added this year. United, however, narrowed the gap considerably this year, upping its score by 0.27 points on the survey's five-point scale year over year and cutting the gap between it and Delta by nearly half. With that, United easily maintained its second place rating from last year, as American Airlines and Southwest Airlines remained in third and fourth place, respectively. No airline's total score declined year over year, and overall sentiment in the survey reflected that, with 51.8 percent of respondents saying that they have seen their airlines' customer service improve over the past year and 43 percent saying that customer service had remained the same. Only 5.2 percent said their customer service had worsened over the past year.

Delta Dominates Again

Delta earned an overall score of 4.39 in the survey, unchanged from its score in 2018, and it remained nearly four tenths of a point above its nearest competitor. Its scores were up year over year in five categories, including its strongest category: quality of customer service.

"Delta Air Lines is top notch," one buyer wrote in the survey's open-ended section. "They treat all business travelers with care and put programs in place to continue to make our travelers feel important."

One of Delta's focuses in recent years has been "reducing the seams" among its partners, including those benefits for business travelers, Delta VP of sales operations and development Kristen Shovlin said. After aligning its Corporate Priority benefits—which include priority boarding, priority rebooking during irregular operations and waived fees in selecting certain economy seats—with Air France-KLM last year, both Virgin Atlantic and Aeromexico adopted them this year. Delta is working with Korean Air and WestJet to do the same, Shovlin said.

As such, Delta's joint businesses also earned the highest scores in the survey, with its Air France-KLM/Alitalia partnership and Virgin Atlantic partnership each earning a score as high or higher than Delta's score itself. Earlier this year, the plan to sync the Air France-KLM and Virgin Atlantic partnership into a single joint venture gained antitrust approval from U.S. regulators.

"We have employees embedded in their organization, and likewise, they have employees in ours," Shovlin said of Delta's partner airlines. "When we look at partners, it's not just making sure our network expands but that travelers are able to transcend across those partners."

Delta's overall network, partnerships and frequencies also earned a higher score year over year from buyers, as Delta has "continued to focus on top business destinations," SVP of global sales Bob Somers said. Delta now is targeting a new geography with plans to form a joint partnership with Latam, which it wooed away from American Airlines once their planned joint venture hit a regulatory snag in Chile. Delta also is building its service out of Tokyo's Haneda airport with newly won slots this year, with which it will "dig deeper and try to expand our footprint in Asia" in tandem with its Korean Air partnership, Somers said.

Distribution strategy was another area of improvement for Delta this year, for which Somers pointed to Delta's work with ATPCO on developing Next Generation Storefront standards and technology. Delta has taken a hard line with some of its distribution partners in pushing the standards, which are designed to make the amenities and restrictions associated with ticket types clearer, including pulling its content from TripActions earlier this year until it was able to meet its display demands.

"Travelers deserve a premium shopping experience, and we're working on driving that through the managed travel side with good collaboration and partnerships with agencies, [global distribution systems] and corporate travel managers," Shovlin said.

In addition, Delta tweaked its offerings on meetings this year, another area in which its scores improved. For example, it made access to fares for those registering through its platform more quickly available, and it added real-time data on top destinations, region-specific data and back-end payment details to its Delta Edge Meetings tool.

With nearly a decade on top of the survey, Delta's performance has become something of an expectation from buyers. "There have not been any surprises," one buyer wrote in the survey. "Their operation is one that works, passengers are happy and account managers continue to be creative."

For Delta, however, the survey itself has become an annual goal to hit, not just for the sales team but across the carrier, Somers said.

"It never gets old for us," Somers said. "It's a motivator for us to continue and lead the industry in as many things as we can. We want to continue to win this award, because it's voted on by our customers."

United Breaks Away from the Pack

Speaking at a recent Media Day event in Chicago, United CEO Oscar Munoz said 2019 was the year "that we've taken the narrative about United from ‘What's wrong?' to ‘What's next?'"

The progress shone through in survey results this year, as United was the only carrier to improve its score year over year in every single category. After several years of a close head-to-head battle with American Airlines, United distanced itself from its competitor by more than three tenths of a point. United also cracked the four-point barrier in its overall score, the only carrier besides Delta to do so in recent survey history.

Under Munoz's leadership, part of United's overarching strategy has been to empower its employees to solve issues rather than having to rely on strict rules or protocol—enabling flight attendants to hand out a drink voucher to a customer having a tough time, for example. That attitude has affected the sales side as well.

"United has done an amazing job of increasing their sales support," one buyer said in the survey. "They have a much more flexible approach to help solve problems and deliver value to my travelers."

The carrier has been particularly busy with new products for its corporate customers in recent years.

"We took a scientific view in how to approach the marketplace and identified product gaps in the corporate space," SVP of worldwide sales Jake Cefolia said. "We set about closing those gaps this year."

That has included continued work on its Jetstream portal, introduced in 2017, for which United is "constantly looking at ways to make that a better tool for customers," Cefolia said. Earlier this year, United added a meetings portal, through which meeting organizers can register meetings and get discount offers within 24 hours. United also migrated its prepaid PassPlus program to the Jetstream portal this year, making management of the program more automated, and it plans to move its PerksPlus corporate rewards program onto the portal next year.

One buyer in the survey noted that Jetstream "has reached a great maturity in usability, combined with an excellent set of features."

In addition, United launched a corporate discount program for midsize travel programs, Propel, last year. This year, it has signed up more than 500 new accounts to Propel, Cefolia said.

United's highest scoring category was its network, partnerships and frequencies. The carrier has been building service significantly from its hubs over the past few years, which Cefolia said for the sales team has been "an important lever to achieve the results we want."

Both United's transatlantic partnership with Air Canada and Lufthansa and its transpacific partnership with All Nippon Airlines earned scores around the four-point mark. Like Delta, United is working on aligning more with its partners, including a new pricing model it is working on with the transatlantic joint venture.

"Rather than Lufthansa pricing westbound, Air Canada out of Canada and United out of the United States, it now is one-time pricing globally for those accounts," Cefolia said. "It's greatly improved our speed to market."

The carrier now is working on developing a joint venture for Latin America with partners Avianca, Copa and Brazilian carrier Azul.

Distribution was another high-scoring area for United, to which Cefolia said the carrier has taken a "flexible" approach. It has been on the forefront of a few NDC initiatives, including making NDC content available through TripActions in the form of ancillaries and bundled fares, but United "isn't looking to force anyone into" NDC content, Cefolia said. "We want to be on any shelf the customer wants to buy on," he said.

American Holds Ground During Tough Year

American Airlines, which declined to provide an interview for the survey issue this year, kept its score steady year over year. Its score improved in five categories, including meeting pricing flexibility, negotiating services and amenities, client communications, account manager relationships and customer service quality.

Operationally, American has faced a tough year. While already facing flight schedule disruptions related to the grounding of the Boeing 737 Max, it also has faced challenges related to labor negotiations with its mechanics and fleet workers.

On the carrier's third-quarter earnings call, CEO Doug Parker said that while he believed those operational issues "are now behind us," focus on operational improvements remains at the forefront.

"We must restore American's operational reliability to the standards of excellence that our customers and team members deserve," Parker said. "We simply will not allow our customers and team members to experience another period like this past summer again."

American also recently announced a significant restructuring of its commercial and operations teams, which American Airlines president Robert Isom said would help the carrier "find a way past temporary difficulties and make American better every day." That restructuring moved SVP of global sales and distribution Alison Taylor to report to SVP of revenue and head of the revenue division Don Casey, intended to get revenue initiatives to market quicker.

Those initiatives include work around NDC, and American's highest score was in the distribution category. American has been testing corporate bundles with travel management companies including AmTrav, Copastur in Brazil and Marplay in Mexico that include main cabin Preferred Seats, an extra bag and the ability to change the ticket. It also has worked with American Express Global Business Travel, which this summer began processing live booking using NDC standards via Amadeus Travel's application programming interface.

American scored well for its network, partnerships and frequencies as well. The carrier finally was able to get antitrust immunity for its joint venture with Qantas this year, after facing rejection in 2016. While losing its partnership with Latam was a blow, the carrier is exploring ways to make that up as well.

"The great news is that our network by far is the best in South America, and there's a lot we can do to augment that on our own," Isom said in the earnings call. "The network we have in South America could be really attractive to a lot of partners, so we're busy exploring and evaluating the opportunities that are out there right now. So, good things to come."

Southwest Deploys New Strategy

Although remaining in fourth place this year, Southwest Airlines closed the gap a bit on American Airlines as it improved its score in all categories year over year with the exception of one: meeting pricing negotiation, which was the same year over year.

Distribution was once again one of the areas in which Southwest's score lagged, but that could soon change with its "bold new distribution strategy" announced this year, VP of Southwest Business Dave Harvey said. Among the biggest announcements was that Southwest would be providing content and full booking capabilities to both Travelport and Amadeus by mid-2020, meaning buyers and agents will be able to book, change, cancel and modify reservations through the GDS. Southwest also joined ATPCO's NDC Exchange platform, through which it already has announced connections to TripActions and AmTrav, and "we literally have 10 more in the pipeline," Harvey said.

Southwest is improving its direct approach, with "some major releases" planned for its Swabiz channel next year, Harvey said. In addition, Southwest has been investing in its API and earlier this year eliminated the access fee to it.

"Some of the big online booking tools were passing that fee on to the buyers and adding additional fees," Harvey said. "Getting it out of the way lowers the overall cost of sale for our buyer and the agency."

In addition to distribution, that also gives Southwest an extra edge in what has traditionally been its strongest performing category in the survey: overall price value. This year was no exception, with Southwest outscoring United in that category and coming closer to Delta in that respect than any other airline in any other category this year.

"Clearly, that's our low fares, no change fees and no bag fees carrying the day," Harvey said.

Complaint/problem resolution was another strong-scoring category for Southwest. Harvey credited that to a new B2B partner service desk set up earlier this year, at which a "small but mighty team" helps the carrier's top buyers.

Southwest's other big focus of late has been establishing and growing its service to Hawaii, including its recent announcement that it would be adding service from San Diego to both Honolulu and Kahului. While Hawaii might seem like a mostly leisure play, it's also helped Southwest win some new corporate business, particularly thanks to its interisland service, which broke up what essentially was a monopoly on the routes by Hawaiian Airlines.

"We've been picking up quite a few local Hawaiian Islands accounts: banks, education and utilities," Harvey said. "West Coast businesses, folks based west of the Rockies, also tend to do more transient travel to the islands, so extended travel agreements with them has been a nice windfall."

Ultimately, Southwest would like to develop an international network via interlines and codeshares with partners in Europe, South America and Asia, though Harvey said that is still "several years off."

Airline Survey Methodology

From Sept. 12 to Oct. 11, BTN collected 705 responses from travel manager and buyer members of the BTN Research Council and subscribers of BTN and Travel Procurement and 95 responses from travel agents. Fourteen percent of the travel buyers spent less than $500,000 on U.S.-booked air volume in 2018, 11 percent spent $500,000 to $1.9 million, 39 percent spent $2 million to $12 million, and 37 percent spent more. BTN developed the categories with travel buyers, corporate travel agency managers and airline sales executives. The categories were the same as the 2018 survey with one addition: quality of data and reporting tools. BTN averaged scores in each category to create an overall score for each carrier, weighing each category equally. Respondents graded only those airlines with which they negotiated a contract or booked a meaningful amount of business in the past year. Participants who offered no response for a particular category or airline were not included in that category or airline's average rating. The survey listed the largest domestic airlines as identified by the U.S. Department of Transportation, excluding regional affiliates of major carriers. Alaska Airlines, Frontier Airlines and JetBlue elicited responses from less than 30 percent of the final survey sample and therefore were excluded from this report. Equation Research hosted the survey and tabulated the results.