Delta Air Lines soared to its 11th consecutive victory in BTN’s annual Airline Survey, continuing to burnish its reputation among buyers as the U.S. airline industry experiences a bumpy recovery of corporate travel.

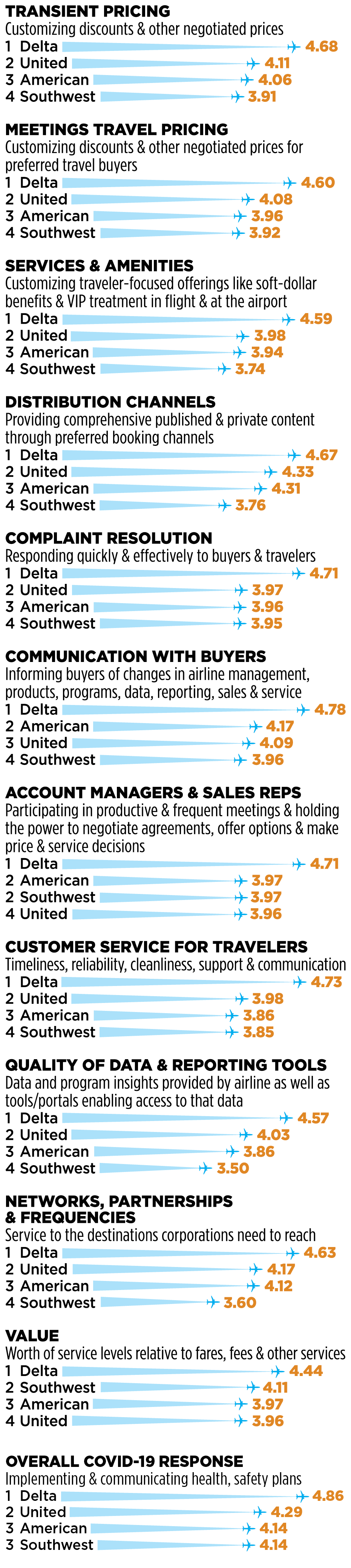

While Delta’s winning streak several years ago set a record in the survey, the carrier’s total score this year rose to an all-time high of 4.66 on a 5-point scale, up from 4.59 in 2020. Its scores were up year over year in all categories save one: quality of customer service, which was down only one-hundredth of a point year over year and already had been one of Delta’s highest-scoring areas.

United Airlines, meanwhile, scored its own all-time high score of 4.08, up from 3.91 in 2020, allowing the carrier to recapture second place in the survey from American Airlines, which placed third this year. United was the only carrier to improve scores year over year in all categories in the survey.

Despite falling behind United in total score, American Airlines also improved its total score to 4.03, up from 3.94 in 2020. The increase came as American improved year over year in all but two categories, and it marks the first time American has broken the 4-point threshold in the survey. United had done so only once before, in 2019.

Southwest kept its fourth-place ranking with a total score of 3.87, down 0.01 points from its score in 2020.

Even with the general improvement across most individual airlines, buyer sentiment in this year’s survey toward airlines was mixed. Just under 48 percent of buyers in the survey said overall customer service has improved over the past year, compared with more than 60 percent who said so in 2020. About 35 percent said customer service had stayed the same year over year, comparable to last year, leaving a larger portion saying service had worsened. Buyers in small programs, with less than $500,000 in booked air in 2019, were more likely to say service had worsened than buyers in larger programs.

The survey was in the field at the same time as some airlines, Southwest in particular, faced a weekend of widespread delays and cancellations, which also likely affected those overall customer service results. Southwest’s customer service score dropped to 3.85 from 4.13 last year, and its complaint/problem resolution score was down to 3.95 from 4.05 in 2020. A few buyers in the open-ended portion of the survey specifically mentioned the operational problems.

Southwest subsequently adjusted capacity and staffing to be able to better respond to disruptions, and Southwest VP Dave Harvey said that bore fruit during the recent busy Thanksgiving holiday travel season, when no major incidents were reported.

“We got staffing where we need to be, and operations were tight and reliable, so we were able to deliver on the promise,” Harvey said.

Communication Was Key

Quality of communication was one of the most frequently recurring themes in the survey’s open-ended questions, which asked buyers to name what their airline partners had done to drive satisfaction and what they could do to improve satisfaction. Several buyers spoke highly of receiving constant updates and critical information over the course of the pandemic, and similarly, a common complaint was from those who said they heard very little from their sales reps during that time.

Several singled out Delta, which earned one of its highest scores in quality of client communications.

Delta “provided personal and consistent communication to support me as needed with phone calls, emails, follow-up, knowledge, and being there when I needed someone to talk to,” one buyer wrote.

They also pointed to the virtual town halls Delta conducted for its corporate clients. Those were “a way to bring in experts to talk about things,” Delta VP of sales of sales operations and development Kristen Shovlin said. “When the pandemic started, we found that our customers were really searching for a lot of information, and we wanted to face the uncertainty.”

American, which earned one of its highest scores in client communications and outscored both United and Southwest in the category, also reported success with town halls for clients. While the focus has shifted on what needed to be communicated, American has kept the same focus on how it tailors information to clients, global head of corporate sales Hank Benedetti said.

“Over the past 20 months, we have been talking to customers as if their travel would start the next day,” he said. “We have to constantly be in that mode of preparing buyers, saying, ‘Here’s the best information we have right now.’”

United SVP of worldwide sales Doreen Burse said much of the carrier’s communication now centers around helping buyers “remove the barriers to travel. It’s answering those questions—what do they need to know?—and staying out ahead of things that change frequently.”

One of the challenges airlines have faced with communication, and maintaining relationships, has been the turnover due to the pandemic.

“We lost a significant portion of the sales team, and when we lost them, we lost their intellectual property as well,” Delta SVP of global sales Bob Somers said. “We had new sellers that didn’t have a lot of years in the industry, so we’ve been working with our teams, providing them with the support needed to connect with the customers and have a relentless focus on anticipating needs.”

Southwest, where the score for its sales team improved year over year, has been rapidly growing its sales team even amid the pandemic. Harvey said the carrier has received feedback from travel managers for “keeping it consistent” and “how well the team did in engagement, focusing on the items that mattered.”

The pandemic even brought some new opportunities for collaboration outside of travel. United, for example, led the industry in its announcement of a Covid-19 vaccine mandate for employees, already having the vast majority of its workforce vaccinated even before federal requirements began to arise. That was a positive move to attract corporate partnerships, given that more than 60 percent of buyers in the survey said an airline’s employee vaccination rate was either critical or very important to their partnership decisions. But Burse said the impact of that decision went much further. United found itself a leader for companies looking to enact similar mandates.

“We had at least 45 operations reach out and spend time talking to our executive VP of HR about our vaccination journey—the research we did and how we approached different employee groups—to help those corporations with their own journey,” Burse said.

Focus on Flexibility

Although the recent emergence of the potentially more transmissible omicron Covid-19 variant once again has made uncertain the trajectory of corporate travel recovery, carriers remain optimistic that business travel will accelerate next year, when many companies plan to get their employees back to the offices. In the week prior to the discovery of omicron, American’s corporate bookings were running between 55 and 60 percent of pre-pandemic levels, Benedetti said.

Even before that extra level of uncertainty, buyers in the survey still spoke of the need for flexibility, especially in the management of unused tickets still remaining due to the pandemic. Delta, for one, this year developed a new tool for unused ticket management to “provide greater visibility and lots of control,” Shovlin said.

Similarly, American also sought quickly to provide “complete transparency” via value reports for unused tickets, VP of global sales Kyle Mabry said. That was coupled with other instruments in American’s SalesLink tool, which included operational data and corporate flex fund usage, he said.

The three largest airlines last year took a big step in flexibility with the elimination of change fees, and so far, they all have kept to their pledge to maintain that standard even as demand begins to recover. Southwest, of course, never had charged change fees, and it continued to maintain a healthy premium over both American and United in its overall price-value score.

The carrier added more flexibility around waivers and favors and this fall rolled out a new meetings program to add additional value, Harvey said.

“We not only invested in the account management, but we invested in the analytics, sales enablement, call center team and our team selling approach,” he said. “All that translated to more time and more customization of the contract or travel agreement we put in front of the travelers.”

Overall in the survey, airlines generally posted their best scores in terms of their overall response to the pandemic. It was the highest-scoring individual category for all carriers except American, for which it was second-highest.

Network Growth

As airlines build back their schedules, all said they remain in close contact with corporate customers to ensure they have schedules that meet their needs.

“We’ve been more connected with the network teams in the last year than in many years,” Delta’s Somers said. “[They] were on many sales calls with us, talking about where they need us to come back and whether we need different aircraft.”

United as of this month has reached more than 3,500 daily domestic flights, with its domestic network more than 90 percent recovered from pre-pandemic levels, and it also is planning its largest transatlantic expansion in the company’s history, Burse said. That includes a significant increase in its service to London, she said.

As it adds international destinations, American this year also benefited from new alliances with Alaska Airlines and JetBlue, the latter of which is still facing a challenge from the U.S. Department of Justice. Mabry said corporate business response to those have exceeded American’s projections.

“On the West Coast, we had corporate accounts where we had a hard time meeting some of their needs for travel,” Mabry he said. “Because of the West Coast international alliance, we now have the strongest network for our customers, and the Northeast Alliance is doing similar things on the East Coast.”

Eyes on Sustainability, DE&I

Travel buyer emphasis on sustainability has been magnified as they build back their travel programs. More than 80 percent of buyers in the survey noted an airline’s sustainability program was important to their partner decision-making, with about 15 percent indicating it was critical to partnership decision-making and 42 percent saying it was very important.

In addition to the work all major U.S. airlines are doing in terms of adding more fuel-efficient aircraft and reducing waste from their operations, all four of the largest U.S. carriers this year announced agreements in which corporate customers help offset the cost of sustainable aviation fuel. The fuel currently is available only in small quantities and at a much higher price than standard aircraft fuel, and the idea is that further investment could help increase its availability and lower its price.

American’s Benedetti, who noted that the carrier is “on the cusp of signing its largest SAF purchase to a single corporate client,” said that SAF is key to achieving about 40 percent of airlines’ target to be carbon neutral by 2050.

Airlines are developing other ways to help their clients meet their own sustainability goals. In addition to its SAF purchasing program, Southwest, for example, recently announced its Green Incentive Program in which companies can earn funds for their preferred initiatives, such as offsets or charitable donations, Harvey said. United, meanwhile, has announced several investments in technology to cut down on carbon emissions and counteract climate change, including carbon sequestration and aircraft fueled by electric and hydrogen power, Burse said.

“It’s pretty exciting, and we don’t want to be alone in that space,” she said.

Airlines’ efforts around diversity, equity and inclusion rates are similarly important with buyers, with 19 percent indicating they were critical to partnership decision-making, 43 percent indicating they were very important and 25 percent indicating they were important.

American’s Benedetti said that while buyers have been asking questions about both DE&I and sustainability during the request-for-proposals process, such as the amount of spending with minority suppliers, “we are being asked to provide more granular data in RFPs.”

Methodology

From Oct. 12 to Nov. 8, BTN collected 489 responses from travel manager and buyer members of the BTN Research Council and subscribers of BTN and Travel Procurement and 107 responses from travel agents. Eight percent of the travel buyers spent less than $500,000 on U.S.-booked air volume in 2019, 8 percent spent $500,000 to $1.9 million, 34 percent spent $2 million to $12 million, and 50 percent spent more than $12 million. Due to low business travel volumes in 2020, BTN continued to use 2019 spending levels as a baseline. BTN developed the categories with travel buyers, corporate travel agency managers and airline sales executives. The categories were the same as the 2020 survey with the exception of the removal of two specific questions related to airlines’ communication and flexibility in the Covid-19 pandemic. The general category about airlines’ Covid-19 response remains in the survey. BTN averaged scores in each category to create an overall score for each carrier, weighing each category equally. Respondents graded only those airlines with which they negotiated a contract or booked a meaningful amount of business in the past year. Participants who offered no response for a particular category or airline were not included in that category or airline’s average rating. The survey listed the largest domestic airlines as identified by the U.S. Department of Transportation, excluding regional affiliates of major carriers. Alaska Airlines, Frontier Airlines and JetBlue elicited responses from less than 25 percent of the final survey sample and therefore were excluded from this report. Equation Research hosted the survey and tabulated the results.