Since Vista Equity's high-profile acquisition of Cvent last

year, investors—both venture capital and private equity—have been keen to get in

on the action. They're not so interested in in helping businesses manage costs,

though it's a great hook to get into the enterprise. Rather, the honey pot for investors

is in harnessing participant data to track a meetings' impact on top-line revenue.

Will GDPR Be a Fly in the Ointment?

If engagement intelligence and marketing automation/customer

relationship management tools are the cure for live event strategy, how will the

European Union's looming General Data Protection Regulation to protect EU citizen's

data privacy factor in?

"Meetings and travel include very heavy traffic of PII data,"

GoldSpring senior consultant Kevin Iwamoto said, referring to personally identifiable

information. "The purpose of GDPR is to establish consistency for collection,

maintenance and purging of this data. Information on employees, clients or prospects

for meetings—it all has to adhere to the same level of scrutiny." And under

GDPR, that scrutiny is more restrictive than the former Safe Harbor rules and the

current Privacy Shield patch that the EU put in place after Safe Harbor was challenged

in court.

The impact for meeting participants could be just irksome inconveniences

like filling out online forms without autofill. However, Iwamoto suggested that

the impact for meetings engagement, personalization and data mining for marketing

and business conversion could be much more severe. "It conflicts big-time,"

said Iwamoto. "Think about the first marketing or sales touch all the way to

[becoming a client] and buying something. Look at all those touchpoints in the middle:

the data processing and the handover. I gotta believe that that's going to be impacted.

If a participant registers for the class but we process the registration with artificial

intelligence and predictive analytics and conclude the participant must be interested

in a related product or service, you have to wonder if that will be prohibited with

GDPR. My intention was to sign up for the class, not to be marketed to later for

something else.

The regulation goes into effect May 25, 2018.

"This is not something that can be solved in the event or marketing department.

It can't be addressed by IT. It has to be escalated to the most senior leadership,"

Iwamoto said. "Data is a gold mine and we've used it that way in the U.S.,

but for any company that employs EU citizens or has them as customers—so that's

nearly all companies—this has to be addressed."

On the heels of the Vista Equity-Cvent announcement last April,

Etouches scored $20 million in venture capital funds. The company, lost no time

in bolstering its tech stack with Orlando-based meetings sourcing platform Zentila

that June. This March, it scooped up Loopd, an onsite wearable and data analytics

tool. Still flush with funding, Etouches accepted a 60 percent buyout from private

equity firm HGGC in May. Notably, HGGC put Etouches in a marketing portfolio and,

even before the buyout closed, matched it with Selligent, a marketing automation

tool similar to Vista's Marketo.

"After Vista bought Cvent, meetings started to raise a lot

of eyebrows in the investment community," said Etouches chief technology officer

Shane Edmonds. "HGGC did their research, and they found out what those of us

who have been in the industry knew all along: that there is a lot of white space."

The white space, in short, is end-to-end meetings automation.

Traditional "Strategic" Meetings Tech

Such automation is the holy grail that technology stacks like

Cvent have chased for a long time, and Cvent remains the leader in the space, considerably

so now that it has merged with its nearest rival, Lanyon. Its hotel network numbers

nearly 250,000 for sourcing. Its attendee management technology has been in the

field since 2000. And the data reporting suite—which provides budget, contracting

history, savings against the first offer, price per attendee and many more drill-down

metrics for sourcing—provides a backbone for meetings management.

That's a comfy place for corporate travel managers who are increasingly

tasked with getting a grip on meetings spend. There have been different flavors

in the market, but like travel management technology, traditional "strategic"

meetings tech has largely focused on procurement, logistics, savings and record

keeping for the organization. It supports negotiations and contracts. It organizes

financial metrics for year-over-year comparisons.

What that backbone hasn't done—but what meetings technology companies

aspire to do now—is measure on-the-ground attendee experience and engagement and

then connect that data with registration details as well as sales and marketing

strategies. If you're a travel manager or a procurement-oriented strategic meetings

manager, this could be unfamiliar territory, but it's essential to understanding

the value of an individual meeting and to defining an organization's overall business

strategy for meetings.

Tracking Engagement

"Companies invest all of this money [on meetings] without

then knowing how people interact with the event. Attendees pick up their badges,

but what they do for the next three days is anyone's guess," said Cvent SVP

of global sales Brian Ludwig. "We have to understand who [participants] are

having conversations with, what sessions they go to, how long they are staying.

After that, you want to see what the impact is on the business, on the sales cycle,

on the pipeline."

But: To put it in travel management terms, there's no real equivalent

to "managing behavior" or requiring a "workflow" for live people

moving in a space. Rather, technology needs to follow the participant and encourage

interactions with people and content. Mobile meetings apps have played a big part

in that effort. They've replaced printed agendas, they allow organizers to mass-communicate

program changes to attendees and they enable interactions like audience surveying,

social sharing and proximity-based networking alerts. On their own, however, they

can't deliver a full picture of engagement, not least because a good portion of

attendees won't use them. Meetings Professionals International reported in 2015

that just 54 percent of attendees will download an event-specific app. That means

tracking and measuring engagement has to be a multipronged approach, with targeted

solutions that can flow right into the participant's natural path.

Cvent acquired Alliance Tech in late 2015, which put a collection

of onsite tech like smart badges and RFID-enabled floor mats into the Cvent solutions

basket, alongside its existing app and social wall. Etouches' acquisition of Loopd

is a move in this direction. The wearable is a low-profile, Bluetooth-enabled smart

badge that passively collects information and interactions as meeting attendees

move through the event. It also has its own storage, records sessions and can work

without the mobile event app, though it's more powerful when combined.

Don't Lecture Me About Engagement: Give Me an Easy Way to Book Meetings

Many companies just need an efficient way to book a handful of

hotel rooms and a meeting space without a six-week process for RFP, contract signing

and legal approval. They also want to track the meeting budget and keep a handle

on spend. Small meetings technologies sensed that pain in the market, and investors

are backing them, as well. Tony Wagner told BTN that CWT had tested about six small

meetings technologies so far. He says there's still work to do in the space, but

that it's gaining viability. He also hinted that CWT might leverage its new RoomIt

technology for small meetings. Here's a rundown of some other interesting options:

Bizly

Started as an instant booking app that targeted day meetings under 40 attendees. The company has since expanded and is

now the only enterprise offering with both hotels and restaurant private dining

rooms, with all original content. The company offers

instant booking at hundreds of venues as well as chat-based messaging for

custom orders, replacing the traditional RFP process. The chat platform

uses intelligent reminders to eliminate the need for complex contracts and

addendums. Users also leverage the chat platform to book sleeping room blocks directly with the

venue, which is a newer function not originally supported by Bizly. Enterprise features include automated budget-based approvals; the tool also allows companies to customize the venue ecosystem with preferred

venues and negotiated rates.

Groupize

A big selling point for Groupize is its integration with Concur.

It facilitates sleeping room bookings for fewer than 10 people via an overlay of

the Concur booking tool. This means group sleeping room bookings can be made directly

into the Travelport global distribution system and clients will see the bookings

in Concur reporting. For larger meetings that require hotel meeting space, an email-based,

simple RFP form is available online; then all responses route to the organizer's

inbox. The tool also stores the correspondence string. Preferred hotels in the GDS

are prioritized in the booking tool, and the RFP tool also notes corporate preferred suppliers.

Meetago

Launched in North and South America this summer but available

in Europe for seven years, Meetago uses parent company HRS's extensive network for

sourcing. It is a facilitated RFP tool for simple meetings of as many as 50 people.

The tool limits RFPs to four per meeting, and the solutions team behind the scenes

actively encourages responses. Preferred hotels can be loaded and prioritized in

the system. Meetago is updating the user interface.

MeetingPackage

The first small meetings tool on the market to integrate

directly with hotel sales and catering systems, MeetingPackage.com has three booking/RFP

workflows. The RFP inquiry allows organizers to define every line item and make

a request. The package option allows hotel partners to offer packages from which

meeting organizers request a booking. The third option is facilitated through a

recent integration with Oracle's Opera Sales and Catering software. MeetingPackage's

vision is to partner with multiple systems to give complete online access to hotel

sleeping and meeting rooms and catering, thus creating instant booking for meetings.

It's based in Finland and offers 250,000 meeting rooms around the world.

"Attendees can use it to interact with each other [via proximity

notifications]; they can show attendance, show booth time," said Etouches VP

of sourcing and hospitality solutions Mike Mason. "Organizers can see the hang

time of top customers: when they were there, how long, where. Organizers can begin

to see via heat mapping and other ways how they can impact the attendee at the event.

They can start to map out the perfect experience. It's all moving in this direction,

toward engagement and onsite tech. That's where event organizers are going to get

the real data that matters."

The Journey to Metrics

"Meetings give off intense volumes of data," said GoldSpring

senior consultant Kevin Iwamoto, who previously held senior roles at Lanyon and

Starcite. Combing through that data to get to meaningful metrics is a daunting task

that the industry is grappling with overall.

According to an Etouches survey published in July, 65 percent

of meeting organizers measure event ROI. Mason sounded skeptical. "[They may

look at] revenue to expense, but they have no idea how to pull the data out and

make decisions from it. They say they do it, but they separate the two: 'I have

the data for data's sake, but what do I do with it?' We know there's a gap."

Tony Wagner, VP Carlson Wagonlit Meeting & Events for the

Americas and South Pacific, said some companies are starting to bridge that

gap, but it doesn't happen overnight. "Our most successful accounts have been

on a multiyear journey," he said. "They started tactical and operational

with supplier normalization. Then they moved from operational to more data driven

and stakeholder engagement. Now, they are evaluating the model and turning it on

its head. They focus on attendee experience and integrating marketing automation

tools into their event data. Our most mature client is looking at totally redesigning

their model."

Cvent, too, has seen progress among certain customers and is

working with them on personalization and attendee experience goals. Cvent chief

technology officer David Quattrone told BTN that clients that are technology companies

are a group to watch: "We have a number of large tech companies doing cutting-edge

things, working with us as partners, pulling things in-house, investing internally

in some of these systems. They are thinking of it not just on internal impact on

pipeline but also to use the information to make the entire experience better for

attendees—bubbling up recommendations and even tracking the differences between

what participants said they were interested in and what they actually did during

the event."

Etouches launched an ROI tool last year to help clients go deeper

into their event data. It pulls data from across the technology stack—sourcing,

registration, mobile and onsite tech—to create metrics that align with different

types of stakeholders—procurement, marketing, finance. "It's our job to deliver

that intelligence," said Mason.

Linking that up to HGGC portfolio-mate Selligent must be the

next step on Etouches data journey, just as the Vista acquisitions of Cvent and

Marketo brought tighter integration between the two. So once the metrics are established,

the marketing and prospect nurturing can begin.

That means drilling down to the individual meeting participant,

sorting through the data exhaust, scoring the leads or associating them with certain

products. That could be a job for artificial intelligence, which Mason said Etouches

has in its vision, though he declined to go into specific plans.

Wagner sees a near future when business decisions that range

from venue selection to budget allocation hinge on how well a meeting or event drives

sales. "If it's that kind of business, the events that deliver will get the

preference. Even down to venue selection: If you think about it, you can start to

see the types of venues that get more engagement or business closure. Those are

the things we will start to assess."

Watch the Smaller Players

Even as major players in meetings technology consolidate and

acquire unique functionalities, smaller players push the envelope and disrupt the

two-player game between Cvent and the fast-growing Etouches. Meetings technology

consultant Corbin Ball said smaller players are worth watching, as they're the ones

that find the cracks in the pavement.

Event app provider DoubleDutch, which has benefited from $45

million in venture capital over its seven-year lifespan, launched Live Engagement

Marketing last year. The model is to track event metrics and integrate with marketing

automation to deliver follow-up marketing and content to event participants, but

the company has been quiet on details. Founder and CEO Lawrence Coburn told BTN

in December that the company is changing its strategy to partner with more players

along the end-to-end event cycle and to target more strategic enterprise contracts

rather than event-specific clients.

Ball said agile open-platform technologies are likely to take

this collaboration route. "Development of integration tools is coming out strong.

Event Tech Tribe started this year. It's a bunch of cloud-based companies that are

separate but designed to work well together."

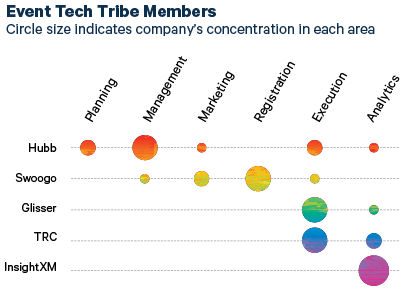

Event Tech Tribe's five current members connect through multi-directional

application programming interfaces. Swoogo focuses on registration and a drag-and-drop

wizard for making event websites; Hubb manages event content; Glisser is a suite

of online, mobile attendee engagement features; TRC offers onsite attendee tracking

solutions; and InsightXM's event analytics tool will launch formally in October.

InsightXM, like Etouches and Cvent, is working toward producing strategic business

insights from event data. It will act as a centralized focal point for data from

all the Tribe solutions. According to InsightXM CEO Brent Pearson, it eventually

will integrate with marketing automation and CRM tools.

The up-and-coming competition isn't lost on the bigger players.

"There is a lot to do with CRM and the cloud, and there are a lot of things

to do with data and pushing information," said Quattrone. "We are looking

at the functionalities and individual tools and want to stay best in class [with

each of them and with] how they work together. Cvent has always had an entrepreneurial

culture with people who want to make sure that we are always improving the product

and innovating."

Ludwig echoed Quattrone: "We love it. We've seen lots of

companies come and go in this space. Sometimes the little guys are ahead and we

follow, and sometimes we are ahead." Cvent announced in June that it has made

its largest ever tech investment: in an event website wizard with drag-and-drop

design function and customization options. It is projected to hit the market in

full next year.

Quattrone said managing a large-platform technology is not an

impediment to innovation. "There are challenges with the bigger platform, but

we have not seen it slow us down. I have 800 engineers and 100 open [tech] positions.

We have a tech presence in Austin; Portland, [Ore.]; London. It's been helpful to

find talent in these other places."

Etouches, which now clearly wants a piece of the

end-to-end platform pie, is confident with its position, as well. "We have

the resources available to us to grow the way we want," Edmonds said about

the company's influx of capital. "We have our eyes set on a couple other strategic

acquisitions and some other tech investments that would have been more difficult

for us to tackle organically. We are experiencing a lot of growth. Our investors

are focused on the same goals as we are: to grow and dominate."